BlackRock’s IBIT Bitcoin ETF Hits Record $330 Million Outflow Since Launch

- BlackRock's IBIT ETF saw a record $330.8 million outflow on January 2, marking its largest exit since launch.

- Competing ETFs from Fidelity, Ark, and Bitwise logged inflows on the same day.

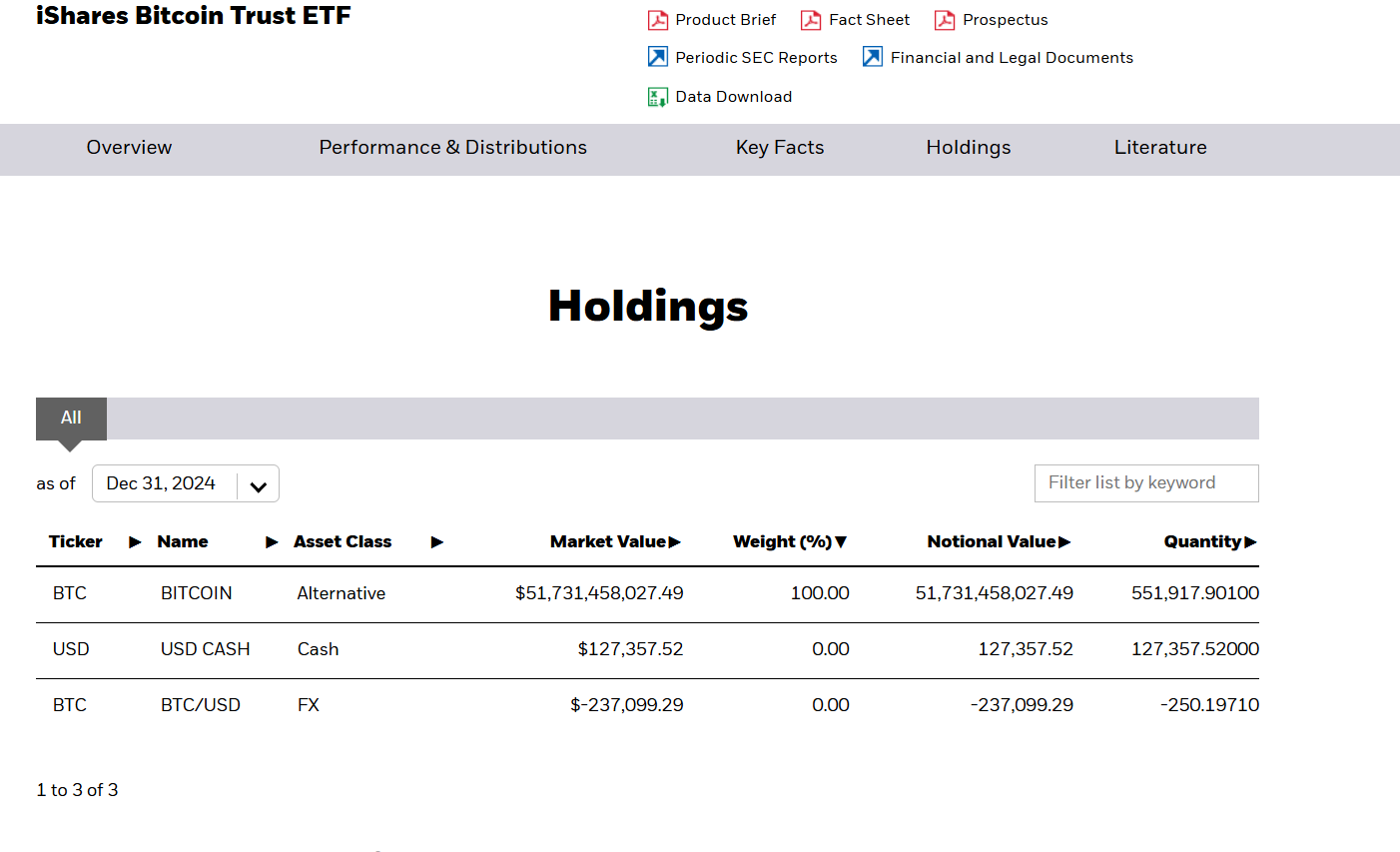

- Despite outflows, IBIT holds 551,000 BTC, accounting for 2.38% of all Bitcoin, maintaining its strong track record.

BlackRock’s iShares Bitcoin Trust (IBIT) ETF has recorded its largest outflow since launching a year ago, marking a significant moment in the Bitcoin ETF market.

The latest outflow surpassed the previous record of $188.7 million, which occurred on December 24, 2024.

Bitcoin ETF Outflows Hit $242 Million as IBIT Bleeds

According to data from SoSoValue, the fund saw a record $330.8 million exit on January 2, equivalent to more than 3,500 BTC. After IBIT’s record exodus, the total daily net outflows of BTC ETFs hit $242 million.

January 2 also marks the third consecutive day of outflows for IBIT, setting another new record. According to data from Farside Investors, BlackRock’s Bitcoin Trust has experienced a total outflow of $391 million over the past week alone.

At the same time, the Fidelity, Ark, and Bitwise BTC ETFs recorded net inflows of $36.2 million, $16.54 million, and $48.31 million, respectively, on January 2.

The IBIT outflows come as Bloomberg ETF analyst Eric Balchunas noted in December that IBIT is the greatest of all ETFs launched. He said this as BlackRock shot up more quickly than any ETFs across the global markets.

“IBIT’s growth is unprecedented. It’s the fastest ETF to reach most milestones, faster than any other ETF in any asset class. At the current asset level and an expense ratio of 0.25%, IBIT can expect to earn about $112 million a year,” claimed James Seyffart, another leading ETF analyst.

As of December 31, IBIT holds ove 551,000 BTC. Since the launch of IBIT, BlackRock has acquired over 2.38% of all Bitcoin that will ever exist.

BlackRock’s confidence in Bitcoin was evident when it said the firm does not plan to launch any new altcoin-focused ETFs, focusing only on BTC and ETH.

In December, Jay Jacobs, the head of BlackRock’s ETF department, emphasized the company’s intention to concentrate on expanding the reach of its existing Bitcoin and Ethereum ETFs, which have performed exceptionally well so far. Interestingly, BlackRock analysts also suggested recently that Bitcoin should comprise 1% to 2% of traditional 60/40 investment portfolios.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10