3 Growth Companies Insiders Are Betting On

As global markets respond positively to the Trump administration's initial policy moves, with major U.S. indices reaching record highs amid AI enthusiasm and softer tariff expectations, investors are keenly observing growth stocks that have outperformed their value counterparts for the first time this year. In such an environment, companies with high insider ownership often attract attention as they suggest confidence from those closest to the business; here we explore three growth companies where insiders are significantly invested.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 20.5% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 36.6% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.9% |

| On Holding (NYSE:ONON) | 19.1% | 29.7% |

| Pharma Mar (BME:PHM) | 11.9% | 55.1% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 110.7% |

Click here to see the full list of 1478 stocks from our Fast Growing Companies With High Insider Ownership screener.

Let's explore several standout options from the results in the screener.

Tabuk Cement (SASE:3090)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tabuk Cement Company manufactures and sells cement in the Kingdom of Saudi Arabia, with a market cap of SAR1.26 billion.

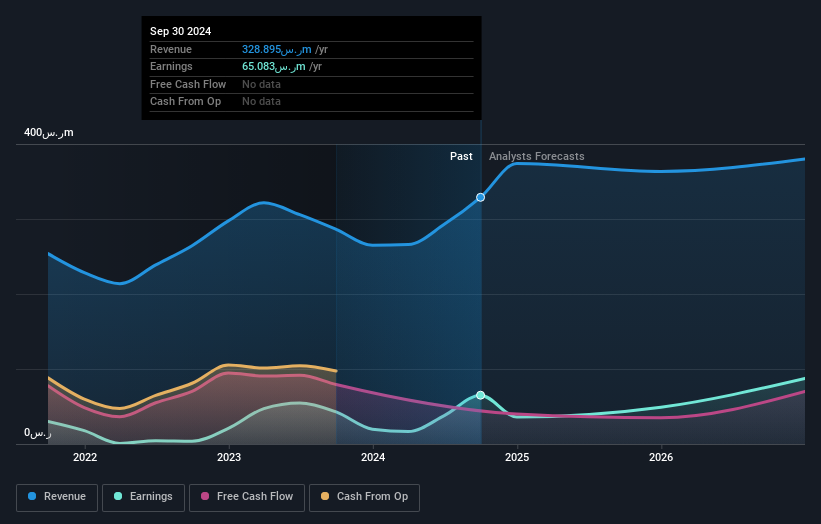

Operations: The company's revenue primarily comes from the sale of packed and unpackaged cement, totaling SAR328.89 million.

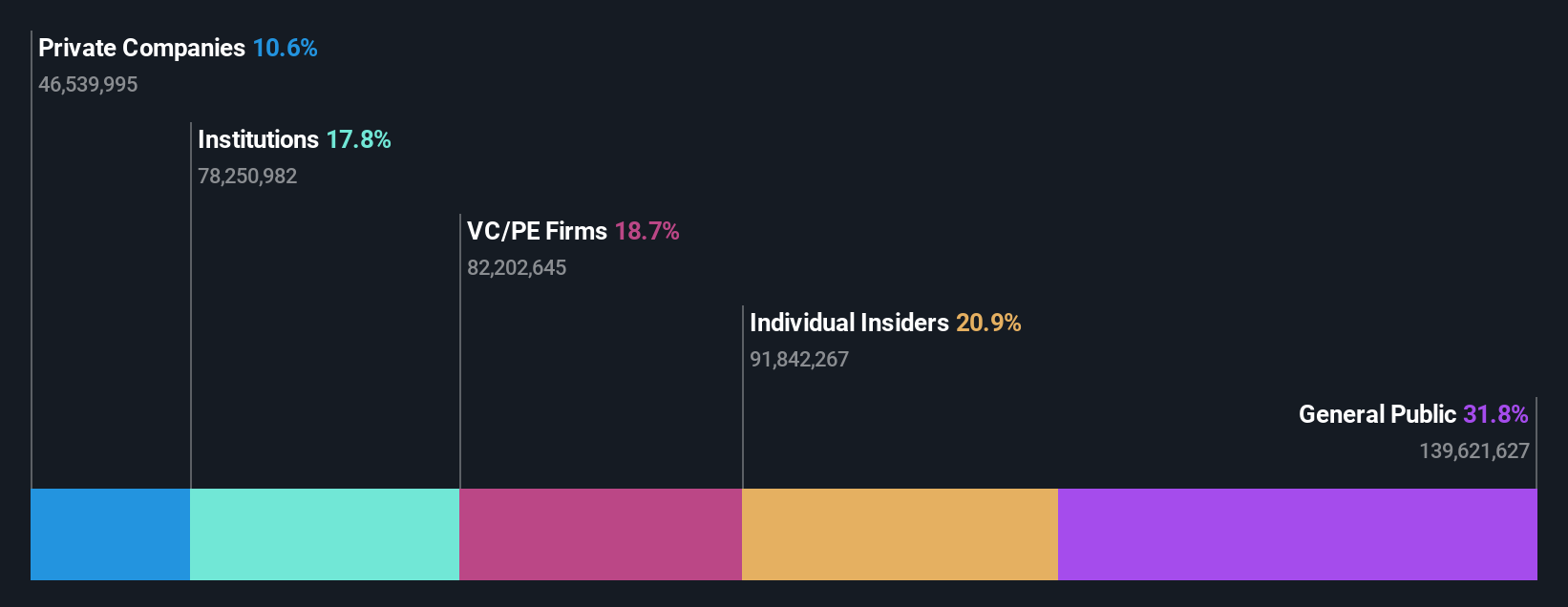

Insider Ownership: 16.1%

Tabuk Cement's earnings are forecast to grow significantly at 21.6% annually, outpacing the South African market's growth rate of 6%. Despite trading at a substantial discount to its estimated fair value, Tabuk Cement has an unstable dividend track record. Recent earnings for Q3 2024 showed sales of SAR 90.12 million and net income of SAR 23.05 million, with basic EPS at SAR 0.26, highlighting its potential for growth amidst fluctuating dividends and low future return on equity forecasts.

- Unlock comprehensive insights into our analysis of Tabuk Cement stock in this growth report.

- Insights from our recent valuation report point to the potential undervaluation of Tabuk Cement shares in the market.

Bairong (SEHK:6608)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bairong Inc. is a cloud-based AI turnkey services provider in China with a market cap of approximately HK$3.83 billion.

Operations: The company's revenue primarily comes from its data processing segment, which generated CN¥2.76 billion.

Insider Ownership: 19.5%

Bairong's earnings are projected to grow significantly at 27.8% annually, surpassing the Hong Kong market's growth rate of 11.3%. Trading at a substantial discount to its estimated fair value, Bairong shows promise despite recent declines in profit margins from 14.7% to 10%. Analysts expect the stock price to rise by 59.4%, although future return on equity is forecasted to remain low at 9.9%.

- Click here to discover the nuances of Bairong with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Bairong is priced lower than what may be justified by its financials.

Shandong Minhe Animal Husbandry (SZSE:002234)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shandong Minhe Animal Husbandry Co., Ltd. operates in the People's Republic of China, focusing on the breeding, production, slaughtering, processing, and sale of commercial broiler chickens with a market cap of CN¥2.86 billion.

Operations: The company's revenue is primarily derived from its activities in breeding, producing, slaughtering, processing, and selling commercial broiler chickens within China.

Insider Ownership: 39.7%

Shandong Minhe Animal Husbandry is set to experience robust earnings growth at 98.79% annually, outpacing the Chinese market's revenue growth of 13.3%. Although its forecasted return on equity in three years is modest at 9.4%, the company’s expected transition to profitability within this period signals potential upside. Despite no significant insider trading activity recently, substantial insider ownership aligns management interests with shareholders, supporting long-term growth prospects.

- Take a closer look at Shandong Minhe Animal Husbandry's potential here in our earnings growth report.

- Our valuation report unveils the possibility Shandong Minhe Animal Husbandry's shares may be trading at a premium.

Where To Now?

- Explore the 1478 names from our Fast Growing Companies With High Insider Ownership screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Bairong might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10