Intuit Inc. (NASDAQ:INTU) will release its second-quarter financial results after the closing bell on Tuesday, Feb. 25.

Analysts expect the Mountain View, California-based company to report quarterly earnings at $2.58 per share, down from $2.63 per share in the year-ago period. Intuit projects quarterly revenue of $3.83 billion, compared to $3.39 billion a year earlier, according to data from Benzinga Pro.

On Nov. 21, 2024, Intuit issued second-quarter adjusted EPS and revenue guidance below analyst estimates.

Intuit shares gained 0.3% to close at $567.24 on Monday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

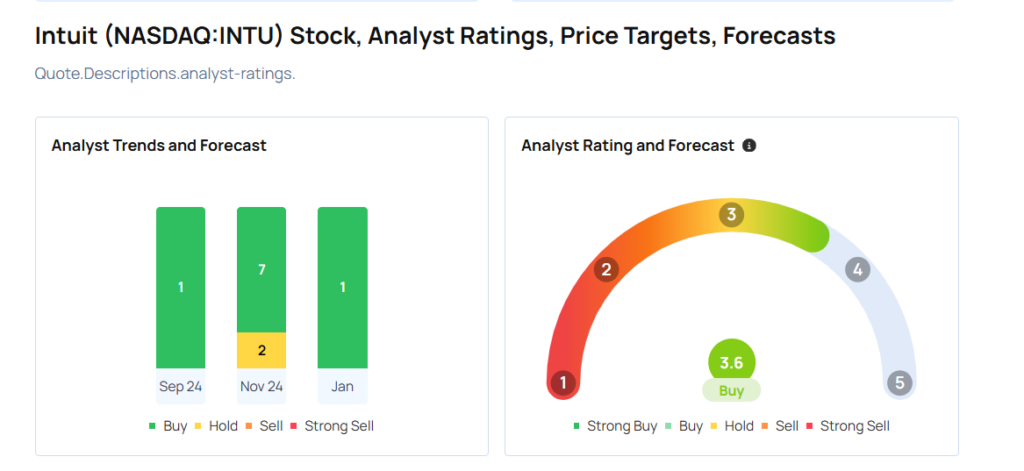

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Jefferies analyst Brent Thill maintained a Buy rating and raised the price target from $790 to $800 on Nov. 22, 2024. This analyst has an accuracy rate of 77%.

- Oppenheimer analyst Scott Schneeberger maintained an Outperform rating and raised the price target from $712 to $722 on Nov. 22, 2024. This analyst has an accuracy rate of 65%.

- Stifel analyst Brad Reback maintained a Buy rating and cut the price target from $795 to $725 on Nov. 22, 2024. This analyst has an accuracy rate of 76%.

- JP Morgan analyst Mark Murphy maintained a Neutral rating and raised the price target from $600 to $640 on Nov. 22, 2024. This analyst has an accuracy rate of 77%.

- Barclays analyst Raimo Lenschow maintained an Overweight rating and slashed the price target from $800 to $775 on Nov. 22, 2024. This analyst has an accuracy rate of 72%.

Considering buying INTU stock? Here’s what analysts think:

Read This Next:

- Top 2 Industrials Stocks That Are Set To Fly This Quarter