Ethereum Faces Criticism Amid Bybit Hack, Sparking Blockchain Security Debate

- MartyParty claims Solidity caused 80% of crypto exploits, citing Bybit’s $1.4B Ethereum hack via phishing and interface flaws.

- Solana’s Rust-based network lost $523M in 2022; Sui’s Move language failed to prevent a $29M 2024 breach.

Cryptocurrency influencer MartyParty sparked controversy by urging followers to sell Ethereum (ETH) and shift investments to Solana (SOL) and Sui (SUI). In a post on platform X, he labeled Ethereum as “old, slow, broken” and criticized its programming language, Solidity, claiming it caused 80% of crypto exploits since 2016.

His remarks followed a $1.4 billion hack targeting Bybit’s Ethereum cold wallet, though forensic reports suggest the attack involved phishing and interface manipulation, not solely Solidity flaws.

Basic rules going forward.

Sell all $ETH into $SOL and $SUI as they try and prop up $ETH. $ETH is the biggest risk to crypto. Its old, clunky, broken and cant be trusted to hold value. This hack will simply be duplicated again and again until all L2 multisigs are compromised.…

— MartyParty (@martypartymusic) February 22, 2025

MartyParty’s post argued that Ethereum’s layer-2 solutions would face similar exploits and praised Solana and Sui for using “safer” languages like Rust and Move. However, his claims lack verified data. While Solidity has known vulnerabilities, such as reentrancy risks, other blockchains like Solana and Sui have also suffered major breaches.

For example, Solana lost $523 million in 2022 due to code flaws in third-party applications, and Sui lost $29 million in 2024 via token theft laundered through privacy tools.

The Bybit hack occurred on February 21, 2025, during a routine transfer from a multi-signature cold wallet to a hot wallet. Attackers altered the signing interface’s logic, redirecting 401,347 ETH (worth $1.4 billion) to unauthorized addresses.

Bybit CEO Ben Zhou confirmed the breach but assured users that client funds remained backed 1:1. Forensic analysts attributed the exploit to phishing tactics targeting employee credentials, highlighting human error as a critical factor.

MartyParty’s assertion that Solidity caused 80% of crypto exploits remains unverified

Platforms like QuickNode outline common risks in Ethereum-based smart contracts but do not quantify exploit rates by language. Meanwhile, Solana’s Rust-based ecosystem faced an $8 million theft in 2022 linked to insecure code in wallet software, not the blockchain itself. Similarly, Sui’s Move language, designed to prevent asset duplication, failed to stop a 2024 exploit involving forged transactions.

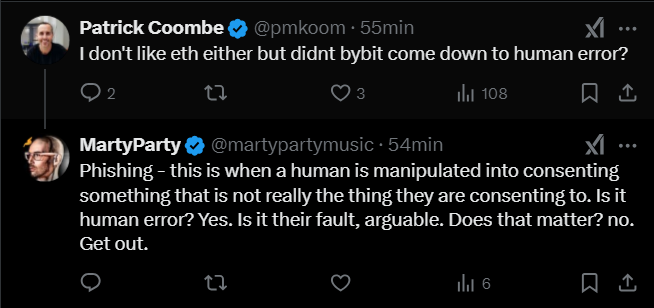

Community reactions to MartyParty’s post were mixed. Some users, like Patrick Coombe (@pmkoom), questioned whether the Bybit hack stemmed from Solidity or phishing. Others defended Ethereum, noting its blockchain has never been directly hacked or shut down. A segment of responders promoted trading groups or alternative tokens, reflecting the speculative nature of such discussions.

The Debate underscores broader tensions in crypto security

While programming languages influence risk, breaches often result from operational oversights, flawed third-party integrations, or social engineering. Ethereum’s dominance in decentralized applications makes it a frequent target, but newer blockchains like Solana and Sui face unique challenges as they scale.

Regulatory scrutiny adds another layer

The SEC’s recent dismissal of charges against Coinbase and pauses on enforcement actions have fueled optimism for clearer guidelines. However, the lack of standardized security practices across blockchains leaves investors navigating uneven terrain.

MartyParty’s recommendations, though attention-grabbing, simplify a complex issue. No blockchain is immune to exploits, and language choice is one factor among many. Investors must weigh technical design, governance, and real-world use cases rather than relying on singular claims.

The current price of Ethereum (ETH) is $2,764.90 USD, reflecting a 3.92% increase in the past 24 hours. Over the past week, ETH has gained 1.42%, but it is still down 14.61% over the last month. Despite recent price volatility, Ethereum is holding key support levels, indicating a potential bullish reversal if momentum continues.

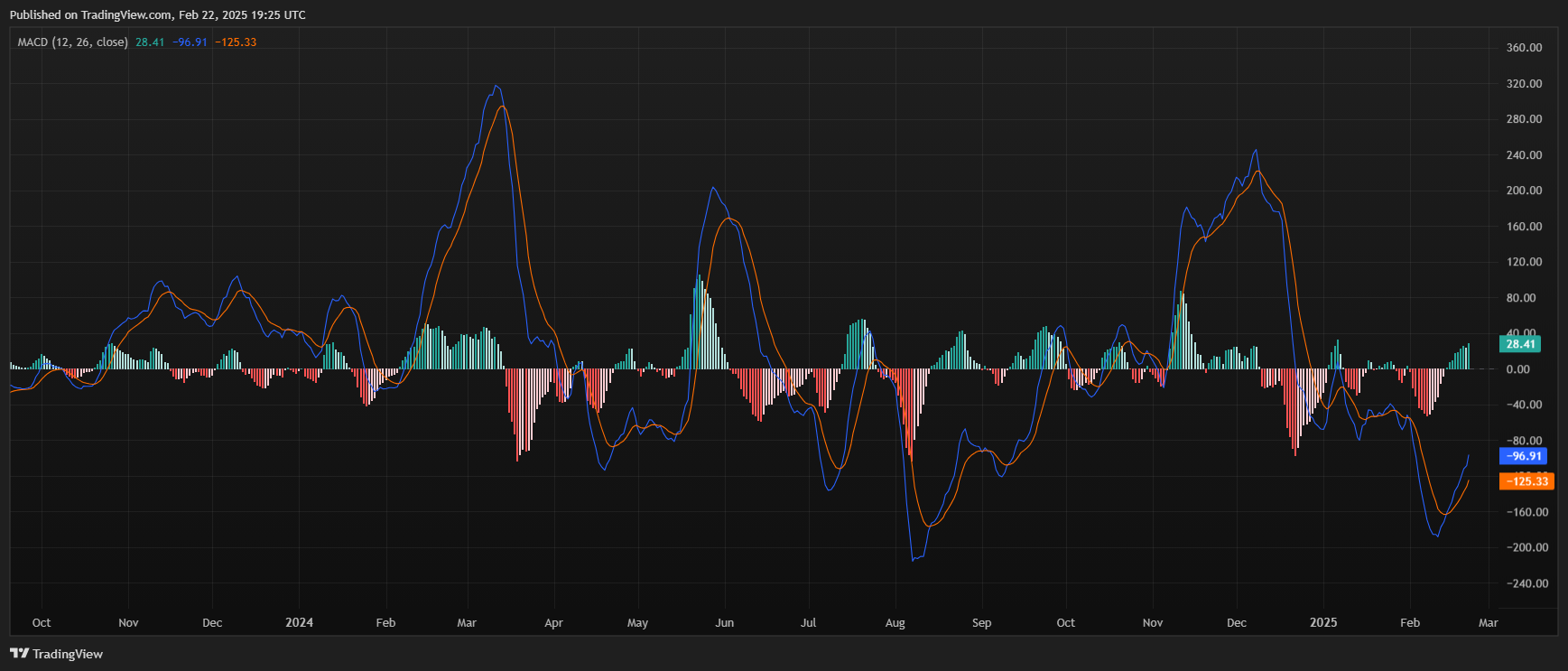

From a technical analysis perspective by ETHNews, Ethereum’s Relative Strength Index (RSI) is currently in a neutral zone, meaning ETH is neither overbought nor oversold. The Moving Average Convergence Divergence (MACD) also remains neutral, suggesting the market is consolidating and awaiting a breakout in either direction.

Additionally, oscillators and moving averages are showing a mixed trend, with no strong buy or sell signals emerging at this moment.

Looking at support and resistance levels, Ethereum is currently testing a major support zone between $2,700 and $2,650 USD. If ETH holds above this level, it could provide a solid foundation for a rebound. On the upside, resistance is found at $2,770 and $2,800 USD.

A breakout above $2,800 USD could push ETH towards $3,000 USD, a key psychological barrier that could spark further bullish momentum. However, failure to maintain its current levels might result in a retest of $2,650 USD, potentially leading to a short-term correction.

The post Ethereum Faces Criticism Amid Bybit Hack, Sparking Blockchain Security Debate appeared first on ETHNews.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10