3 ASX Undervalued Small Caps With Recent Insider Action In Australia

The Australian market recently saw the ASX200 reach a new all-time intra-day high, reflecting a buoyant session driven by strong performances in the materials and discretionary sectors. As gold prices continue their record rally, small-cap stocks on the ASX are drawing attention, especially those showing recent insider activity which can be an indicator of potential value amidst current market dynamics. Identifying promising small caps involves assessing factors like sector performance and insider actions that may signal confidence in future growth prospects.

Top 10 Undervalued Small Caps With Insider Buying In Australia

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Rural Funds Group | 7.9x | 5.9x | 32.92% | ★★★★★★ |

| Infomedia | 42.4x | 3.8x | 30.01% | ★★★★★☆ |

| Collins Foods | 18.5x | 0.6x | 1.39% | ★★★★★☆ |

| Autosports Group | 5.9x | 0.1x | 7.45% | ★★★★☆☆ |

| Abacus Group | NA | 5.5x | 24.85% | ★★★★☆☆ |

| Healius | NA | 0.6x | 4.04% | ★★★★☆☆ |

| Dicker Data | 20.2x | 0.7x | -76.03% | ★★★☆☆☆ |

| Abacus Storage King | 11.0x | 6.9x | -28.17% | ★★★☆☆☆ |

| Eureka Group Holdings | 19.6x | 6.3x | 20.77% | ★★★☆☆☆ |

| Cromwell Property Group | NA | 5.0x | 19.07% | ★★★☆☆☆ |

Click here to see the full list of 21 stocks from our Undervalued ASX Small Caps With Insider Buying screener.

Let's uncover some gems from our specialized screener.

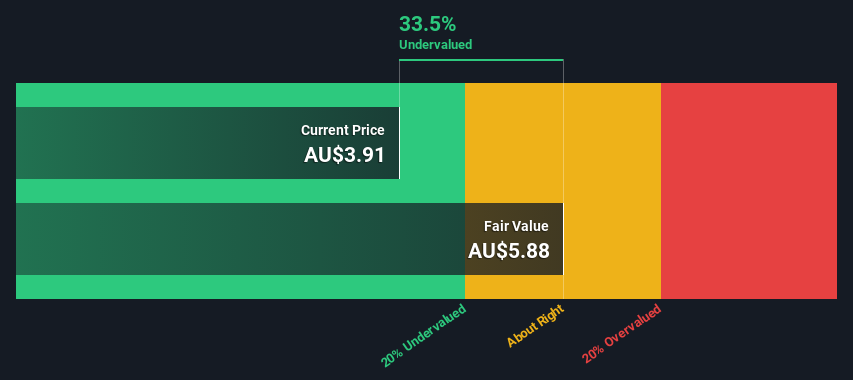

Arena REIT (ASX:ARF)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Arena REIT is an Australian real estate investment trust that focuses on investing in and managing a portfolio of social infrastructure properties, with a market capitalization of approximately A$1.79 billion.

Operations: Arena REIT generates revenue primarily through rental income, with a focus on managing operating expenses to enhance profitability. Over recent periods, the company has experienced fluctuations in its net income margin, which reached 0.72% as of December 2024. The gross profit margin showed a trend of stability around 91.83% during the same period, indicating effective management of cost of goods sold relative to revenue generation.

PE: 20.5x

Arena REIT, a small Australian company, is positioned for growth with earnings projected to rise by 10.78% annually. Despite relying entirely on external borrowing for funding, which carries higher risk, the company's consistent dividend distributions underscore its commitment to shareholder returns. Recently reaffirmed dividends align with their fiscal guidance, showcasing stability in cash flow management. Insider confidence is evident through recent share purchases by key players within the company. As they prepare to release first-half 2025 results soon, investors might watch closely for further insights into potential growth trajectories and financial health.

- Dive into the specifics of Arena REIT here with our thorough valuation report.

Assess Arena REIT's past performance with our detailed historical performance reports.

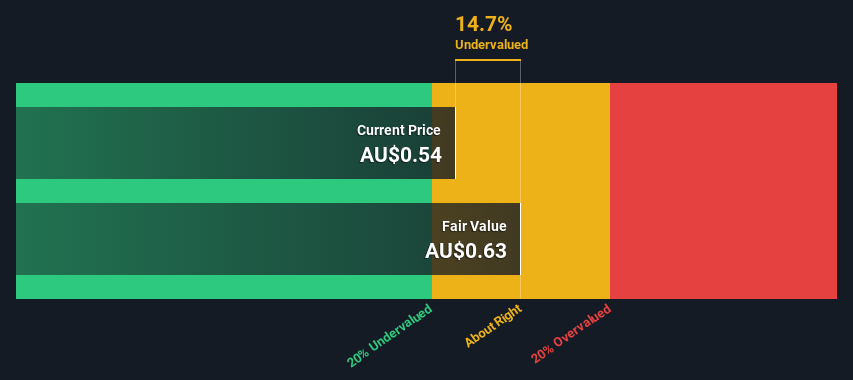

Centuria Capital Group (ASX:CNI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Centuria Capital Group is a diversified investment manager specializing in property funds management, co-investments, and development finance, with a market capitalization of approximately A$1.63 billion.

Operations: Centuria Capital Group generates revenue primarily from Property Funds Management, Co-Investments, and Development activities. The company's net profit margin has shown variability over time, with a recent high of 22.39% in June 2024. Operating expenses have been a significant component of costs, impacting net income alongside non-operating expenses.

PE: 19.3x

Centuria Capital Group, a smaller player in the Australian market, is drawing attention with its mix of financial strategies and leadership changes. Kristie Brown's insider confidence is evident from their purchase of 250,000 shares valued at approximately A$453,035 in early 2021. This aligns with Centuria's forecasted earnings growth of 12.81% annually. The company recently increased its interim distribution to 5.20 cents per security for late December 2024, signaling potential stability and shareholder value enhancement amidst evolving executive dynamics.

- Take a closer look at Centuria Capital Group's potential here in our valuation report.

Examine Centuria Capital Group's past performance report to understand how it has performed in the past.

United Overseas Australia (ASX:UOS)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: United Overseas Australia is a property development and investment company with operations primarily focused on land development and resale, as well as investments, with a market capitalization of A$1.05 billion.

Operations: The company's primary revenue streams are from investments and land development and resale. Over recent periods, the net income margin has shown a significant upward trend, reaching 60.59%.

PE: 11.1x

United Overseas Australia, a smaller player in the Australian market, has recently seen insider confidence with share purchases from October 2024 to January 2025. The company, however, faces challenges with earnings declining by 4.4% annually over five years and relies solely on external borrowing for funding. Despite these hurdles, its high-quality earnings suggest resilience amidst one-off financial impacts. Looking ahead, growth prospects hinge on improving revenue streams and managing funding risks effectively in an evolving economic landscape.

- Navigate through the intricacies of United Overseas Australia with our comprehensive valuation report here.

Gain insights into United Overseas Australia's historical performance by reviewing our past performance report.

Turning Ideas Into Actions

- Reveal the 21 hidden gems among our Undervalued ASX Small Caps With Insider Buying screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10