3 Growth Stocks Insiders Are Confident In

In a week marked by mixed performances in global markets, the Nasdaq Composite reached a new milestone while growth stocks continued to outpace their value counterparts. Amidst these developments, expectations for an upcoming Federal Reserve rate cut have solidified, reflecting ongoing economic adjustments and market anticipation. In this environment, high insider ownership can be seen as a positive indicator of confidence in a company's potential for growth, making it an essential factor to consider when evaluating investment opportunities.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Medley (TSE:4480) | 34% | 31.7% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Click here to see the full list of 1529 stocks from our Fast Growing Companies With High Insider Ownership screener.

Below we spotlight a couple of our favorites from our exclusive screener.

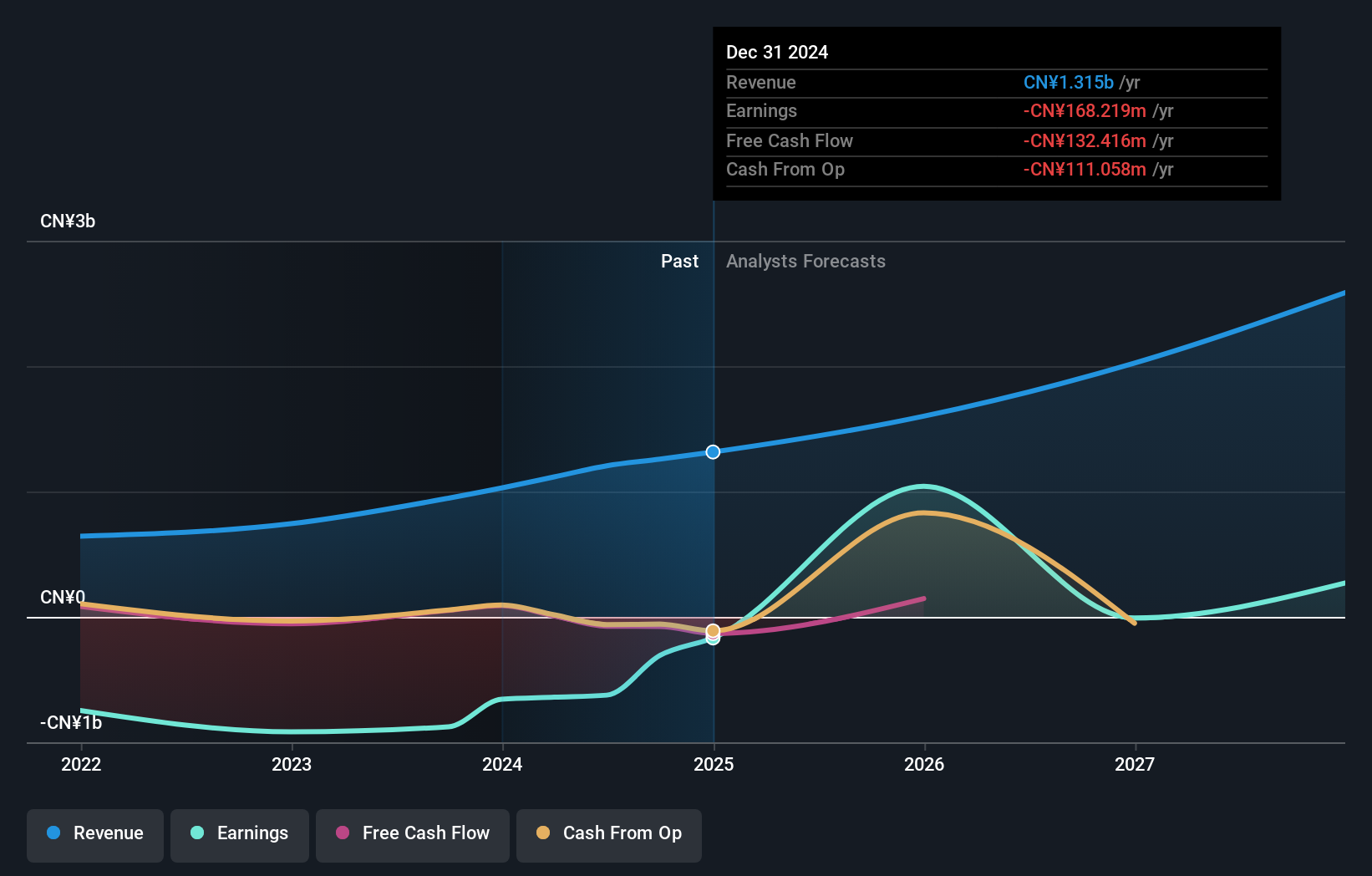

Lianlian DigiTech (SEHK:2598)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lianlian DigiTech Co., Ltd., along with its subsidiaries, offers digital payment and value-added services to small and midsized merchants and enterprises in China, with a market cap of HK$10.10 billion.

Operations: The company's revenue is derived from three main segments: Global Payment (CN¥722.95 million), Domestic Payment (CN¥309.92 million), and Value-Added Services (CN¥153.01 million).

Insider Ownership: 19.7%

Lianlian DigiTech's revenue is forecast to grow at 18.9% annually, outpacing the Hong Kong market average of 7.8%, with earnings expected to increase by 95.65% per year, indicating strong growth potential despite a low future return on equity of 14.3%. Analysts agree on a potential stock price rise of 21%, and while there's no substantial recent insider trading activity, high insider ownership aligns management interests with shareholders as the company aims for profitability within three years.

- Dive into the specifics of Lianlian DigiTech here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Lianlian DigiTech's share price might be too optimistic.

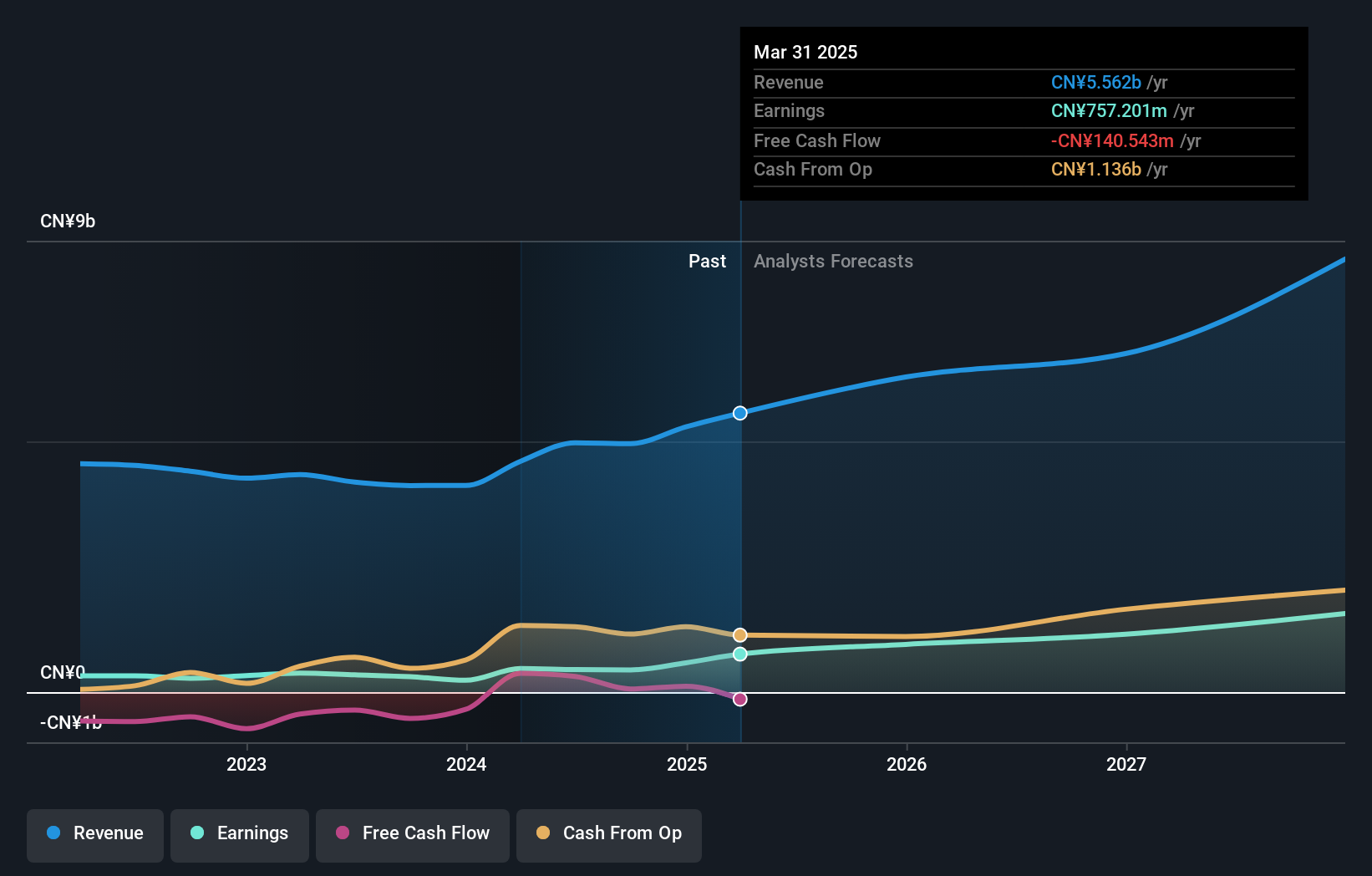

Shenzhen Noposion Crop Science (SZSE:002215)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Noposion Crop Science Co., Ltd. engages in the research, development, production, and sale of agricultural inputs both in China and internationally, with a market cap of CN¥11.05 billion.

Operations: Shenzhen Noposion Crop Science Co., Ltd. generates revenue through the research, development, production, and sale of agricultural inputs domestically and globally.

Insider Ownership: 28.0%

Shenzhen Noposion Crop Science has demonstrated robust growth, with earnings rising by 44.3% over the past year and net income reaching CNY 487.61 million for the first nine months of 2024. The company's earnings are expected to grow significantly at 37% annually, surpassing the Chinese market average of 25.7%. Although it faces a high debt level and slower revenue growth compared to market expectations, its price-to-earnings ratio of 26.8x suggests good value relative to peers.

- Click here and access our complete growth analysis report to understand the dynamics of Shenzhen Noposion Crop Science.

- Our valuation report here indicates Shenzhen Noposion Crop Science may be undervalued.

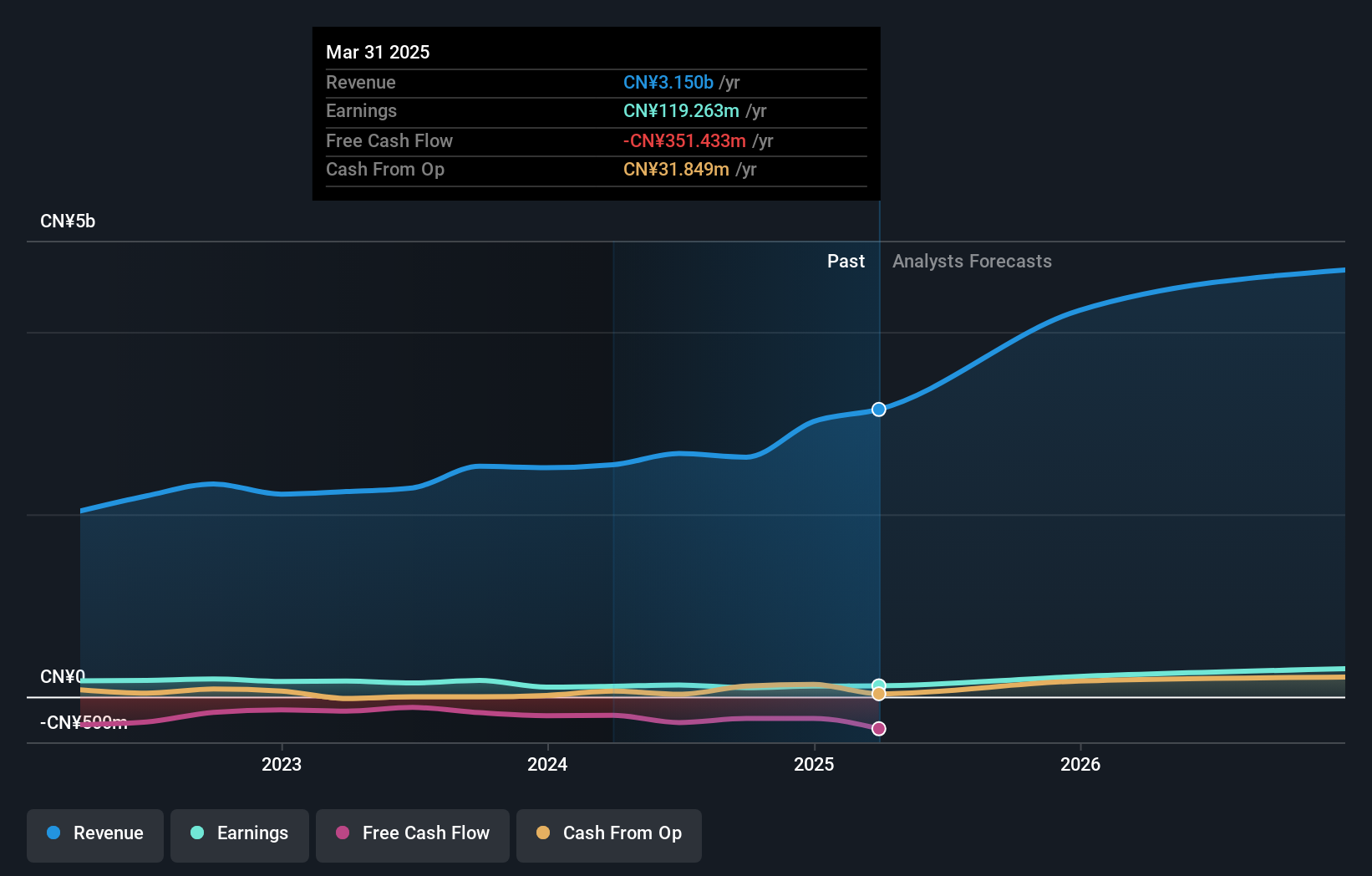

Guangdong Shenling Environmental Systems (SZSE:301018)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Shenling Environmental Systems Co., Ltd. operates in the environmental systems industry and has a market cap of CN¥7.95 billion.

Operations: Guangdong Shenling Environmental Systems Co., Ltd. has revenue segments in the environmental systems industry, contributing to its market presence with a market cap of CN¥7.95 billion.

Insider Ownership: 38.7%

Guangdong Shenling Environmental Systems is poised for strong growth, with earnings projected to rise 40.6% annually, outpacing the Chinese market average. Despite a decline in net profit margins from 7.1% to 3.8%, revenue is expected to grow at 23.4% per year, faster than both the market and its own historical performance. Recent earnings show sales of CNY 1.98 billion for the first nine months of 2024, though net income slightly decreased to CNY 142.87 million from last year’s figures.

- Navigate through the intricacies of Guangdong Shenling Environmental Systems with our comprehensive analyst estimates report here.

- The analysis detailed in our Guangdong Shenling Environmental Systems valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Unlock our comprehensive list of 1529 Fast Growing Companies With High Insider Ownership by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10