KOP Leads The Pack Of 3 Promising Penny Stocks

Global markets have recently experienced volatility, with U.S. stocks ending the week lower amid tariff uncertainties and mixed economic signals, such as a cooling labor market and fluctuating manufacturing activity. Amidst these broader market movements, investors often seek opportunities in various segments of the stock market, including those that are less conventional yet intriguing. Penny stocks, while sometimes viewed as outdated due to their historical connotations, continue to hold potential for growth and value discovery when backed by strong financials. In this article, we explore three penny stocks that stand out for their financial robustness and potential long-term promise.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.535 | MYR2.64B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £481.5M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £330.8M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.335 | MYR918.11M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.95 | HK$44.2B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.938 | £149.49M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.97 | £451.13M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$144.95M | ★★★★☆☆ |

Click here to see the full list of 5,695 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

KOP (Catalist:5I1)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: KOP Limited is an investment holding company engaged in real estate development and entertainment operations across Singapore, Indonesia, and the United Kingdom, with a market cap of SGD37.67 million.

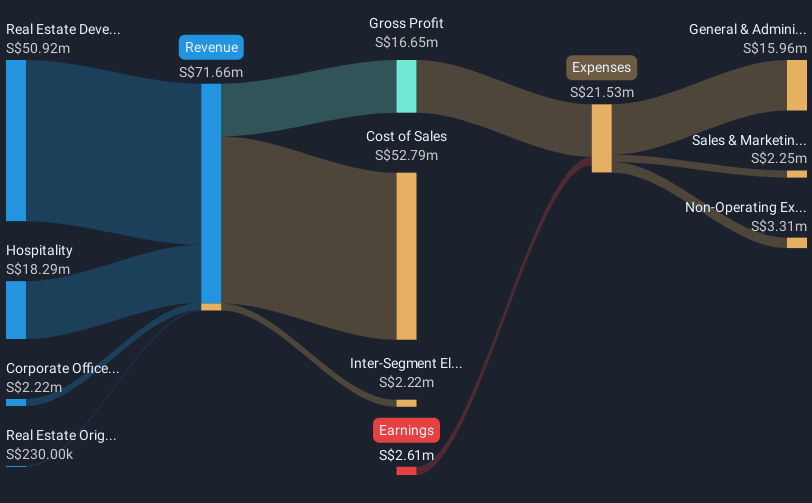

Operations: The company generates revenue from Hospitality (SGD17.98 million), Corporate Office (SGD2.28 million), Real Estate Development and Investment (SGD65.42 million), and Real Estate Origination and Management Services (SGD0.23 million).

Market Cap: SGD37.67M

KOP Limited, with a market cap of SGD37.67 million, operates in real estate development and entertainment across multiple regions. Despite recent earnings showing a net loss of SGD1.96 million for the third quarter, the company maintains positive cash flow and has more cash than debt, ensuring over three years of operational runway. Its board and management team are experienced, with average tenures exceeding industry norms. However, KOP's share price is highly volatile and trades significantly below its estimated fair value while remaining unprofitable with declining earnings over the past five years at 4.8% annually.

- Take a closer look at KOP's potential here in our financial health report.

- Gain insights into KOP's past trends and performance with our report on the company's historical track record.

Xikang Cloud Hospital Holdings (SEHK:9686)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Xikang Cloud Hospital Holdings Inc., with a market cap of HK$580.89 million, primarily offers cloud hospital platform services in the People's Republic of China.

Operations: The company generates revenue from Health Management Services amounting to CN¥217.21 million.

Market Cap: HK$580.89M

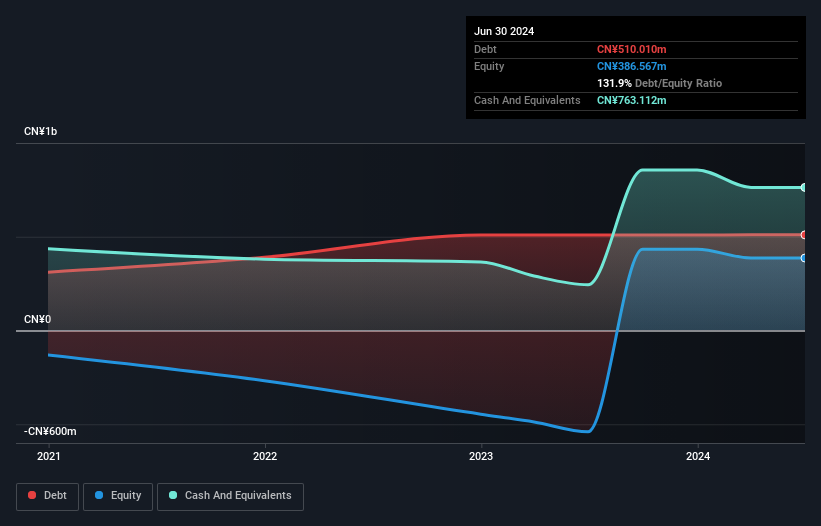

Xikang Cloud Hospital Holdings Inc., with a market cap of HK$580.89 million, generates CN¥217.21 million in revenue from health management services, primarily in China. The company has renewed agreements with Neusoft Corporation to provide IT and health management services through 2025, supporting its revenue stream. Despite being unprofitable with a negative return on equity of -31.14%, Xikang's short-term assets exceed both its long-term and short-term liabilities, indicating financial stability. The firm also boasts an experienced management team and sufficient cash runway for more than three years without significant shareholder dilution recently observed.

- Navigate through the intricacies of Xikang Cloud Hospital Holdings with our comprehensive balance sheet health report here.

- Evaluate Xikang Cloud Hospital Holdings' historical performance by accessing our past performance report.

Fujian Start GroupLtd (SHSE:600734)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fujian Start Group Co. Ltd specializes in providing anti-intrusion detection systems in China and has a market capitalization of CN¥8.89 billion.

Operations: No specific revenue segments are reported for this company.

Market Cap: CN¥8.89B

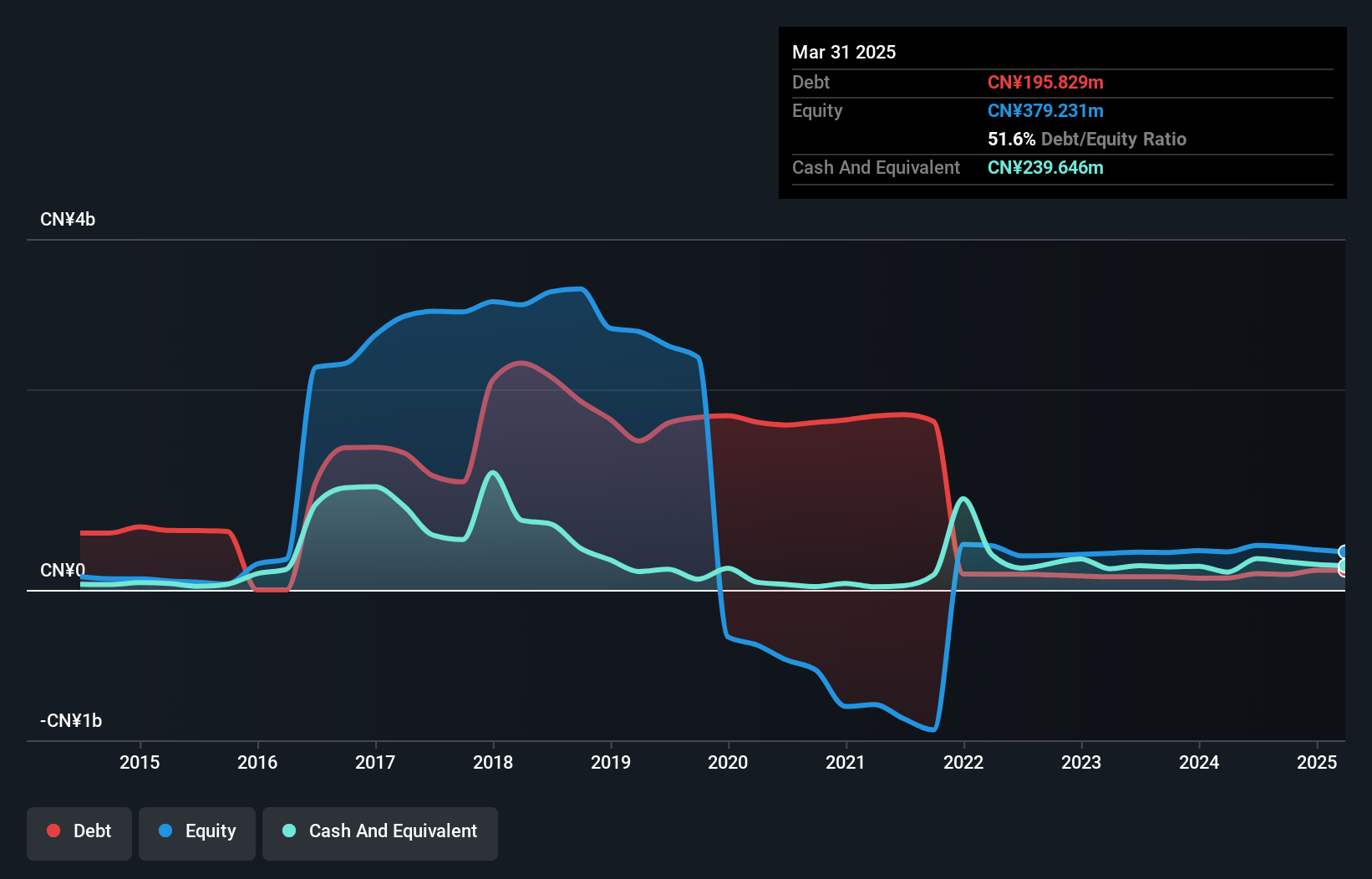

Fujian Start Group Co. Ltd, with a market cap of CN¥8.89 billion, has demonstrated significant earnings growth of 532.7% over the past year, surpassing its 5-year average of 64.3% per year, indicating accelerated profit growth. Despite having a relatively inexperienced board with an average tenure of 2.9 years and negative operating cash flow impacting debt coverage, the company maintains financial stability as short-term assets exceed liabilities and cash surpasses total debt levels. Additionally, Fujian Start Group has not experienced meaningful shareholder dilution recently and shows improved net profit margins from last year's figures.

- Click here to discover the nuances of Fujian Start GroupLtd with our detailed analytical financial health report.

- Assess Fujian Start GroupLtd's previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Unlock more gems! Our Penny Stocks screener has unearthed 5,692 more companies for you to explore.Click here to unveil our expertly curated list of 5,695 Penny Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KOP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10