Donald Smith & Co. Increases Stake in Genworth Financial Inc.

Overview of the Recent Transaction

On September 30, 2024, Donald Smith & Co (Trades, Portfolio). made a significant addition to its investment portfolio by acquiring 901,485 shares of Genworth Financial Inc. (GNW, Financial). This transaction increased the firm's total holdings in Genworth to 25,015,294 shares, marking a substantial investment move. The shares were purchased at a price of $6.85 each, reflecting a strategic addition to the firm's substantial portfolio in the financial services sector.

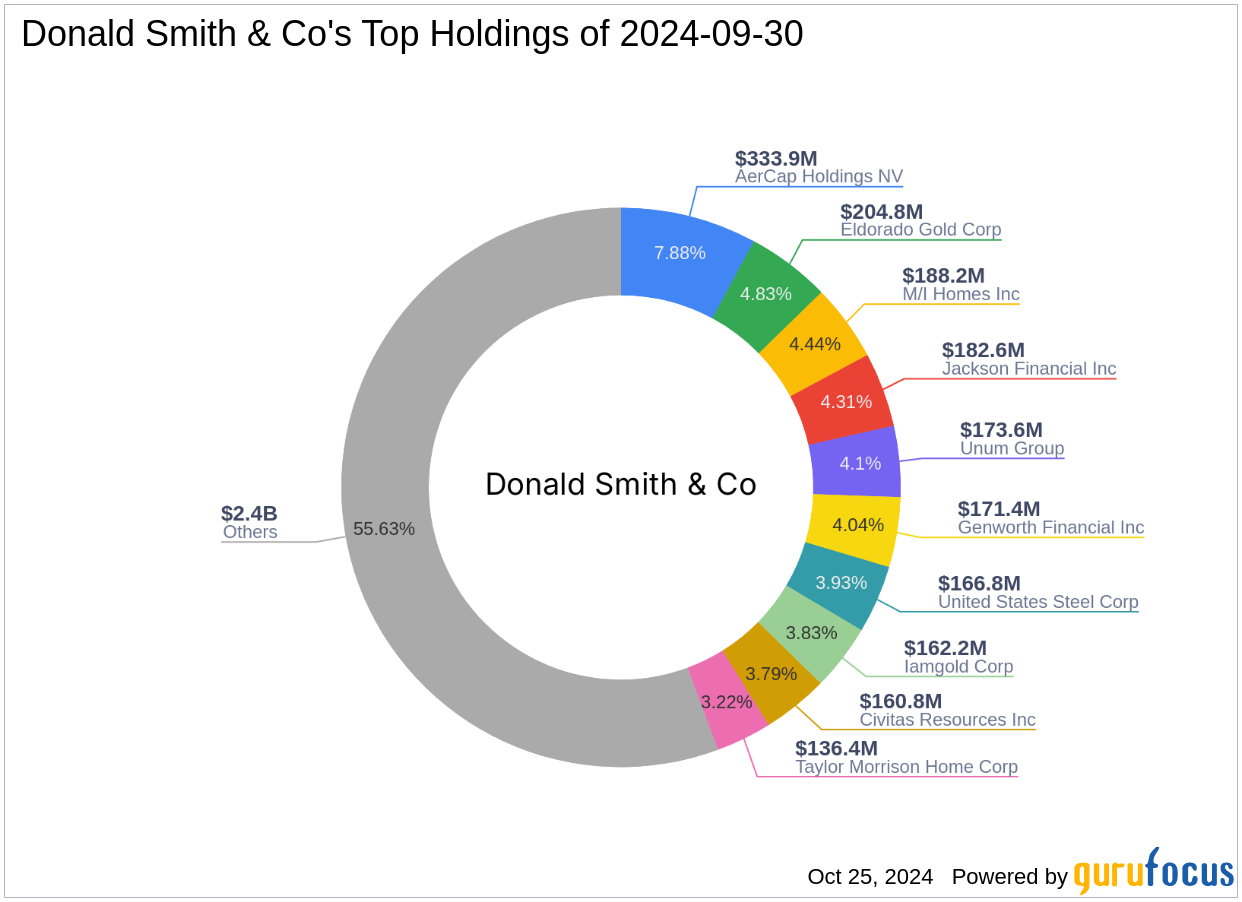

Profile of Donald Smith & Co (Trades, Portfolio).

Founded by Donald G. Smith, Donald Smith & Co (Trades, Portfolio). has been a prominent name in the investment community since 1980. The firm is renowned for its deep-value investment philosophy, focusing on out-of-favor companies that trade at discounts to their tangible book value. The firm's approach is rigorously bottom-up, seeking firms in the lowest decile of price-to-tangible book ratios with a positive earnings outlook over the next two to four years. Donald Smith & Co (Trades, Portfolio). manages an equity portfolio valued at approximately $4.24 billion, with top holdings in diverse sectors such as financial services and basic materials.

Introduction to Genworth Financial Inc.

Genworth Financial Inc., headquartered in the USA, operates as a diversified insurance holding company. Since its IPO on May 25, 2004, the company has developed a robust portfolio of products including life insurance, mortgage insurance, and annuities. Genworth's business is primarily segmented into Enact, Life and Annuities, and Long-Term Care Insurance, with the majority of its revenue generated from the Long-Term Care segment. Despite a challenging market, Genworth maintains a market capitalization of $2.91 billion.

Analysis of the Trade's Impact

The recent acquisition by Donald Smith & Co (Trades, Portfolio). has increased its position in Genworth Financial Inc. by 3.74%, bringing its total shareholding to 5.79% of the company. This move not only underscores the firm's confidence in Genworth's value but also significantly impacts its portfolio, with Genworth now constituting 4.36% of the total investments.

Market Performance and Valuation of Genworth Financial Inc.

Currently, Genworth's stock is trading at $6.74, slightly below the transaction price, reflecting a modest decline of 1.61% since the purchase. The stock is considered modestly overvalued with a GF Score of 66/100, indicating potential for future performance. The company's financial strength and profitability are areas of concern, with low rankings in growth and profitability metrics.

Sector and Financial Analysis

Genworth operates in the competitive insurance industry, where it has struggled with its financial metrics. The company's interest coverage ratio and Altman Z score are low, indicating potential financial distress. However, its investment in long-term care insurance could be a strategic move to leverage growth in this sector, given the aging population.

Future Outlook and Implications

The strategic increase in Genworth shares by Donald Smith & Co (Trades, Portfolio). suggests a positive outlook on the company's recovery and long-term value. For Genworth, this investment could signify strengthened investor confidence, potentially stabilizing its stock performance. For Donald Smith & Co (Trades, Portfolio)., this move aligns with its deep-value investment strategy, potentially yielding significant returns as market conditions evolve.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10