The most oversold stocks in the communication services sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Sohu.com Ltd – ADR (NASDAQ:SOHU)

- On Feb. 18, Sohu.com posted a non-GAAP net loss of $15 million for the fourth quarter, versus a year-ago loss of $11 million. Total revenues fell 5% year-over-year to $135 million. Dr. Charles Zhang, Chairman and CEO of Sohu.com Limited, commented, “In the fourth quarter of 2024, our brand advertising revenues hit the high end of our previous guidance, while both our online game revenues and bottom line performance were much better than expected. For Sohu media platform, we continued to refine our products, optimized algorithms, and strictly controlled budgets.” The company's stock fell around 41% over the past month and has a 52-week low of $7.79.

- RSI Value: 19.3

- SOHU Price Action: Shares of Sohu gained 5.3% to close at $8.33 on Thursday.

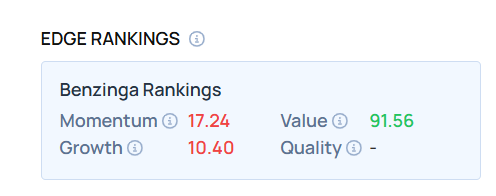

- Edge Stock Ratings: 17.24 Momentum score with Value at 91.56.

IAC Inc (NASDAQ:IAC)

- IAC will post its first quarter results after the closing bell on Monday, May 5. The company's stock fell around 17% over the past month and has a 52-week low of $32.08.

- RSI Value: 28.7

- IAC Price Action: Shares of IAC gained 0.8% to close at $33.02 on Thursday.

- Benzinga Pro’s charting tool helped identify the trend in IAC stock.

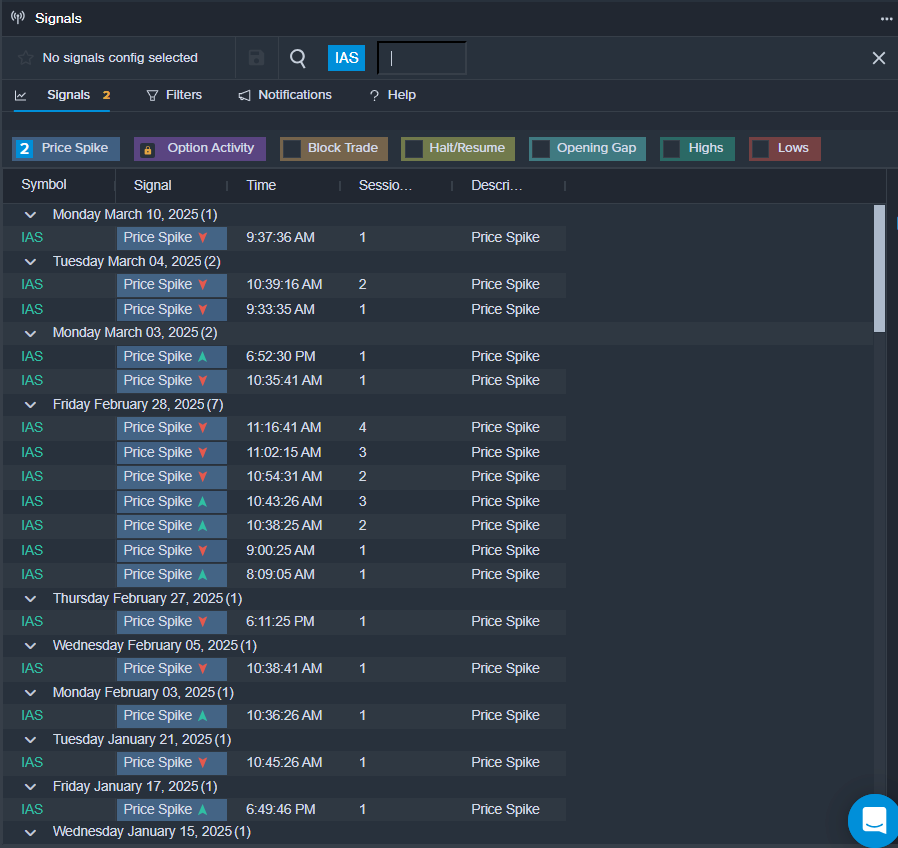

Integral Ad Science Holding Corp (NASDAQ:IAS)

- On April 17, Morgan Stanley analyst Matthew Cost maintained Integral Ad Science with an Equal-Weight rating and lowered the price target from $13.5 to $12.5. The company's stock fell around 28% over the past month and has a 52-week low of $6.32.

- RSI Value: 28.4

- IAS Price Action: Shares of Integral Ad Science gained 1.7% to close at $6.52 on Thursday.

- Benzinga Pro’s signals feature notified of a potential breakout in IAS shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

- Top 3 Materials Stocks That Are Ticking Portfolio Bombs

Photo via Shutterstock