Confluent, Inc. (NASDAQ:CFLT) reported better-than-expected fourth-quarter financial results on Tuesday.

Confluent reported quarterly earnings of 9 cents per share which beat the analyst consensus estimate of 6 cents per share. The company reported quarterly sales of $261.22 million which beat the analyst consensus estimate of $256.83 million.

Confluent expects first-quarter revenue to be in the range of $253 million to $254 million. The company expects full-year 2025 revenue to be in the range of $1.117 billion to $1.121 billion.

Confluent announced a pair of partnership updates around the same time earnings were released. The company inked a new deal with Jio Platforms Limited to bring Confluent Cloud to Jio Cloud Services.

Confluent also announced an expanded partnership with Databricks to empower enterprises with real-time data for AI-driven decision-making through the combination of Confluent's complete Data Streaming Platform and Databricks' Data Intelligence Platform.

Confluent shares jumped 20.5% to trade at $36.33 on Wednesday.

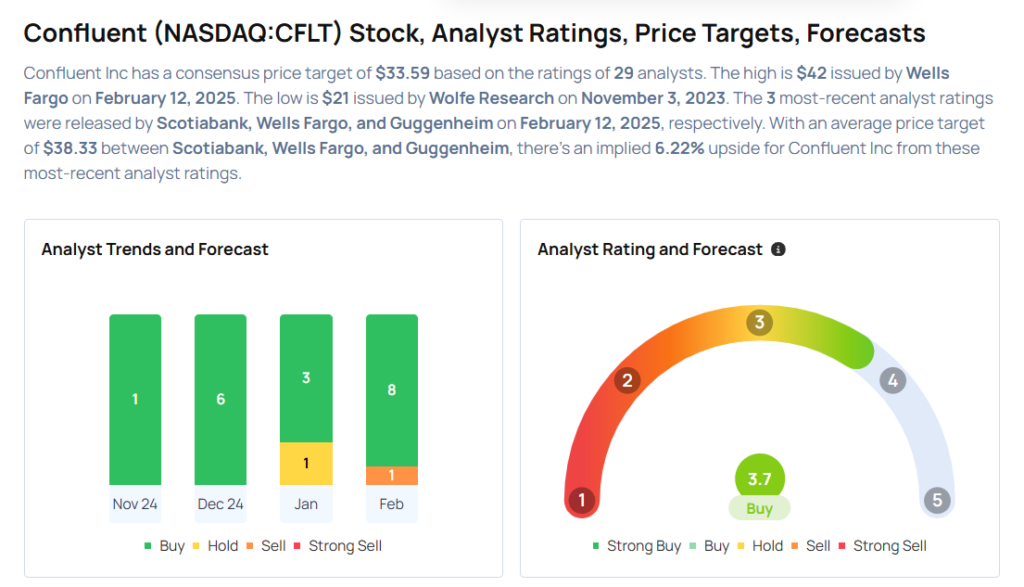

These analysts made changes to their price targets on Confluent following earnings announcement.

- B of A Securities analyst Brad Sills maintained Confluent with an Underperform and raised the price target from $26 to $31.

- Barclays analyst Raimo Lenschow maintained Confluent with an Overweight and raised the price target from $35 to $37..

- Needham analyst Mike Cikos maintained the stock with a Buy and raised the price target from $31 to $40.

- Stifel analyst Brad Reback maintained Confluent with a Buy and raised the price target from $37 to $40.

- Canaccord Genuity analyst Kingsley Crane maintained the stock with a Buy and boosted the price target from $34 to $38.

- Evercore ISI Group analyst Chirag Ved maintained Confluent with an Outperform and lifted the price target from $32 to $40.

- Piper Sandler analyst Rob Owens maintained the stock with an Overweight and raised the price target from $35 to $40.

- Guggenheim analyst Howard Ma maintained Confluent with a Buy and increased the price target from $35 to $38.

- Wells Fargo analyst Michael Turrin maintained the stock with an Overweight and raised the price target from $40 to $42.

- Scotiabank analyst Nick Altmann maintained the stock with a Sector Perform and raised the price target from $27 to $35.

Considering buying CFLT stock? Here’s what analysts think:

Read This Next:

- Snowflake To Rally Around 9%? Here Are 10 Top Analyst Forecasts For Wednesday