Hims & Hers Health (NYSE:HIMS) Climbs 60% Despite Market Volatility

Hims & Hers Health (NYSE:HIMS) has experienced a significant 60% increase in its share price over the past month, which stands out amid broader market volatility. During the same period, the Dow Jones and other major indexes saw declines. This spike in HIMS's stock can be attributed to recent company announcements and performance, which have resonated strongly with investors despite a general market downturn. While market news indicated that many stocks, especially in the technology and healthcare sectors, were under pressure, HIMS managed to buck the trend. This resilience is noteworthy given the wide-scale market sell-off, as major healthcare stocks struggled after the Department of Justice's investigation news impacted giants like UnitedHealth. In contrast, strong investor sentiment surrounding HIMS underscores the company's distinct positioning and potential in the telehealth space, despite broader economic challenges.

Get an in-depth perspective on Hims & Hers Health's performance by reading our analysis here.

Over the past three years, Hims & Hers Health, Inc. has achieved an impressive total shareholder return of 829.81%, reflecting a remarkable growth journey. Contributing to this performance, the company outperformed the US market over the past year, which itself gained 18.3%, highlighting robust investor confidence in HIMS's capabilities and growth trajectory.

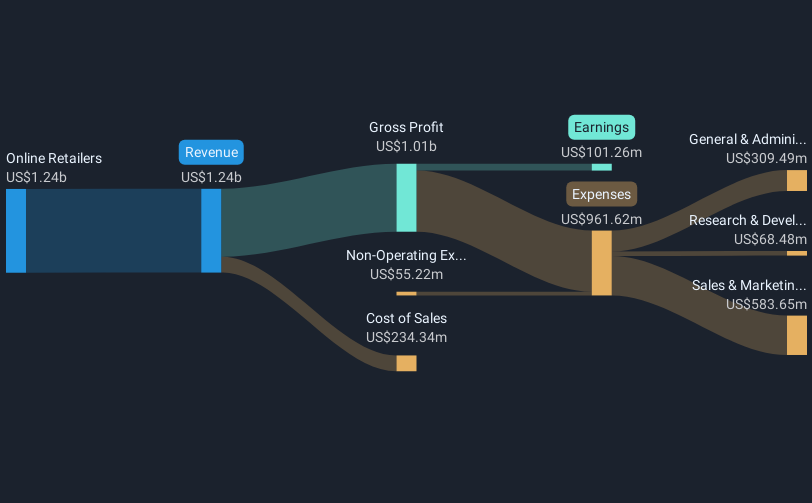

Key drivers in this period include the company's impressive financial turnaround, becoming profitable in the last year with sales reaching US$995.38 million for the nine months of 2024, alongside a net income of US$100.01 million. HIMS has expanded its product offerings, notably introducing GLP-1 injections and new skincare lines, which cater to growing health and wellness demands. Additionally, strategic movements such as the introduction of a share repurchase program up to US$100 million and inclusion in several indices have bolstered investor sentiment and market positioning.

- See whether Hims & Hers Health's current market price aligns with its intrinsic value in our detailed report

- Analyze the downside risks for Hims & Hers Health and understand their potential impact—click to learn more.

- Is Hims & Hers Health part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hims & Hers Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10