Richard Pzena's Strategic Reduction in Genesco Inc Holdings

On December 31, 2024, Richard Pzena (Trades, Portfolio), a prominent figure in the investment world, executed a significant transaction involving Genesco Inc. This transaction saw a reduction of 170,185 shares, marking a 13.97% decrease in the firm's holdings of the company. The shares were traded at a price of $42.75, impacting Pzena's portfolio by a marginal -0.02%. Post-transaction, Pzena holds 1,047,673 shares of Genesco Inc, which now constitutes 9.30% of the firm's holdings in the stock. This strategic move reflects Pzena's ongoing assessment of market conditions and the intrinsic value of Genesco Inc.

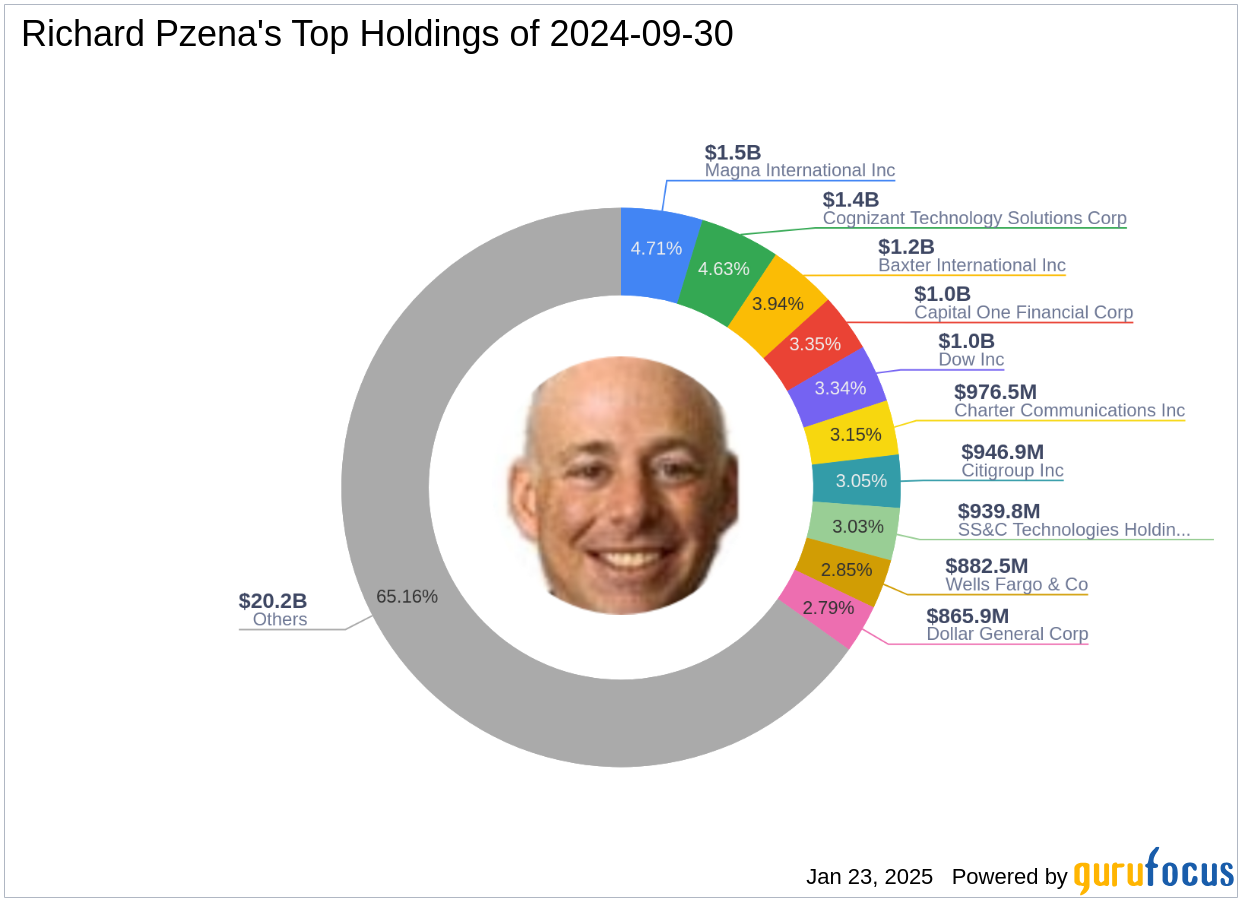

Richard Pzena (Trades, Portfolio): A Profile of Investment Acumen

Richard Pzena (Trades, Portfolio) is the founder and Co-Chief Investment Officer of Pzena Investment Management, LLC, a firm established in 1995. With a strong educational background from the Wharton School and the University of Pennsylvania, Pzena has built a reputation for his investment philosophy centered on value investing. The firm focuses on purchasing undervalued shares of fundamentally sound businesses, with a keen eye on whether price declines are temporary or permanent. This disciplined approach has positioned Pzena Investment Management as a significant player in the financial services and healthcare sectors, with top holdings in companies like Cognizant Technology Solutions Corp and Baxter International Inc.

Genesco Inc: A Retail Powerhouse

Genesco Inc, a USA-based company, is a key player in the Retail - Cyclical industry, with a market capitalization of $480.34 million. The company operates through several segments, including Journeys Group and Johnston & Murphy Group, offering a diverse range of products such as footwear, headwear, sports apparel, and accessories. Despite its robust market presence, Genesco Inc is currently considered modestly overvalued, with a GF Value of $36.96 and a Price to GF Value ratio of 1.16. The company's GF Score stands at 75/100, indicating likely average performance in the near term.

Financial Metrics and Market Performance

Genesco Inc's financial metrics reveal a mixed picture. The company has a balance sheet rank of 5/10 and a profitability rank of 6/10, suggesting moderate financial health and profitability. The stock has shown a year-to-date price change of 2.44% and a 3-year revenue growth of 18.10%. With a high momentum rank of 9/10 and a 14-day RSI of 59.98, the stock exhibits moderate momentum, indicating potential for future growth.

Analysis of the Transaction's Impact

The reduction in Genesco Inc holdings by Richard Pzena (Trades, Portfolio) reflects a strategic decision likely influenced by the company's current valuation and market conditions. Despite the reduction, Pzena Investment Management LLC remains the largest holder of Genesco Inc shares among the gurus, underscoring the firm's continued confidence in the company's long-term potential. Other notable investors, such as Barrow, Hanley, Mewhinney & Strauss, also hold shares in Genesco Inc, indicating a shared belief in the company's prospects.

Overall, this transaction highlights the dynamic nature of investment strategies and the importance of continuous evaluation of market conditions and company performance. As Genesco Inc navigates the challenges and opportunities in the retail sector, its financial metrics and market performance will be closely watched by investors and analysts alike.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10