Bitcoin Nears $100,000 After Hitting New Highs, Whales and Long-Term Holders Fuel the Growth

- Bitcoin surges to $97,864 ATH, driven by whale accumulation of 56,397 BTC worth $5.42 billion, signaling strong bullish momentum.

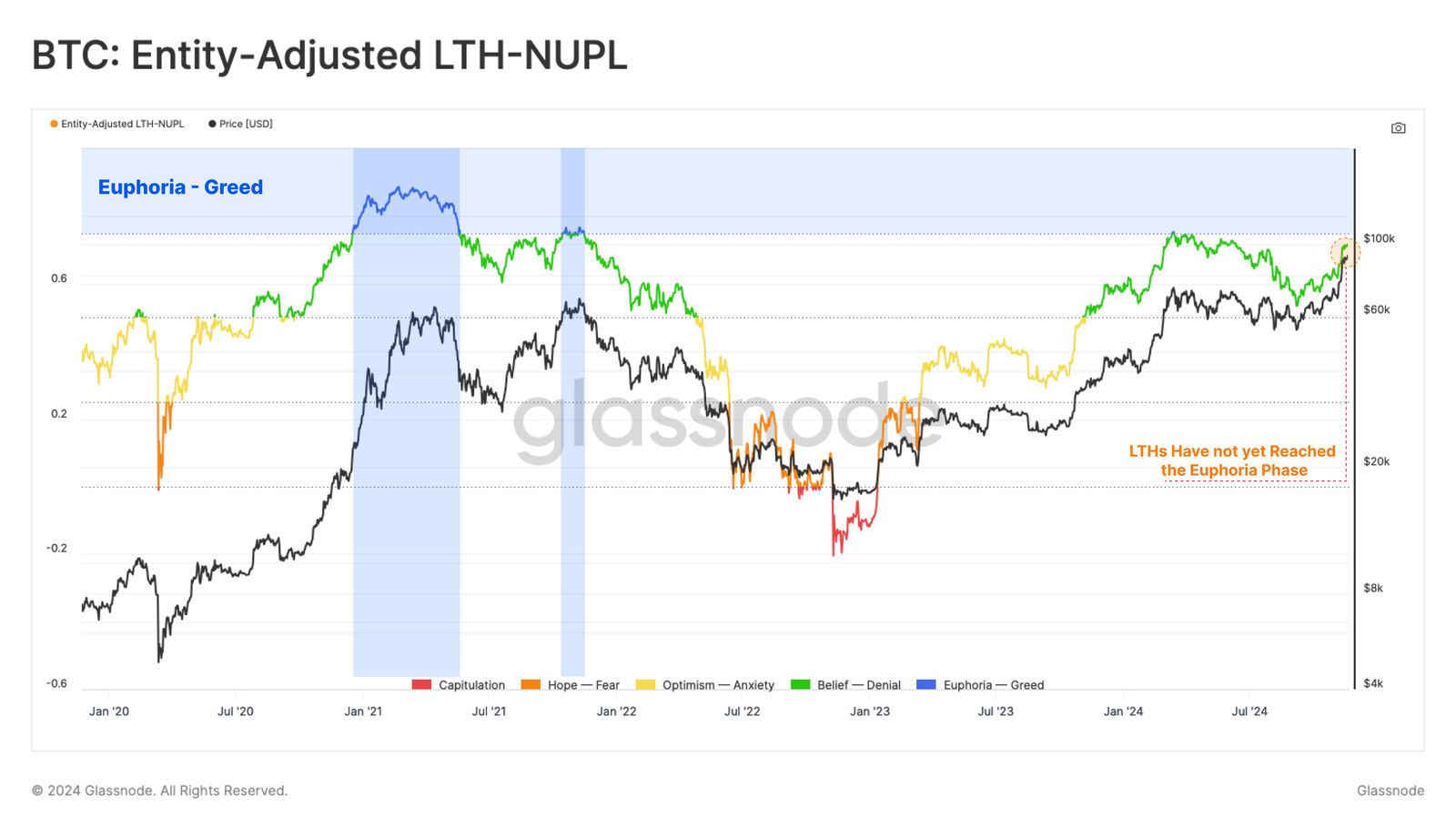

- LTH NUPL metric shows growth potential, with unrealized profits below the euphoria threshold, supporting Bitcoin’s path to $100,000.

- Sustaining $97,864 as support is critical; falling below $89,800 could trigger corrections and delay Bitcoin’s $100,000 milestone.

Bitcoin continues its record-breaking bull run, setting a new all-time high (ATH) every few days. The cryptocurrency recently surged close to the highly anticipated $100,000 milestone.

This achievement has been fueled by strong activity from whale investors and long-term holders (LTHs), who have played a pivotal role in Bitcoin’s rally.

Bitcoin Whales Accumulate

Whale addresses have been steadily accumulating Bitcoin over the past month, adding 56,397 BTC worth approximately $5.42 billion. This consistent buying pressure has significantly supported Bitcoin’s price action, driving it to new highs. Whale activity is considered a bullish indicator, as these large investors often influence market trends.

This accumulation showcases growing confidence among institutional and retail investors alike. The sustained bullish sentiment from whales indicates a strong belief in Bitcoin’s potential to breach the $100,000 mark. Such behavior adds resilience to Bitcoin’s current rally, helping it withstand potential market corrections.

The Long-Term Holder Net Unrealized Profit/Loss (LTH NUPL) metric remains below the Euphoria threshold, suggesting more room for growth. Historically, when LTHs hold significant unrealized profits without reaching the peak of euphoria, the market has further upside potential.

The metric indicates that LTHs are not engaging in widespread profit-taking, maintaining their conviction in Bitcoin’s upward trajectory. This is a strong macro signal that supports the continuation of the current bullish trend, making Bitcoin’s road to $100,000 more achievable.

Bitcoin Price Prediction: ATHs Soar

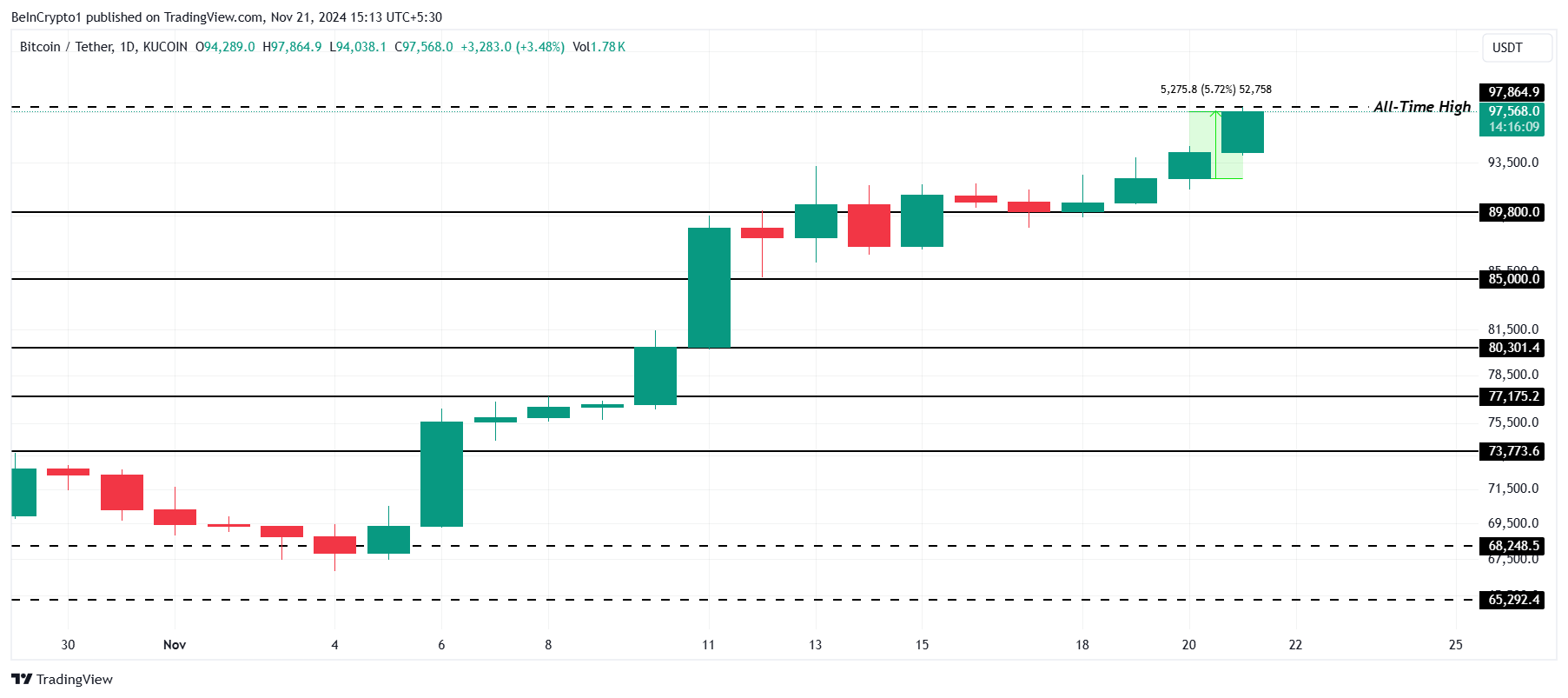

Bitcoin reached an all-time high of $97,864 earlier today, recording a 5.7% increase over the last 24 hours. This spike reflects growing demand and the market’s confidence in Bitcoin’s upward momentum.

To hit $100,000, Bitcoin must sustain its bullish momentum and establish $97,864 as a new support level. A successful flip of this resistance into support, combined with whale accumulation and LTH conviction, could drive Bitcoin to its historic milestone.

However, if profit-taking begins or if whales and LTHs shift their positions, a price correction could occur. A fall below $89,800 would invalidate the bullish outlook, potentially delaying Bitcoin’s rise to $100,000.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10