US Penny Stocks: 3 Picks Below $80M Market Cap

The U.S. stock market has experienced slight declines recently, with major indices like the Dow Jones Industrial Average and S&P 500 dipping as investors await insights from Federal Reserve Chair Jerome Powell. Amid this cautious atmosphere, penny stocks remain a compelling area for exploration, representing smaller or less-established companies that might offer significant value. Despite being an older term, penny stocks continue to present growth opportunities when they are supported by strong financials and clear growth paths.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.81915 | $6.09M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.61 | $2.05B | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $161.52M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| AsiaFIN Holdings (OTCPK:ASFH) | $1.50 | $81.55M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.40 | $125.19M | ★★★★★☆ |

| So-Young International (NasdaqGM:SY) | $1.25 | $72.53M | ★★★★☆☆ |

| Flexible Solutions International (NYSEAM:FSI) | $4.22 | $54.16M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $1.95 | $3.83M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9278 | $87.69M | ★★★★★☆ |

Click here to see the full list of 738 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Yatra Online (NasdaqCM:YTRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Yatra Online, Inc. is an online travel company operating in India and internationally with a market cap of $76.59 million.

Operations: The company's revenue is primarily derived from Air Ticketing (₹1.70 billion) and Hotels and Packages (₹1.62 billion), with additional income from Other Services (₹201.60 million).

Market Cap: $76.59M

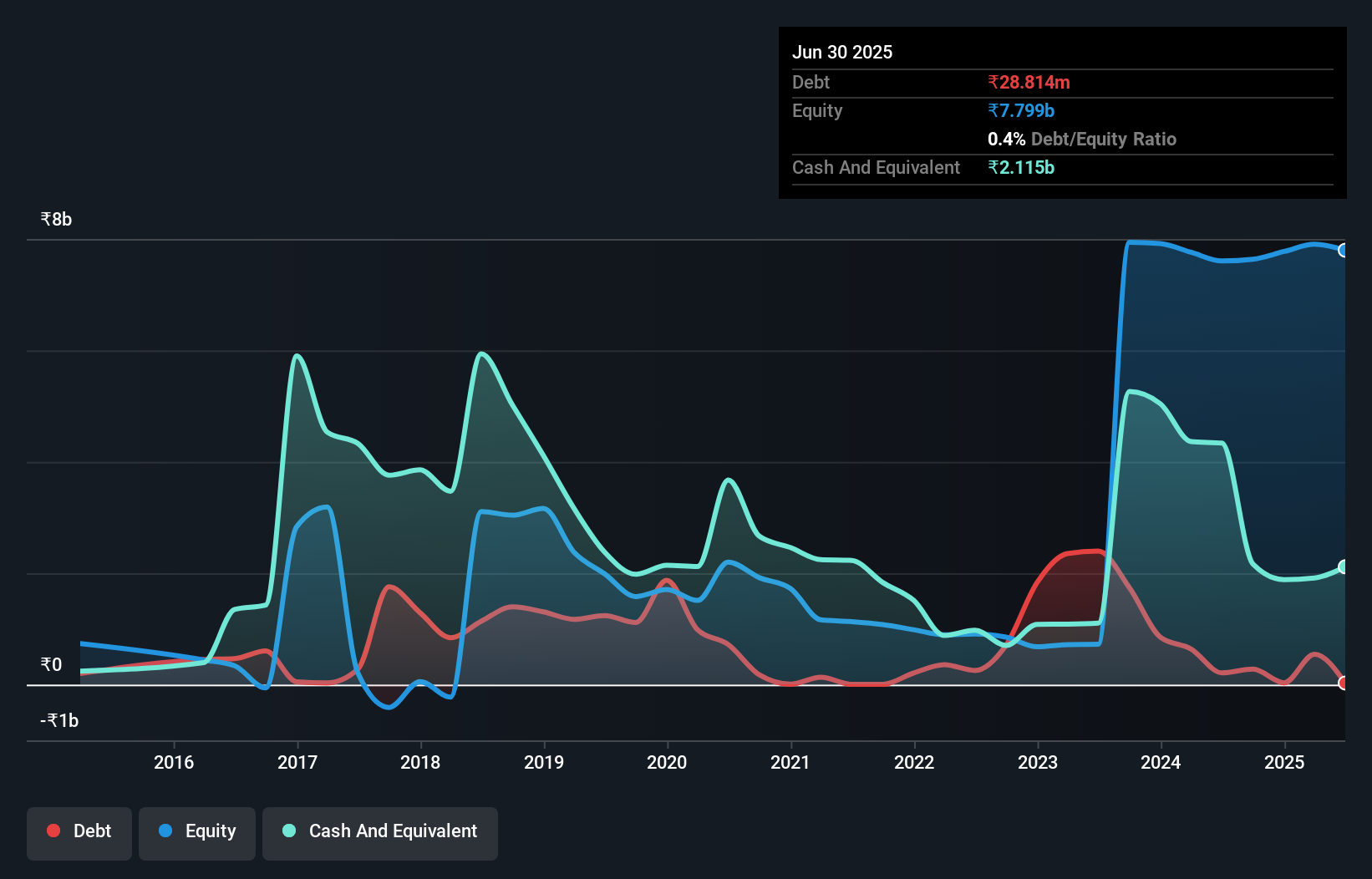

Yatra Online, Inc. has shown significant revenue growth, reporting ₹2.36 billion for the recent quarter compared to ₹947.57 million a year ago, while reducing net losses from ₹269.4 million to ₹15.72 million over the same period. Despite being unprofitable with a negative return on equity of -4.51%, Yatra maintains a strong cash position exceeding its total debt and boasts a substantial cash runway of over three years if its free cash flow continues growing at historical rates. The company’s seasoned management and board contribute to its stability amidst ongoing financial challenges in the competitive travel industry landscape.

- Navigate through the intricacies of Yatra Online with our comprehensive balance sheet health report here.

- Examine Yatra Online's past performance report to understand how it has performed in prior years.

Spruce Power Holding (NYSE:SPRU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Spruce Power Holding Corporation owns and operates distributed solar energy assets in the United States, with a market cap of $43.42 million.

Operations: The company generates revenue of $79.72 million from its Utilities - Independent Power Producers segment.

Market Cap: $43.42M

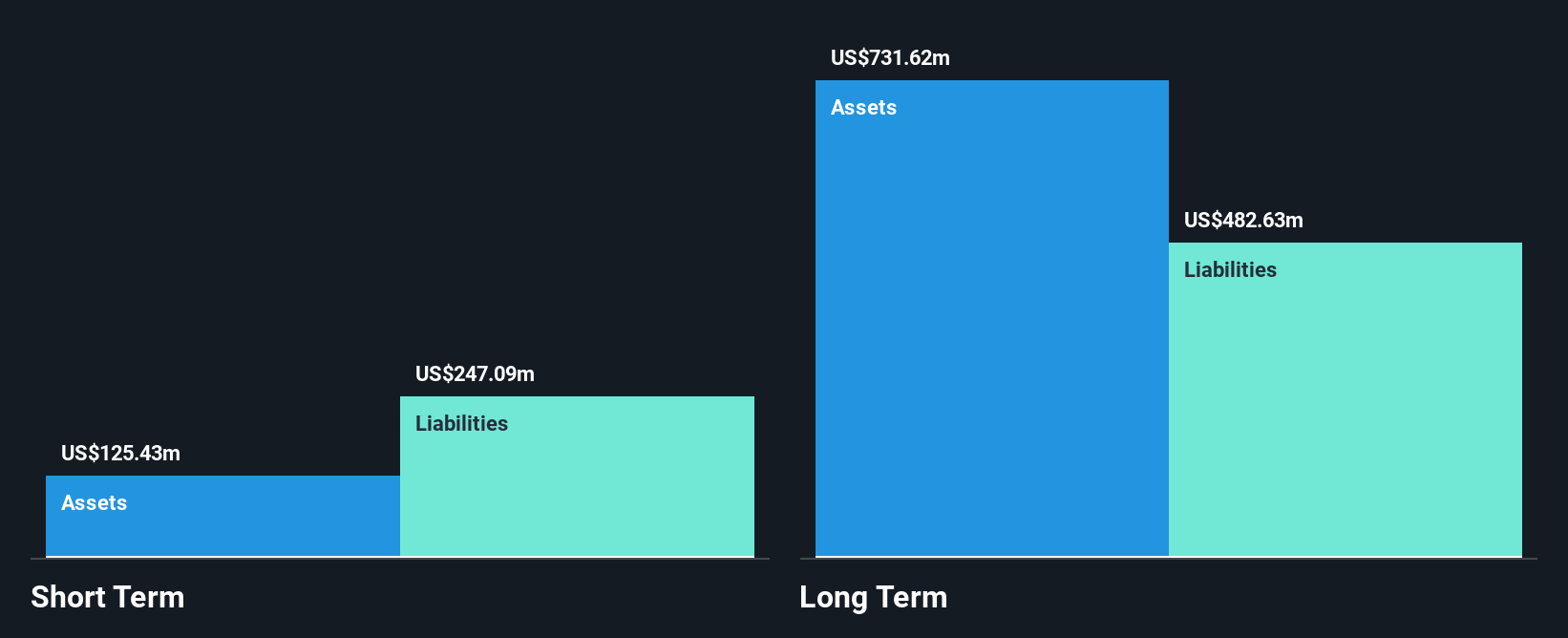

Spruce Power Holding Corporation, with a market cap of US$43.42 million, operates in the distributed solar energy sector but remains unprofitable with earnings declining by 33.4% annually over the past five years. Despite having short-term assets of US$178.9 million that cover its short-term liabilities of US$53.8 million, it faces challenges with long-term liabilities totaling US$600.1 million and a high net debt to equity ratio of 237.7%. Recent financial results show sales slightly decreased to US$22.48 million for Q2 2024, alongside a net loss of US$8.58 million compared to prior profits, reflecting ongoing volatility and financial restructuring needs.

- Click to explore a detailed breakdown of our findings in Spruce Power Holding's financial health report.

- Examine Spruce Power Holding's earnings growth report to understand how analysts expect it to perform.

PAID (OTCPK:PAYD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PAID, Inc. offers SaaS-based business services that streamline website creation, online sales, payment collection, and shipping for businesses in the United States and Canada, with a market cap of $23.46 million.

Operations: The company's revenue is primarily derived from Shipping Coordination and Label Generation Services, contributing $17.31 million, and Merchant Processing Services, which add $0.06 million.

Market Cap: $23.46M

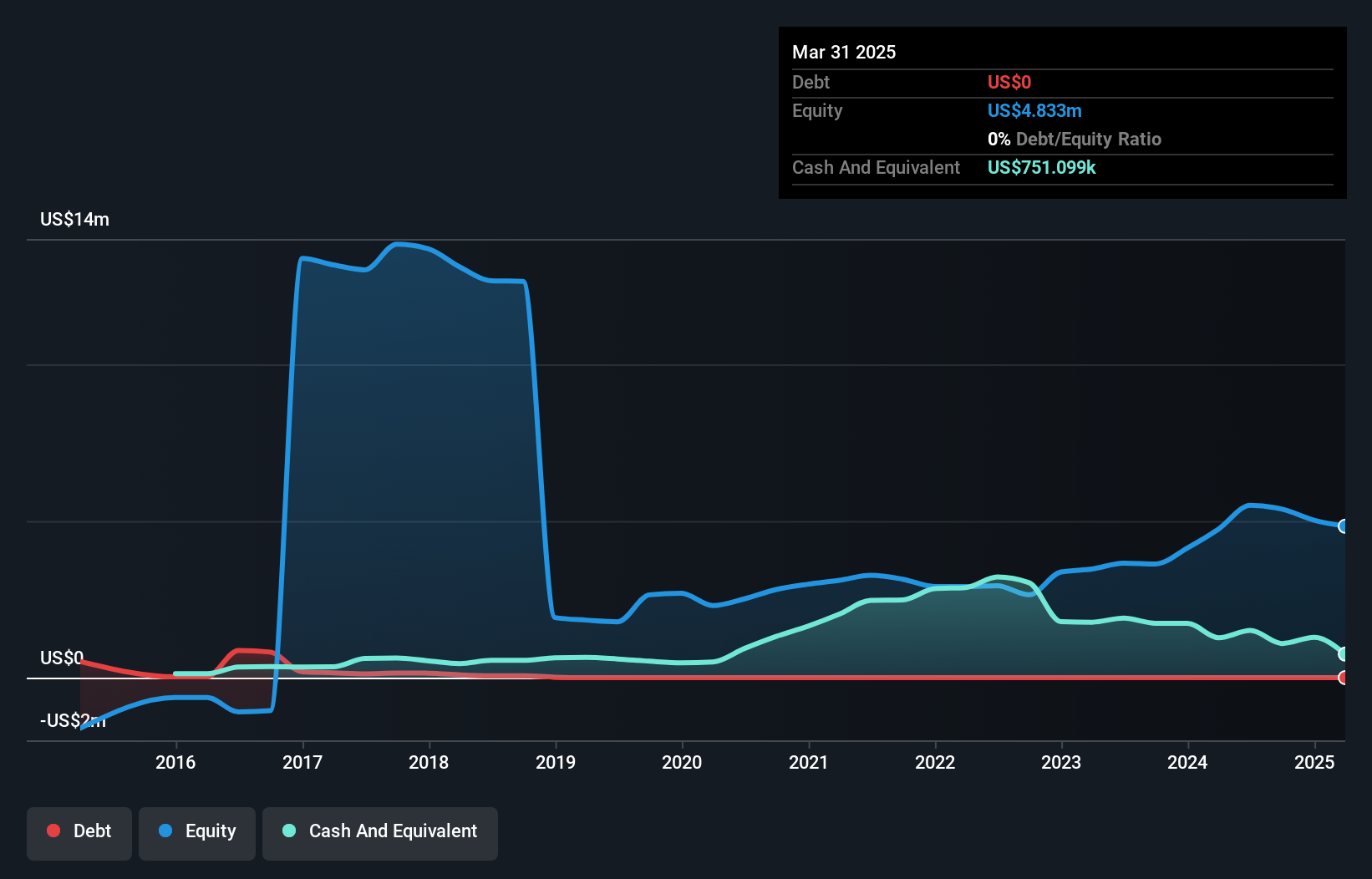

PAID, Inc., with a market cap of US$23.46 million, has shown significant financial improvement recently. For the second quarter of 2024, it reported sales of US$4.6 million and net income of US$0.77 million, marking a substantial increase from the previous year. The company is debt-free and maintains strong liquidity with short-term assets exceeding both its short-term and long-term liabilities. Its net profit margin improved to 9.5% from last year's 2.4%, supported by high-quality earnings and an experienced management team averaging 4.7 years in tenure, positioning it well within its sector's competitive landscape.

- Jump into the full analysis health report here for a deeper understanding of PAID.

- Understand PAID's track record by examining our performance history report.

Seize The Opportunity

- Jump into our full catalog of 738 US Penny Stocks here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10