3 ASX Penny Stocks To Consider In December 2024

Hesitation from Jerome Powell and the Federal Reserve regarding U.S. rates has sent ripples through global markets, including Australia, where ASX 200 futures are expected to open lower. Amidst this backdrop of uncertainty, investors may find opportunities in penny stocks—an investment area that often involves smaller or newer companies with potential for growth at lower price points. While the term "penny stocks" might seem outdated, these investments can still offer significant value when they possess strong financials and a clear growth trajectory.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.76 | A$141.28M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.79 | A$97.91M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.84 | A$237.96M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.92 | A$310.98M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.495 | A$319.37M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.575 | A$766.97M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.92 | A$135.71M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$217.42M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.78 | A$99.83M | ★★★★★★ |

Click here to see the full list of 1,049 stocks from our ASX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Aston Minerals (ASX:ASO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aston Minerals Limited is involved in the acquisition, exploration, and evaluation of mineral properties across Canada, Australia, Indonesia, and Europe with a market cap of A$11.66 million.

Operations: The company's revenue is derived entirely from its mineral exploration activities, totaling A$0.16 million.

Market Cap: A$11.66M

Aston Minerals Limited, with a market cap of A$11.66 million, remains pre-revenue as it focuses on mineral exploration across multiple regions. Despite its unprofitable status and negative return on equity, the company benefits from being debt-free and having short-term assets exceeding liabilities. However, its cash runway is less than a year under current cash flow conditions. Recent developments include structural targeting analysis at the Edleston Gold Project in Ontario, highlighting potential high-grade gold mineralization. The company's management team is relatively new with an average tenure of 1.6 years, though the board has more experience averaging 4.6 years in tenure.

- Navigate through the intricacies of Aston Minerals with our comprehensive balance sheet health report here.

- Gain insights into Aston Minerals' historical outcomes by reviewing our past performance report.

Bass Oil (ASX:BAS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bass Oil Limited, with a market cap of A$14.23 million, is involved in the exploration, development, and production of oil and gas in Australia and Indonesia.

Operations: The company's revenue is derived from its operations in Australia, generating $2.72 million, and Indonesia, contributing $3.76 million.

Market Cap: A$14.23M

Bass Oil Limited, with a market cap of A$14.23 million, has achieved profitability over the past year, generating revenue from its operations in Australia (A$2.72 million) and Indonesia (A$3.76 million). The company is debt-free, eliminating concerns about interest payments and debt coverage. While it has experienced shareholder dilution with an 8.2% increase in shares outstanding over the past year, its short-term assets of A$3.4 million exceed both short-term liabilities (A$1.5 million) and long-term liabilities (A$2.8 million). Despite low return on equity at 2%, Bass Oil's board boasts significant experience with an average tenure of 10 years.

- Dive into the specifics of Bass Oil here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Bass Oil's track record.

Kingsrose Mining (ASX:KRM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kingsrose Mining Limited, with a market cap of A$24.87 million, is a mineral exploration company operating in Norway and Finland.

Operations: Kingsrose Mining Limited does not report any specific revenue segments.

Market Cap: A$24.87M

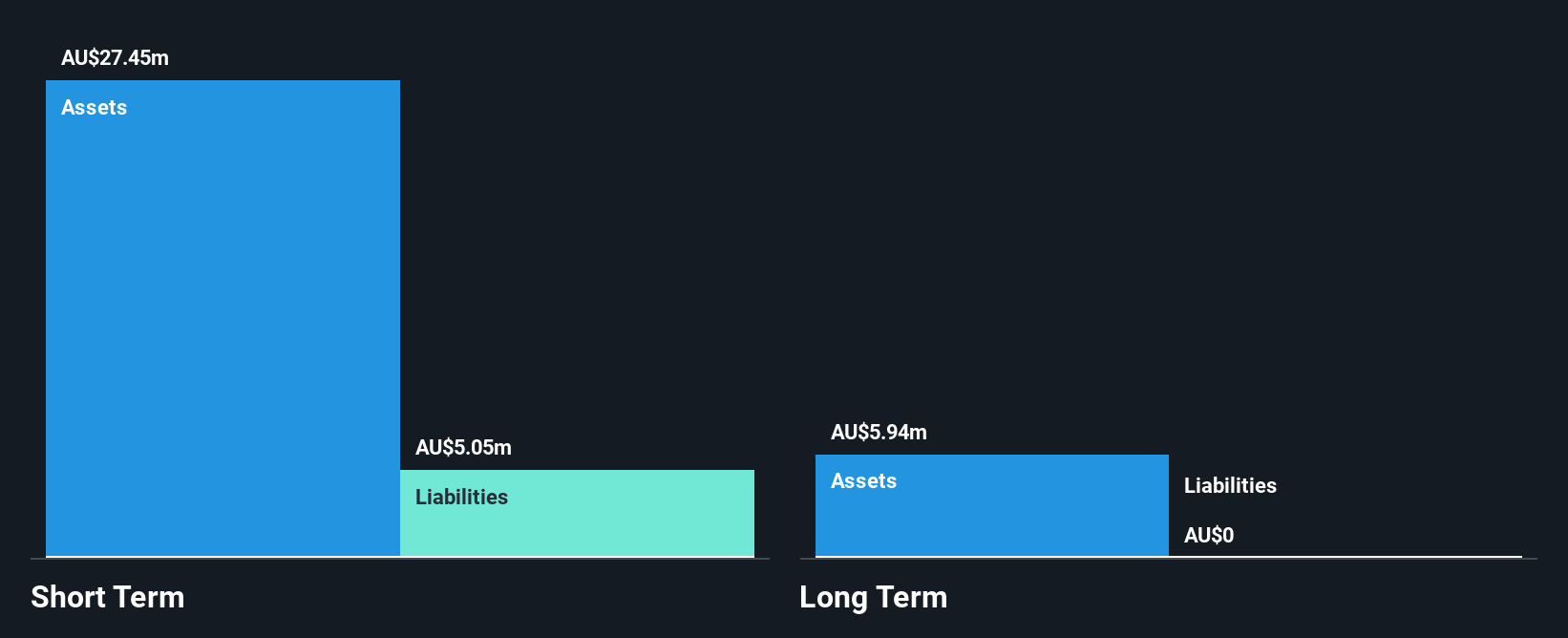

Kingsrose Mining Limited, with a market cap of A$24.87 million, operates as a mineral exploration company in Norway and Finland and is currently pre-revenue. Despite being unprofitable, the company has a substantial cash runway exceeding three years without debt concerns. Its short-term assets of A$29 million comfortably cover short-term liabilities of A$4 million. The board is experienced with an average tenure of 4.1 years, though the management team is relatively new with an average tenure of 1.7 years. The stock exhibits high volatility compared to most Australian stocks, reflecting potential risks for investors in this penny stock space.

- Click here to discover the nuances of Kingsrose Mining with our detailed analytical financial health report.

- Gain insights into Kingsrose Mining's past trends and performance with our report on the company's historical track record.

Where To Now?

- Unlock more gems! Our ASX Penny Stocks screener has unearthed 1,046 more companies for you to explore.Click here to unveil our expertly curated list of 1,049 ASX Penny Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kingsrose Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10