Schneider National, Inc. (NYSE:SNDR) reported weaker-than-expected third-quarter financial results on Wednesday.

Schneider National reported quarterly earnings of 18 cents per share which missed the analyst consensus estimate of 23 cents per share. The company reported quarterly sales of $1.316 billion which missed the analyst consensus estimate of $1.330 billion.

“In the third quarter, our Dedicated and Intermodal businesses demonstrated their resilience, and Logistics maintained its profitable operations,” said Mark Rourke, President and Chief Executive Officer of Schneider. “Dedicated performed well, with a robust new business pipeline, and Intermodal achieved margin growth due to enhanced network optimization, improved dray productivity, and our ongoing cost management actions. Additionally, Logistics continues to effectively manage net revenue and lower the cost of serving customers by advancing our Schneider FreightPower® technology and automation.”

Schneider National shares gained 4.7% to close at $30.44 on Wednesday.

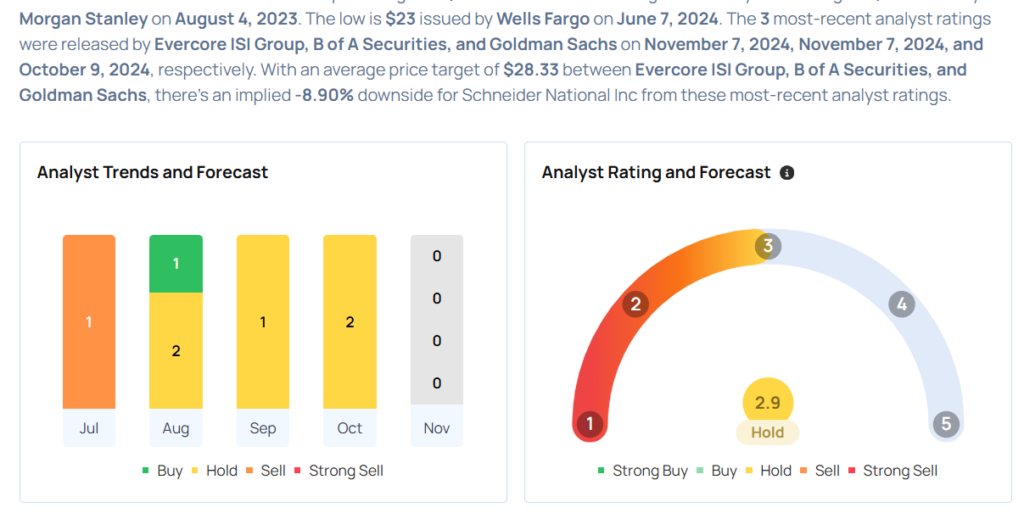

These analysts made changes to their price targets on Schneider National following earnings announcement.

- B of A Securities analyst Ken Hoexter upgraded Schneider National from Underperform to Buy and raised the price target from $27 to $34.

- Evercore ISI Group analyst Jonathan Chappell maintained Schneider National with an In-Line and lowered the price target from $27 to $26.

Considering buying SNDR stock? Here’s what analysts think:

Read More:

- Jim Cramer Recommends Buying This Utilities Stock, Says No To XP