LINK Reaction Remains Muted Despite Ripple’s Chainlink Integration

- LINK's price fell 10% in 24 hours despite Ripple's Chainlink integration for RLUSD stablecoin transactions.

- A 28% trading volume drop and -56.61% DAA divergence highlight low demand and bearish sentiment.

- LINK could dip to $15.77 if $18.46 support breaks but could rally to $30 with renewed accumulation.

LINK’s price has declined 10% in the past 24 hours, mirroring the broader cryptocurrency market downturn. This price drop follows Ripple’s integration of the Chainlink Standard to help bring its new RLUSD stablecoin on-chain.

At press time, LINK trades at $20.77. Its technical and on-chain setup confirms the possibility of further declines, and this analysis explains how.

Chainlink Faces Double-Digit Drop as Bearish Sentiment Intensifies

On Tuesday, digital payment service provider Ripple confirmed its partnership with Chainlink. The collaboration aims to provide secure and accurate price data for RLUSD transactions on Ethereum and the XRP Ledger.

However, the news of this integration has failed to impact LINK’s price positively. In the past 24 hours, its value has dropped by 10%.

Moreover, LINK’s double-digit price decline has been accompanied by a surge in its trading volume, forming a negative divergence. Over the past 24 hours, the token’s trading volume has totaled $1.06 billion, rising by 28%.

When an asset’s trading volume surges during a price decline, it indicates heightened market activity as more participants sell, possibly driven by panic or profit-taking. This signals a strong bearish sentiment and hints at a likely continuation of the downtrend.

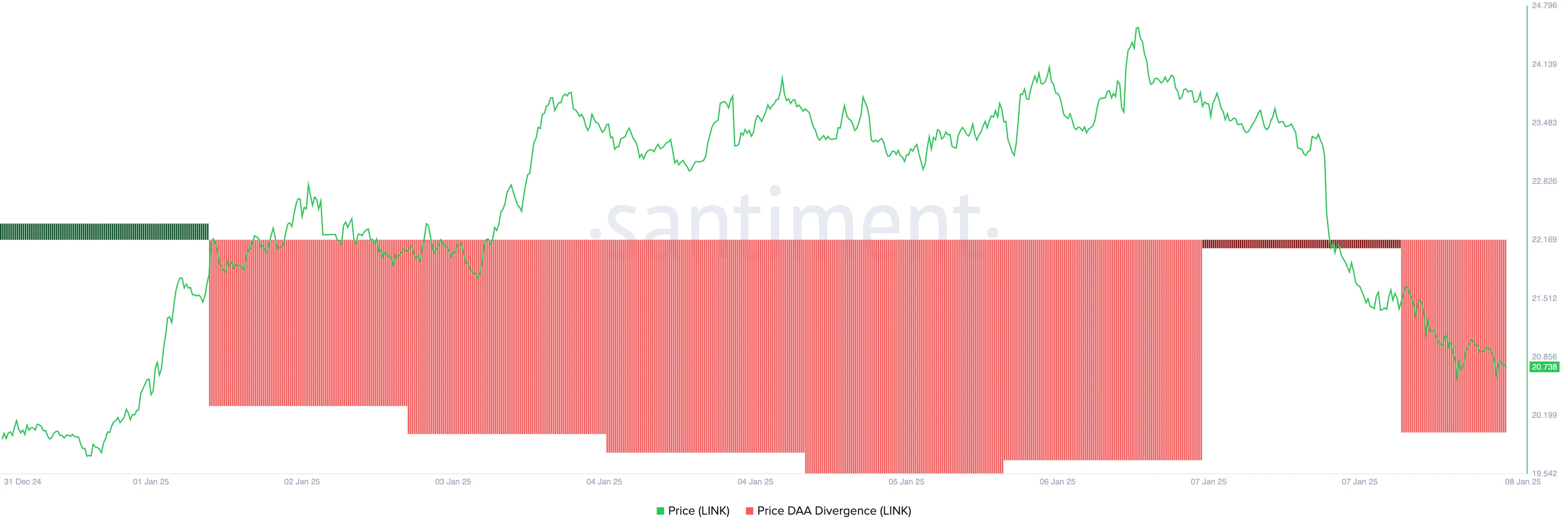

Additionally, the negative readings from LINK’s price daily active address (DAA) divergence highlight the low demand for the altcoin. At press time, this is -56.61%.

This metric measures an asset’s price movements with the changes in its number of daily active addresses. When its value is negative during a price decline, it suggests weakening on-chain activity alongside the bearish price action. This indicates reduced interest or utility for the asset, reinforcing the downward trend.

LINK Price Prediction: A Decline Below $20 or a Rally Above $30?

LINK trades slightly above the support formed at $18.53 on the daily chart. If its current downward trend persists, this support level will be tested. If it fails to hold, LINK’s price could drop further to $15.81.

However, if the broader market sentiment improves and LINK accumulation resumes, it could drive its price above $22.54 and toward the $30 price zone.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10