Institutional Investor Interest Returns! He Bought Bitcoin (BTC) and Four Altcoins, Sold a Surprise Altcoin!

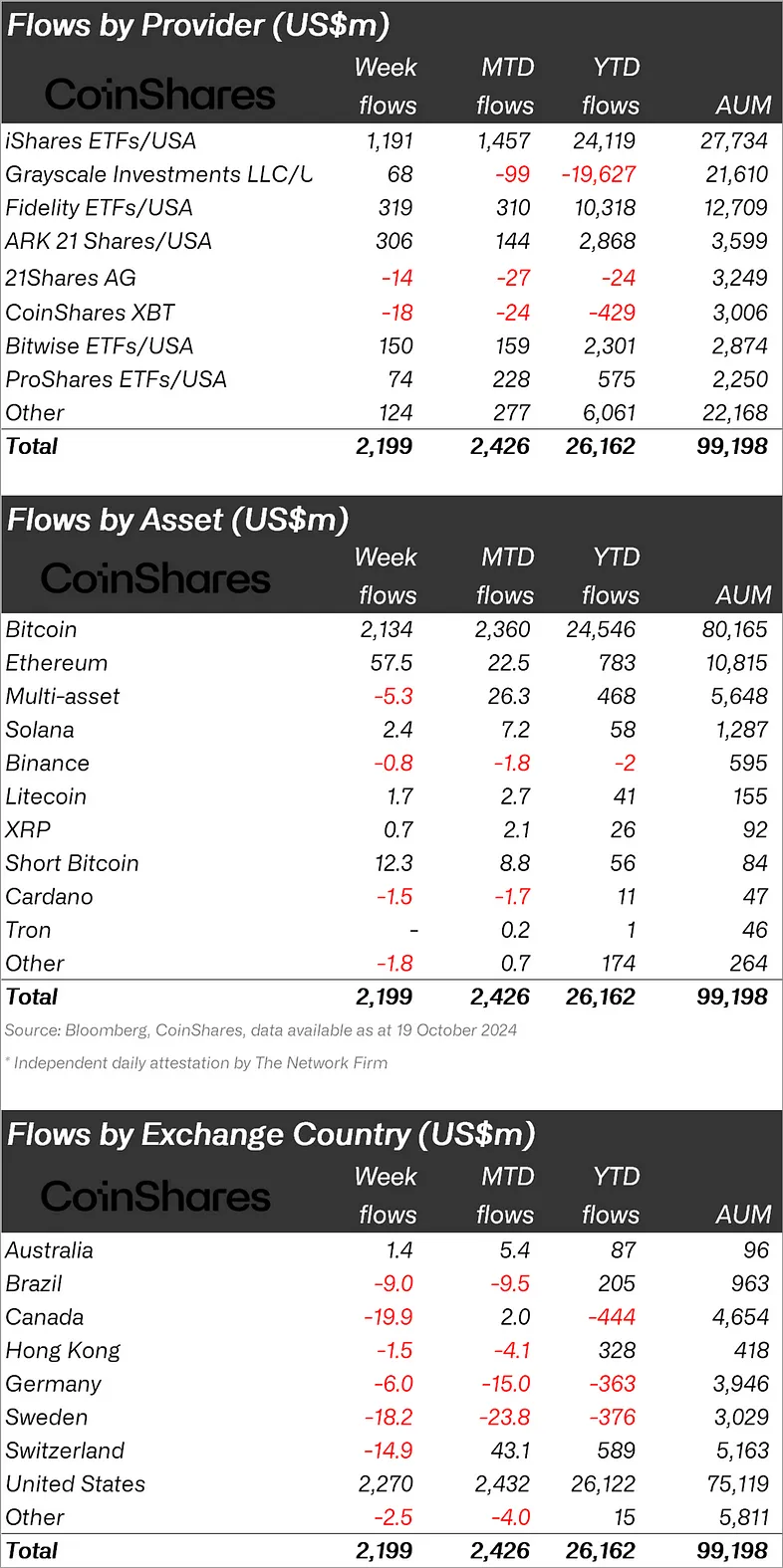

Bitcoin started the new week on the rise and the price rose above $ 69,500. While this increased investors' expectations for an increase, CoinShares published its weekly cryptocurrency report and said that there was an inflow of $ 2.2 billion last week.

“Inflows into cryptocurrency investment products reached $2.2 billion, the highest level since July, on optimism about the possibility of Republicans winning the US elections.”

Bitcoin Becomes the Focus Again!

When looking at crypto funds individually, it was seen that the fund inflows were in Bitcoin.

While BTC saw an inflow of $2.13 billion, Ethereum (ETH) saw an inflow of $57.5 million.

There was also an inflow of $12.3 million in the Bitcoin Short fund, which was indexed to the fall of BTC.

When we look at other altcoins, XRP experienced an inflow of $0.7 million, Solana (SOL) $2.4 million, Litecoin (LTC) $1.7 million, and Cardano (ADA) $1.5 million.

“Bitcoin was the biggest beneficiary, seeing an inflow of $2.13 billion, while with the recent price increase, $12 million inflow was achieved in the short Bitcoin fund, making it the biggest inflow since March of this year.

Ethereum also saw inflows of $58 million, while some altcoins like Solana ($2.4 million), Litecoin ($1.7 million), and XRP ($0.7 million) saw inflows.”

When looking at regional fund inflows and outflows, it was seen that the USA ranked first with an inflow of 2.27 billion dollars.

Australia came in second after the United States with $1.4 million.

In the face of these inflows, Canada had an outflow of $19.9 million, while Sweden had an outflow of $18.2 million.

*This is not investment advice.

Continue Reading: Institutional Investor Interest Returns! He Bought Bitcoin (BTC) and Four Altcoins, Sold a Surprise Altcoin!

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10