Chuck Royce's Strategic Reduction in Amtech Systems Inc Holdings

On December 31, 2024, a significant transaction was executed by Chuck Royce (Trades, Portfolio), involving Amtech Systems Inc (ASYS, Financial). This transaction saw a reduction of 231,872 shares, marking a 13.55% decrease in the firm's holdings in the company. The shares were traded at a price of $5.45, impacting the portfolio by a marginal -0.01%. Post-transaction, the firm holds 1,479,300 shares of Amtech Systems Inc, which constitutes 10.36% of the firm's holdings in the stock. This strategic move reflects a calculated adjustment in the firm's investment strategy.

Chuck Royce (Trades, Portfolio): A Pioneer in Small-Cap Investing

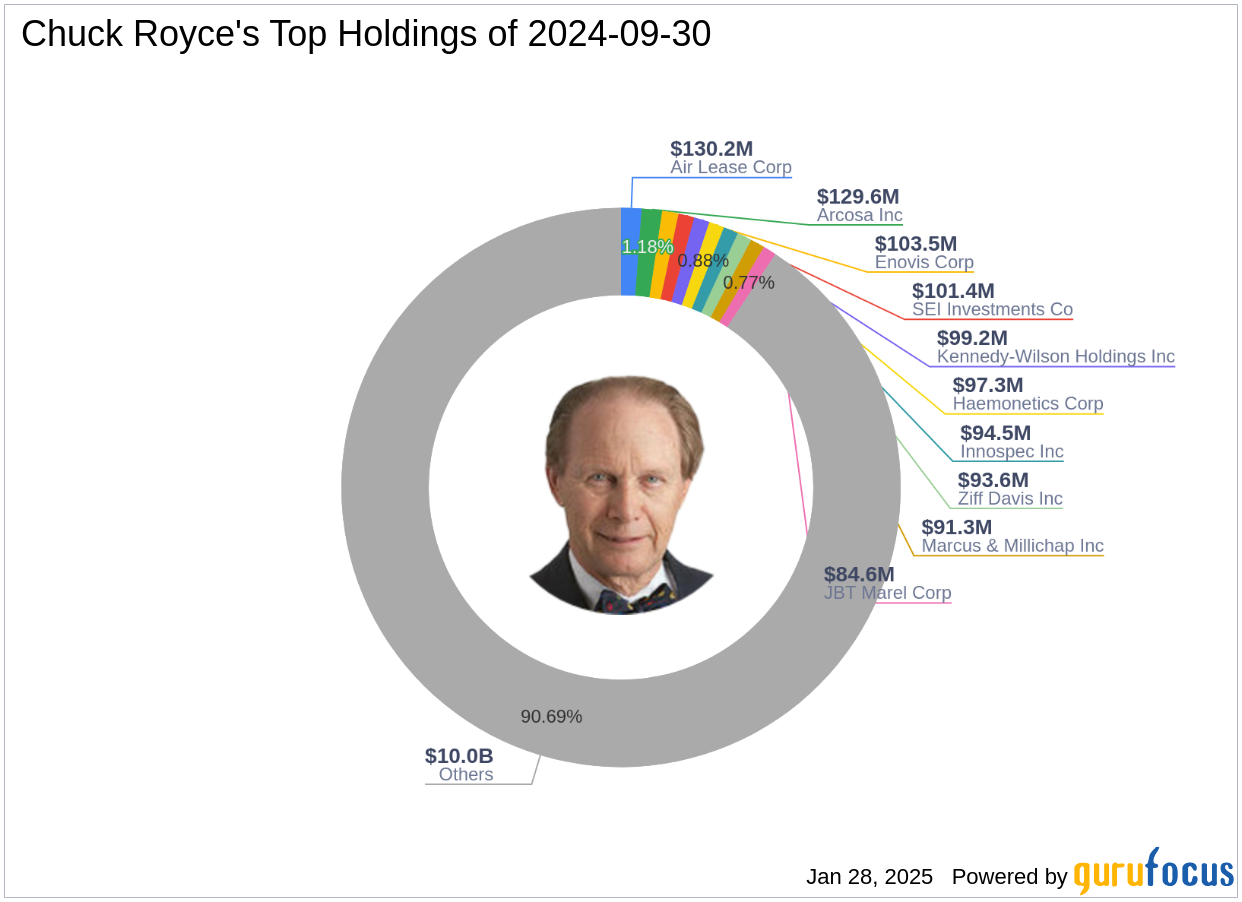

Charles M. Royce is renowned as a pioneer in small-cap investing, having managed the Royce Pennsylvania Mutual Fund since 1972. The firm's investment philosophy centers on smaller companies with strong balance sheets, a history of success, and potential for future profitability. With a focus on value investing, the firm seeks stocks trading below their estimated enterprise value. The firm's top holdings include SEI Investments Co (SEIC, Financial), Air Lease Corp (AL, Financial), Enovis Corp (ENOV, Financial), Kennedy-Wilson Holdings Inc (KW, Financial), and Arcosa Inc (ACA, Financial), with a total equity of $11 billion primarily in the Industrials and Technology sectors.

Amtech Systems Inc: A Key Player in Semiconductor Equipment Manufacturing

Amtech Systems Inc, based in the USA, is a manufacturer of capital equipment for semiconductor device fabrication. The company operates in two segments: Semiconductor Fabrication Solutions and Thermal Processing Solutions, with the latter generating maximum revenue, primarily from the Asia region. Amtech Systems Inc has a market capitalization of $72.813 million and a current stock price of $5.10. The stock is considered a "Possible Value Trap" with a GF Value of $8.36, indicating a Price to GF Value ratio of 0.61. This suggests that the stock is trading below its intrinsic value, warranting cautious consideration by investors.

Financial Metrics and Valuation of Amtech Systems Inc

Amtech Systems Inc's financial metrics reveal a mixed performance. The company has a GF Score of 73/100, indicating likely average performance. Key financial ranks include a Balance Sheet Rank of 7/10 and a Profitability Rank of 5/10, with a notable Momentum Rank of 10/10. The company's Altman Z score stands at 1.77, indicating potential financial distress. The Piotroski F-Score is 6, suggesting moderate financial health.

Market Context and Implications

The stock has experienced a year-to-date price change of -8.93% and a significant decline of 49% since its IPO. The reduction in shares by Chuck Royce (Trades, Portfolio) may reflect strategic portfolio adjustments in response to market conditions or company performance. The firm's decision to reduce its stake in Amtech Systems Inc could be influenced by the stock's current valuation and performance metrics, which suggest a cautious outlook. Investors should consider these factors when evaluating the potential risks and rewards associated with Amtech Systems Inc.

Transaction Analysis

This transaction highlights the firm's strategic approach to portfolio management, balancing risk and opportunity. By reducing its stake in Amtech Systems Inc, the firm may be reallocating resources to other investments with higher growth potential or better alignment with its investment philosophy. The transaction's impact on the portfolio is minimal, indicating a well-diversified investment strategy. As the market evolves, the firm's ability to adapt and make informed decisions will be crucial in maintaining its position as a leader in small-cap investing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10