DIVO: Well-Rounded Dividend Equity ETF, High-Quality Holdings, 4.5% Yield

anyaberkut

The Amplify CWP Enhanced Dividend Income ETF (NYSEARCA:DIVO) is an actively managed ETF focusing on high-quality U.S. dividend stocks, and selling covered calls on a portion of its holdings. DIVO is an incredibly well-rounded investment, with an above-average 4.5% dividend yield, below-average drawdowns and risk, and moderate potential capital gains. It is a solid choice and might be of particular interest to income investors and retirees.

DIVO - Overview and Analysis

Strategy and Portfolio

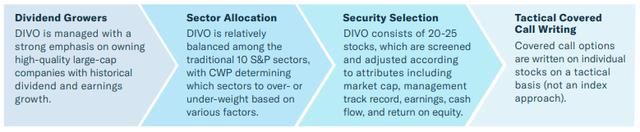

DIVO is an actively managed equity dividend ETF. Its strategy is as follows:

DIVO

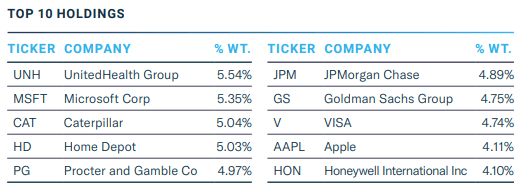

DIVO currently invests in 25 companies, largest of these are as follows:

DIVO

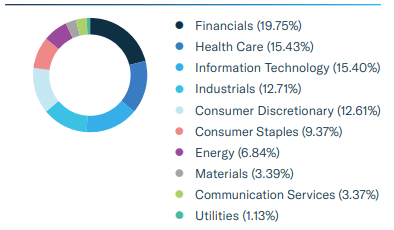

Sector weights:

DIVO

DIVO's strategy has several important implications for shareholders. Let's have a quick look at these.

Concentrated Portfolio

DIVO has much fewer holdings than average, with S&P 500 index funds investing in 500 companies, Nasdaq-100 index funds in 100. DIVO's 25-stock portfolio provides some diversification to shareholders, but much less than average. DIVO's comparatively small, concentrated portfolio is the fund's most significant negative and means significant overweight positions in the fund are unwise. Putting, say, 50% - 100% of your portfolio in the S&P 500 is perfectly reasonable, putting it in DIVO is not. In my opinion at least.

High-Quality Portfolio

DIVO focuses on high-quality, blue-chip U.S. large-caps, including Microsoft (MSFT), Procter & Gamble (PG), and Visa (V). These are comparatively safe, resilient companies, with proven business models and strong balance sheets. Focusing on these companies should reduce portfolio risk, volatility, and drawdowns. Said focus could result in higher returns too, especially considering the fund's small portfolio. Overall, these companies are perfect for retirees, in my opinion at least.

Covered Call Strategy - Above-Average Yield

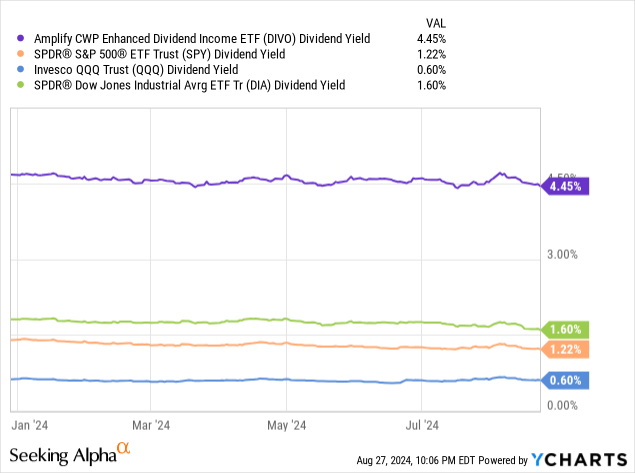

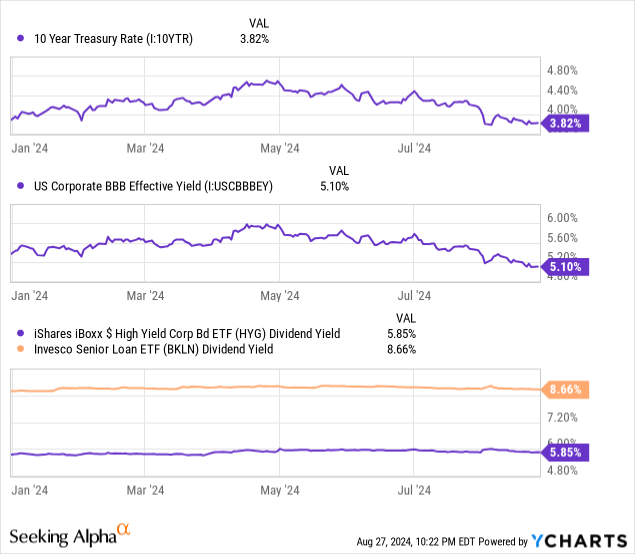

DIVO's covered call strategy boosts the fund's dividend yield to 4.5% and decreases potential capital gains. DIVO's yield is quite a bit higher than that of most equity indexes:

Data by YCharts

But only marginally higher than investment-grade bonds and treasuries, and lower than riskier fixed-income securities.

Data by YCharts

DIVO's dividend growth track-record is slightly below-average, with dividends growing at a 4% CAGR since inception, increasing to 5% these past twelve months. The S&P 500's dividend growth has been marginally lower, with most dividend equity ETFs seeing stronger growth. These include the Vanguard High Dividend Yield ETF (VYM) and the Schwab U.S. Dividend Equity ETF (SCHD).

DIVO's above-average dividend yield is a straightforward benefit for shareholders. It is of particular importance during bear markets, as there are no capital gains during these, with dividends being the only possible source of returns.

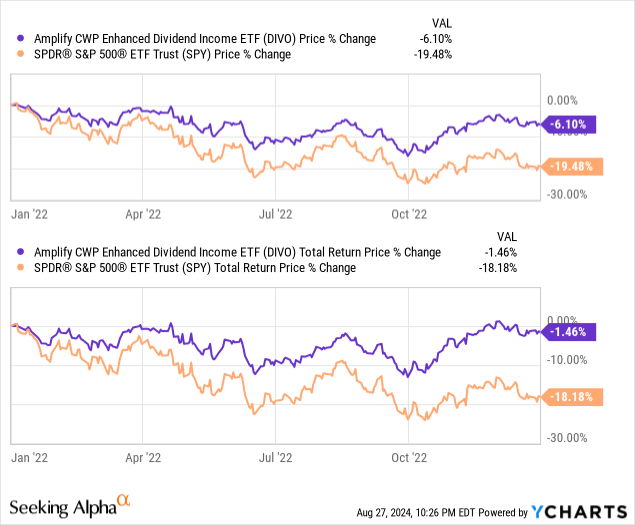

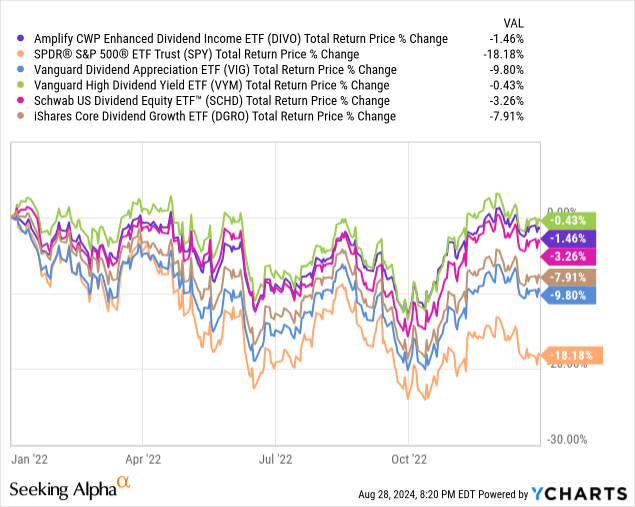

DIVO's high-quality portfolio and covered call strategy both boost returns during bear markets, leading to below-average losses and outperformance during these. As an example, DIVO was down only 1.5% during 2022, compared to S&P 500 losses of 18.2%. DIVO significantly outperformed during the last bear market, as expected.

Data by YCharts

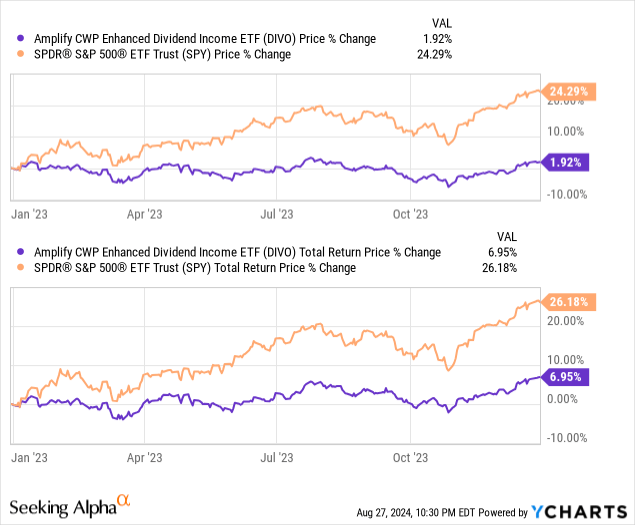

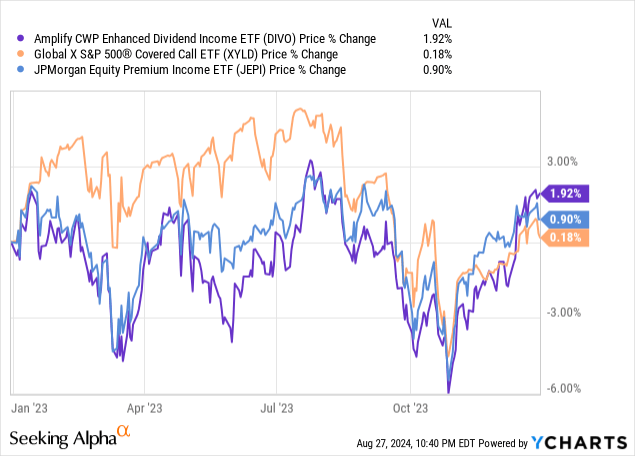

On the flipside, DIVO's covered call strategy somewhat limits potential capital gains, leading to underperformance during bull markets, especially more pronounced ones. As an example, the fund's share price increased by 1.9% during 2023, compared to the S&P 500 rallying by 24.3%. Such a massive difference could not have plausibly been caused by its covered call strategy exclusively, so other portfolio differences had a significant impact too.

Data by YCharts

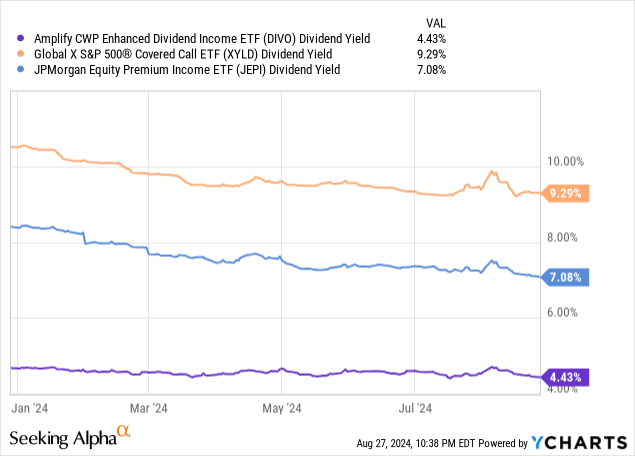

DIVO's covered call strategy is less aggressive / impactful than average for a covered call ETF, including the Global X S&P 500 Covered Call ETF (XYLD) and the JPMorgan Equity Premium Income ETF (JEPI). Dividend yields are lower:

Data by YCharts

Capital gains should be lower, too, although the difference in portfolios makes these somewhat volatile. DIVO's share price increased by a bit more than average during 2023, but the difference was small, and only materialized at the end of the year.

Data by YCharts

Sector Weights

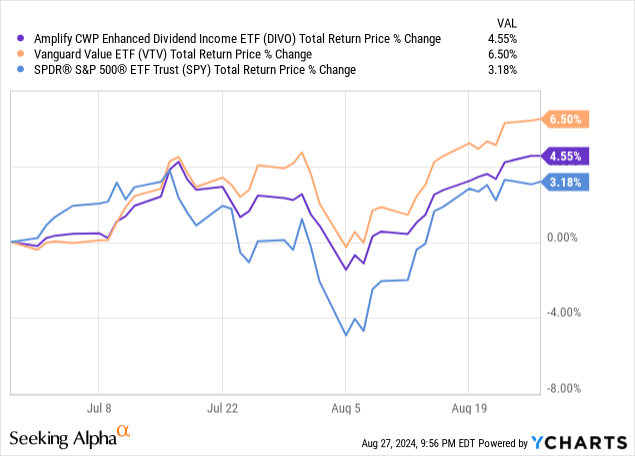

DIVO's sector weights are somewhat typical of value funds, with overweight positions in financials and industrials, underweight positions in tech. DIVO should outperform when value outperforms, and vice versa. These past few years, value has tended to outperform during bear markets, underperform during bull markets, which intersects with the issues above. One (small) exception has been these past two months, during which value has outperformed during a period of rising equity prices. DIVO has outperformed too, as expected.

Data by YCharts

Overall, the fund is an incredibly well-rounded investment, with several positives, and no significant negatives.

DIVO - Performance Track-Record

In my opinion, DIVO's performance track-record is reasonably good, although it doesn't look like that at first glance.

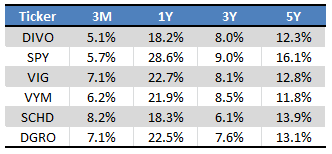

DIVO has underperformed the S&P 500 since inception, and for many relevant time periods. Performance relative to other dividend ETFs is more mixed but leaning towards underperformance. Underperformance is rarely significant though, and in some cases could simply be due to normal equity volatility.

Seeking Alpha - Table by Author

Although the figures above are accurate, they exclude DIVO's periods of outperformance: bear markets. As an example, DIVO significantly outperformed the S&P 500 during 2022, somewhat outperforming the average dividend ETF too, with some exceptions.

Data by YCharts

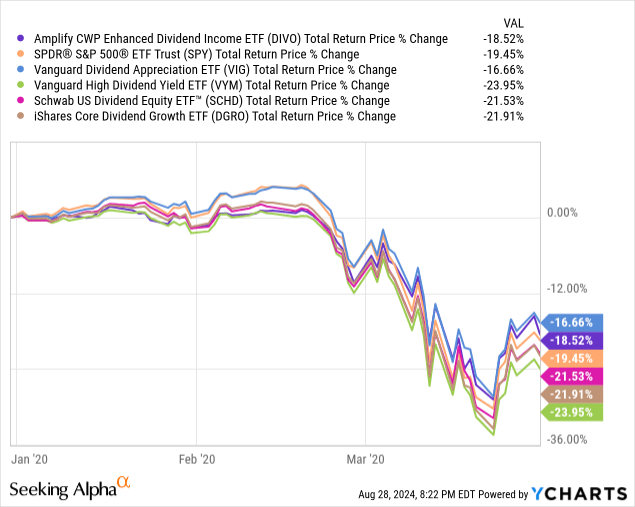

Performance during early 2020, the onset of the pandemic, too.

Data by YCharts

As mentioned previously, DIVO's outperformance during bear markets is due to the fund's high-quality holdings, and its covered call strategy. This same covered call strategy decreases gains during bull markets and should lead to long-term underperformance. DIVO could outperform if we enter into a prolonged bear market, or due to its high-quality holdings, but I'm not expecting this, and I don't think it should be an investor's base case scenario.

In my opinion, the situation with DIVO is clear. DIVO trades away some long-term gains for a higher yield, and better performance during bear markets. For some investors, this is a fantastic trade-off, for others an uncompelling one. I overall like the fund, but some might disagree, and it's mostly a question of preference and desired risk-return.

Conclusion

DIVO is an incredibly well-rounded investment, with an above-average 4.5% dividend yield, below-average drawdowns and risk, and moderate potential capital gains. It is a solid choice and might be of particular interest to income investors and retirees.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10