Catalyst Metals And 2 Other ASX Penny Stocks To Watch

The Australian market has shown positive momentum, rising 1.4% over the last week and 18% over the past year, with earnings projected to grow by 13% annually. In light of these conditions, identifying stocks with solid financial foundations and growth potential is crucial for investors seeking opportunities beyond well-known companies. While penny stocks are a somewhat outdated term, they still represent smaller or less-established companies that can offer significant value; here we explore three such stocks on the ASX that might present compelling prospects for discerning investors.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| LaserBond (ASX:LBL) | A$0.585 | A$68.57M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Helloworld Travel (ASX:HLO) | A$1.955 | A$318.31M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.50 | A$310.07M | ★★★★★☆ |

| MaxiPARTS (ASX:MXI) | A$1.87 | A$103.44M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.89 | A$239.61M | ★★★★★★ |

| Navigator Global Investments (ASX:NGI) | A$1.685 | A$825.78M | ★★★★★☆ |

| West African Resources (ASX:WAF) | A$1.495 | A$1.7B | ★★★★★★ |

| Atlas Pearls (ASX:ATP) | A$0.16 | A$69.71M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.90 | A$483.46M | ★★★★☆☆ |

Click here to see the full list of 1,044 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Catalyst Metals (ASX:CYL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Catalyst Metals Limited is engaged in the exploration and evaluation of mineral properties in Australia, with a market cap of A$666.65 million.

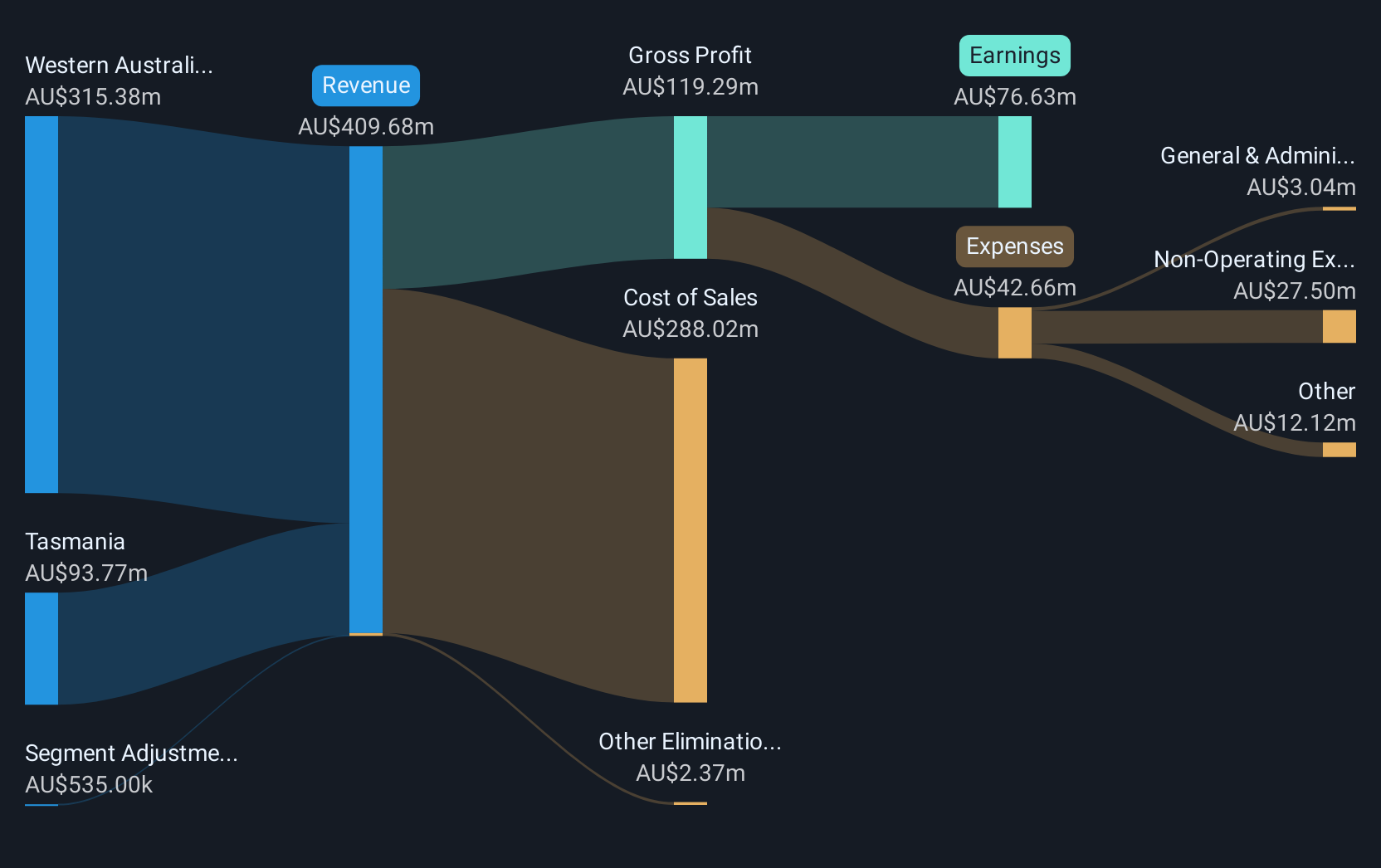

Operations: The company generates revenue from its operations primarily in Western Australia (A$243.77 million) and Tasmania (A$75.08 million).

Market Cap: A$666.65M

Catalyst Metals has transitioned to profitability, reporting A$317.01 million in sales for the year ended June 2024, a significant increase from the previous year. The company's debt is well-covered by operating cash flow, and it holds more cash than total debt, indicating strong financial health. Despite recent shareholder dilution and low return on equity at 11.7%, Catalyst's earnings are forecasted to grow by over 33% annually. Its addition to the S&P/ASX Emerging Companies Index underscores its growing presence in the market. However, short-term liabilities exceed short-term assets slightly, which may warrant attention.

- Jump into the full analysis health report here for a deeper understanding of Catalyst Metals.

- Assess Catalyst Metals' future earnings estimates with our detailed growth reports.

Praemium (ASX:PPS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Praemium Limited, with a market cap of A$311.64 million, offers advisors and wealth management solutions through a seamless digital platform in Australia and internationally.

Operations: Praemium generates revenue of A$82.73 million from its Software & Programming segment.

Market Cap: A$311.64M

Praemium Limited, with a market cap of A$311.64 million, offers a digital platform for wealth management solutions and reported A$82.73 million in revenue for the year ending June 2024. Despite its debt-free status and strong asset coverage over liabilities, Praemium faces challenges with declining profit margins—down to 10.6% from 20.4% last year—and negative earnings growth of -42.3%. The company's low return on equity at 8% highlights profitability concerns, yet it trades at a favorable P/E ratio compared to industry peers. Recent removal from the S&P Global BMI Index may impact investor sentiment moving forward.

- Get an in-depth perspective on Praemium's performance by reading our balance sheet health report here.

- Examine Praemium's earnings growth report to understand how analysts expect it to perform.

RPMGlobal Holdings (ASX:RUL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RPMGlobal Holdings Limited develops and provides mining software solutions across Australia, Asia, the Americas, Africa, and Europe with a market capitalization of A$693.28 million.

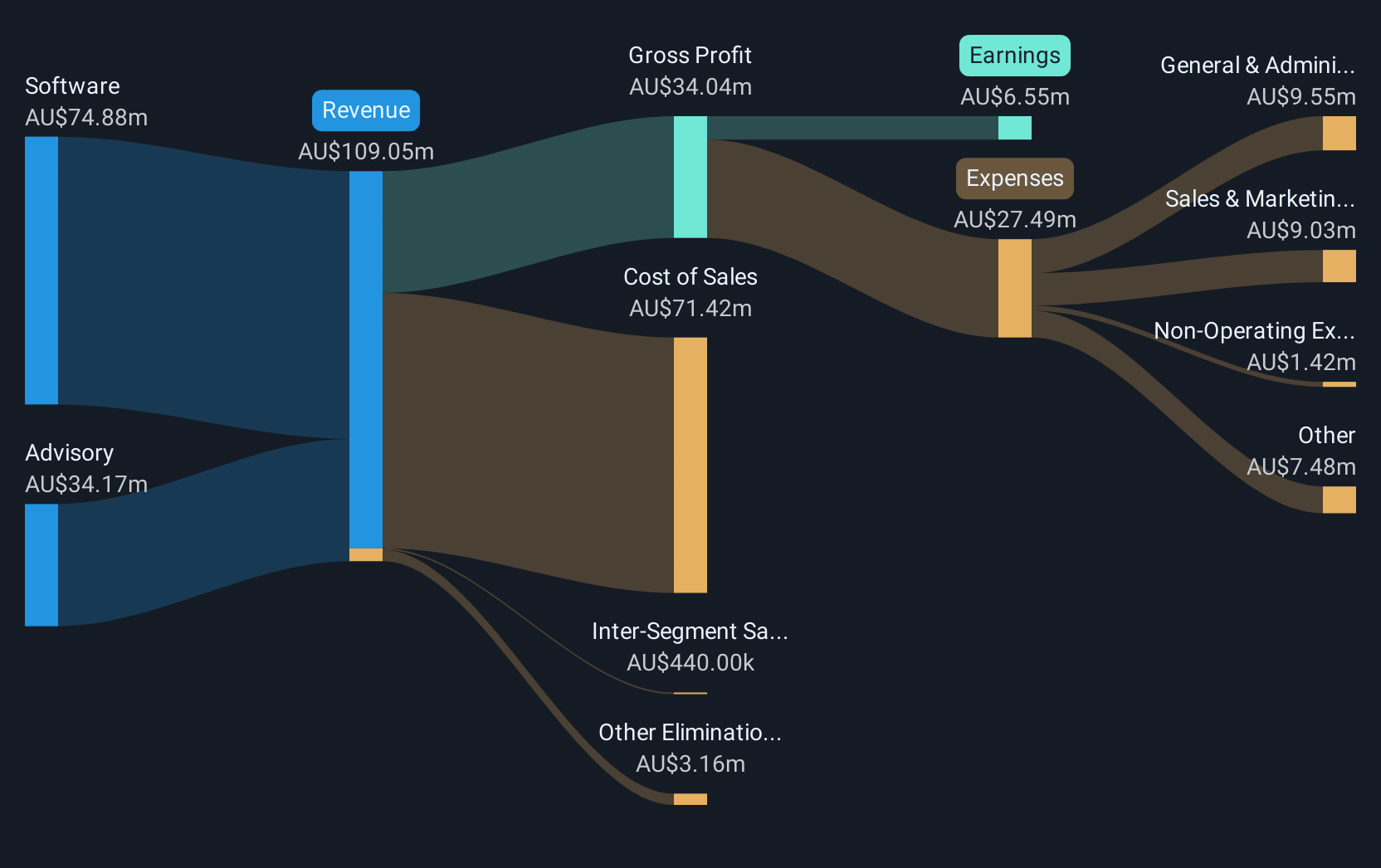

Operations: The company generates revenue through its Advisory segment, which contributes A$31.41 million, and its Software segment, which accounts for A$72.67 million.

Market Cap: A$693.28M

RPMGlobal Holdings, with a market cap of A$693.28 million, stands out for its robust financial health and growth trajectory. The company reported A$104.19 million in revenue for the year ending June 2024, marking an increase from the previous year's A$91.56 million, alongside net income growth to A$8.66 million from A$3.69 million. RPMGlobal benefits from a seasoned management team and board while maintaining a debt-free balance sheet with strong asset coverage over liabilities. Its earnings growth of 134.6% last year surpasses industry averages, though its return on equity remains relatively low at 15.5%.

- Click here to discover the nuances of RPMGlobal Holdings with our detailed analytical financial health report.

- Evaluate RPMGlobal Holdings' prospects by accessing our earnings growth report.

Make It Happen

- Jump into our full catalog of 1,044 ASX Penny Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10