Invesco has launched the world's first synthetic equal weight ETF providing exposure to the S&P 500.

The Invesco S&P 500 Equal Weight Swap UCITS ETF (SPWS) is listed on Deutsche Boerse, the London Stock Exchange, Euronext Milan and SIX Swiss Exchange with a total expense ratio (TER) of 0.20%.

SPWS tracks the S&P 500 Equal Weight index which equally weights each constituent of the S&P 500 rather than weighting according to market capitalisation.

The US asset manager has a physical replication equivalent – the Invesco S&P 500 Equal Weight UCITS ETF (SPEQ) – which housed $640m in assets under management (AUM) as at 8 January, according to data from ETFBook.

Equal weight ETFs have been attracting strong inflows in recent months as investors fret about concentration risk within US equities.

Fiona Boal, global head of equities at S&P Dow Jones Indices, commented: “Investor interest in applying an equal-weight methodology to broad-market, large-cap equity indices, such as the S&P 500, continues to grow.”

Synthetic ETFs capturing US equities benefit from favourable tax treatment owing to the 2017 HIRE Act, which allows the total return of an index used in swap calculations to be free of withholding tax on dividends.

ETFs using physical replication, on the other hand, must pay 15% on US dividends if domiciled in Ireland and 30% if domiciled in Luxembourg.

“In the case of S&P 500 Equal Weight, this corresponded to around a 0.20% per annum improvement based on current dividend levels,” said Chris Mellor (pictured), head of EMEA ETF equity product management at Invesco.

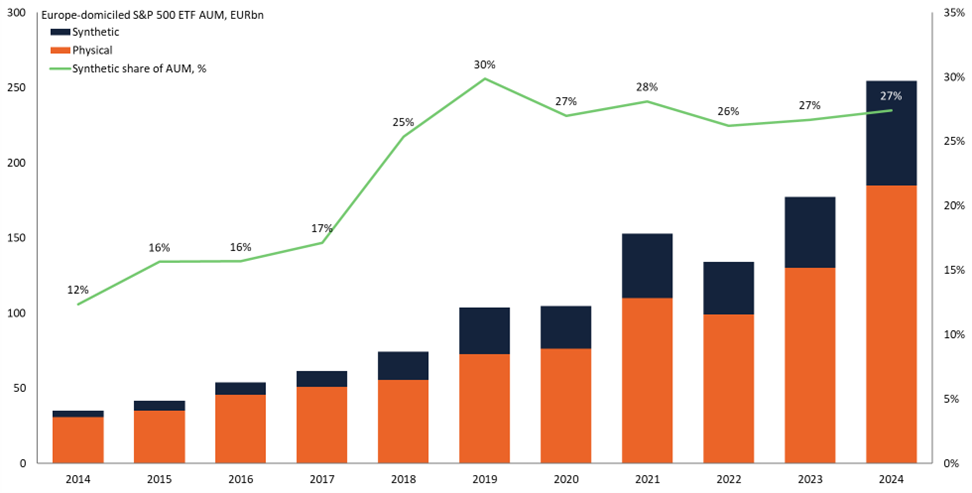

Thanks to the performance uplift, the share of S&P 500 ETF AUM using synthetic replication rose from 17% to 30% between 2017 and 2019.

Chart 1: S&P 500 ETF AUM by replication method, 2014-present

Source: Morningstar Direct.

Invesco has been a vocal advocate for the structure – as well as the space's chief flow generator – but as investors re-engage with the swap-based ETFs the firm is likely to face more competition going forward.