Ethereum Name Service (ENS) Soars to New Yearly High of $37.29, Leads Top 100 Gainers

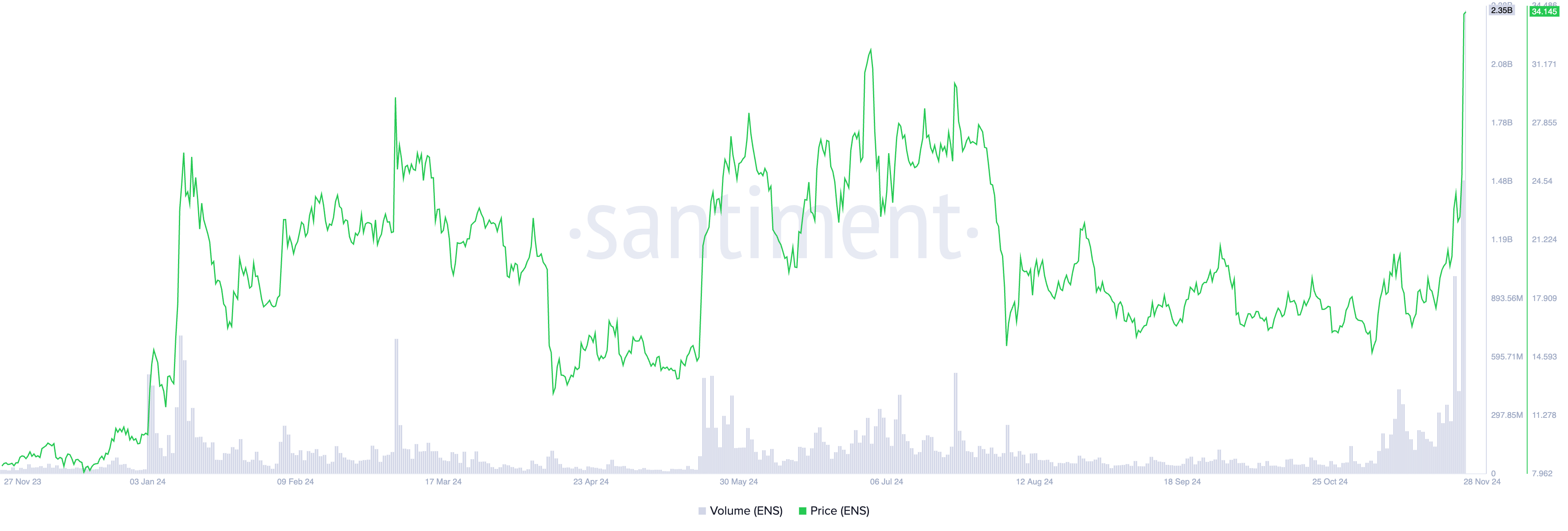

- ENS surges 37%, hitting a new YTD high of $37.29, driven by a 296% spike in trading volume to $2.35 billion.

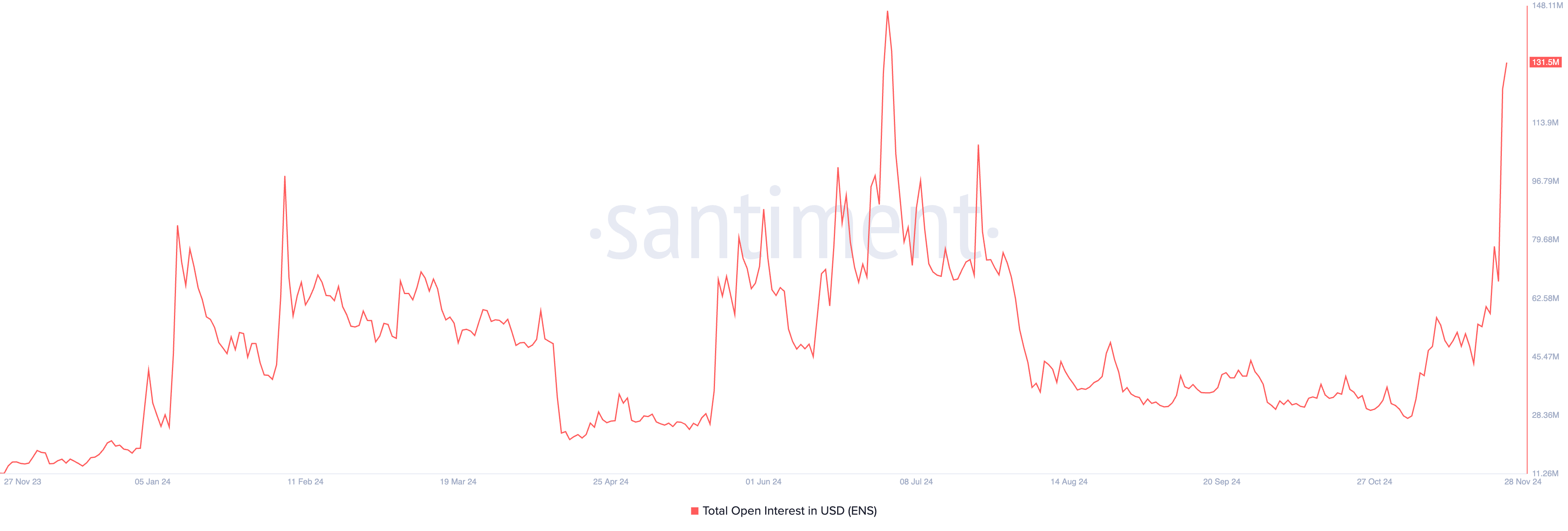

- The token’s open interest rises to $132 million, the highest since July, signaling growing trader conviction in the rally.

- RSI at 78.06 warns of potential buyer exhaustion, with a possible correction bringing ENS down to $31.57.

ENS, the native token of Ethereum Name Service, a decentralized naming system, has seen a sharp price increase, surging by 37% in the past 24 hours. This performance makes it the top gainer among the top 100 cryptocurrencies.

During Thursday’s early Asian session, the altcoin reached a new year-to-date high of $37.29 before pulling back slightly. It is now trading at $34.17, accompanied by a notable rise in trading volume.

Ethereum Name Service Sees Spike in Trading Activity

A significant rise in trading volume has accompanied ENS’ double-digit surge. It has reached an all-time high of $2.35 billion, rocketing by more than 300% over the past 24 hours.

When an asset’s trading volume rallies with its price, it signals strong investor interest. Rising volume confirms that the price movement is supported by active participation, making the rally more sustainable. On the other hand, a price increase without volume growth may suggest a weaker uptrend that could be prone to reversal.

This means that actual demand for the token, rather than mere speculative trading activity, has driven ENS’ rally.

Moreover, the altcoin’s open interest has surged to a multi-month high of $132 million, confirming the rise in trading activity. Per Santiment, this has risen by 7% over the past 24 hours and is currently at its highest level since July.

Open interest measures the total number of outstanding contracts (such as futures or options) that have not yet been settled or closed. When it climbs during a price rally, it indicates that more traders are entering positions, suggesting strong market participation in the rally.

This signals the trend will continue, as increasing open interest reflects growing confidence in the price movement.

ENS Price Prediction: Buyers May Soon Witness Exhaustion

As of this writing, ENS trades slightly above support formed at $31.57. A successful retest of this support level will propel the token’s price to reclaim its year-to-date high of $37.29.

However, readings from ENS’ Relative Strength Index (RSI) indicate that the market is overheated, and buyers may soon experience exhaustion. At press time, the indicator’s value is at 79.27.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges from 0 to 100, with values above 70 suggesting the asset is overbought and potentially due for a correction. Conversely, RSI values below 30 signal the asset is oversold and may be primed for a rebound.

A potential correction will push the ENS token price below support at $31.57 and toward $28.27.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10