Shiba Inu’s 65% Rally Triggers’ Largest LTH Move Since March

- Shiba Inu surges 65%, then pulls back to $0.00002411, with LTH activity signaling uncertainty about its future recovery.

- LTH behavior suggests concern, with a significant shift in holdings, indicating that long-term holders may be losing confidence in SHIB’s short-term outlook.

- SHIB stabilizes at $0.00002267 support, but a break below could lead to further declines to $0.00002093, invalidating the bullish trend.

Shiba Inu (SHIB) price has experienced a remarkable 65% surge in the past week, attracting significant attention from both retail and institutional investors. However, following this rally, SHIB has seen a sharp pullback, bringing it to a critical support level at $0.00002411.

This price action has raised concerns, particularly regarding the behavior of long-term holders (LTHs), whose actions suggest that SHIB’s future recovery may not be as smooth as initially hoped.

Shiba Inu Investors Are Restless

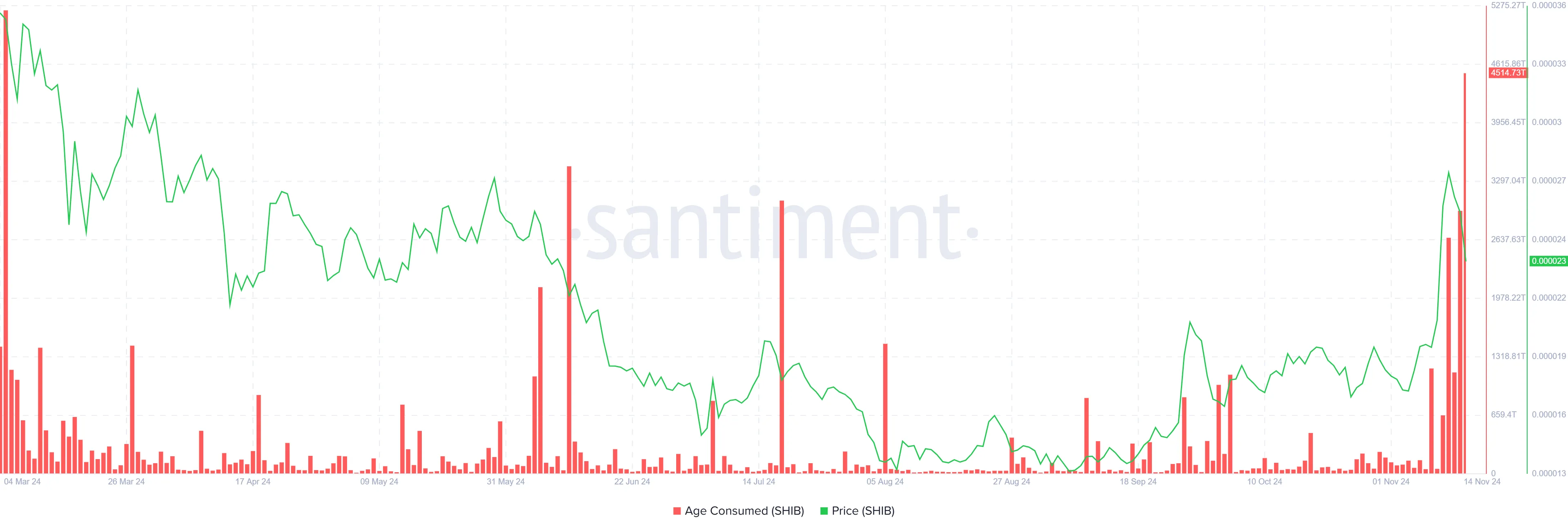

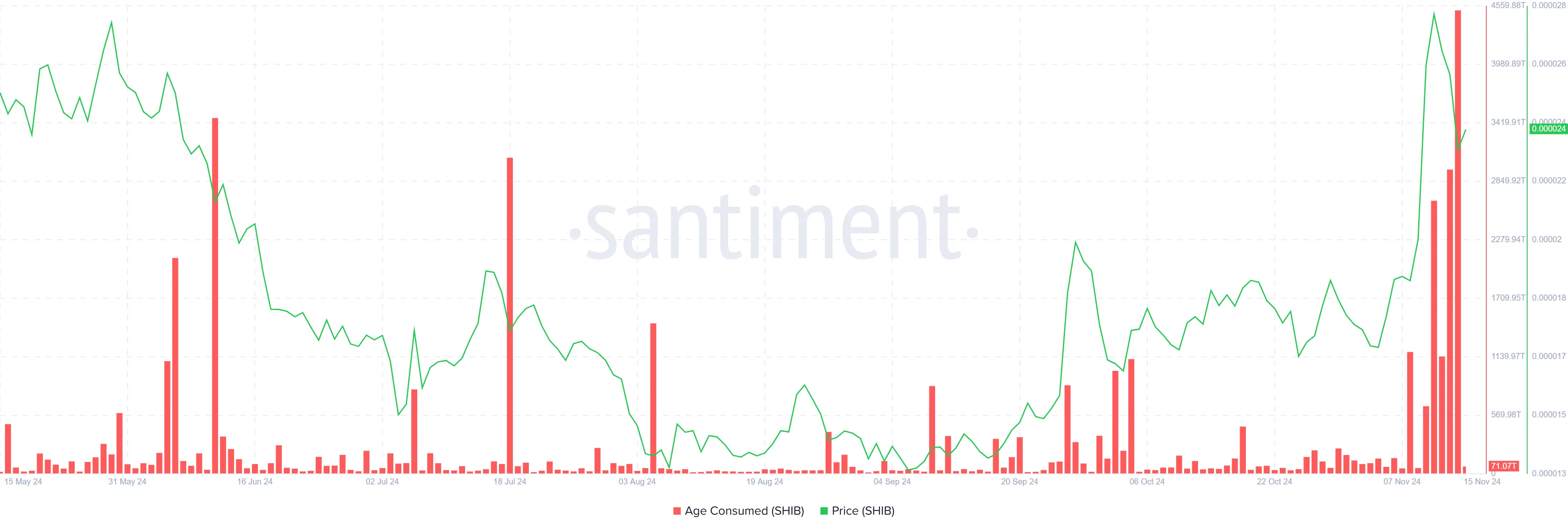

In the past 24 hours, Shiba Inu’s “age consumed” metric—a key indicator for tracking the movement of coins held for extended periods—has surged to its highest levels since March. This spike in activity points to the largest shift of LTH-held SHIB tokens in the last eight months. LTHs, who typically form the backbone of an asset’s market stability, have been moving their tokens more significantly than usual.

This increased activity among long-term holders signals uncertainty, with many investors potentially reconsidering their HODLing strategies. Such moves are typically seen as a bearish signal, suggesting that LTHs may no longer be as confident in the coin’s short-term outlook.

Active deposits, which track the number of unique addresses moving their SHIB holdings to exchanges, have also seen a notable decline. After a significant spike in activity earlier this week, the number of active deposits has dropped, indicating that fewer investors are looking to sell their holdings in the immediate future.

This could be a sign of investors pulling away from the market, possibly awaiting a more favorable market condition or a clearer trend. The decrease in active deposits suggests that there may be less immediate pressure to sell, which is a positive sign for SHIB in the longer term.

SHIB Price Prediction: Saving The Rise

Currently, Shiba Inu’s price stands at $0.00002411, down by 13% over the past 24 hours. This correction, while not drastic, has erased a substantial portion of the recent gains from the 65% rally, leaving investors cautious.

Despite this pullback, SHIB is showing signs of stabilizing around a key support level at $0.00002267, which has held firm for the past few days. If the support level continues to hold, SHIB could start trending upwards once again, with the next resistance target at $0.00002976.

However, if SHIB fails to maintain this support level and slips below $0.00002267, the cryptocurrency could face further downward pressure. A break below this level would open the door for a potential drop to $0.00002093 or even lower, invalidating the current bullish outlook. Such a move would suggest that SHIB is in a more extended period of consolidation or bearish activity, especially if the selling pressure from LTHs continues.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10