Affirm Holdings (NasdaqGS:AFRM) Jumps 17% On Strong Q2 Financial Performance Rocking US$866 Million Sales

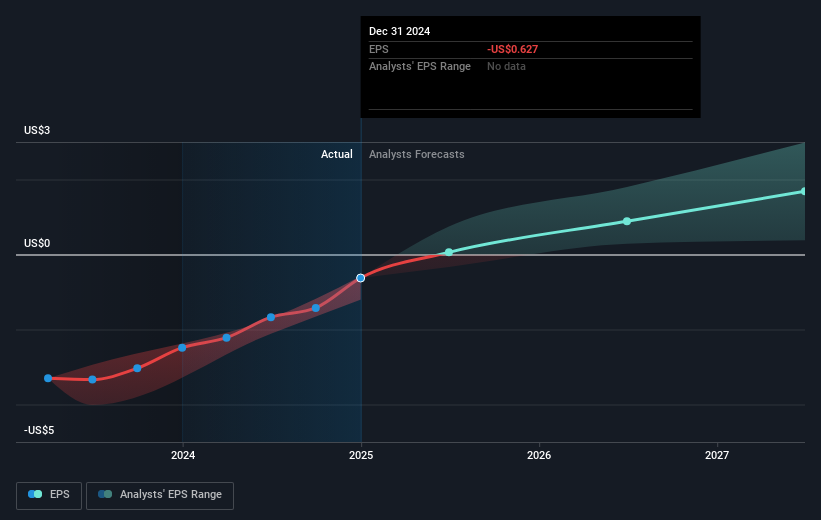

Affirm Holdings (NasdaqGS:AFRM) experienced a 17% share price increase over the past month. This rise came amid a series of significant developments including a promising earnings report showing an impressive swing from a net loss to net income and substantial revenue growth, elevating sales to $866 million for Q2. Furthermore, strategic partnerships with key firms such as Shopify and FIS have positioned Affirm to expand its pay-over-time solutions across e-commerce and banking sectors. Moreover, its collaboration with Coast Dental highlights its growing influence in healthcare. In contrast, while major U.S. indexes, including the tech-heavy Nasdaq, showed mixed reactions due to broader economic concerns, Affirm's positive financial performance and strategic collaborations likely influenced investor confidence. Despite the challenging market environment—a recent 3.6% decline—the strong advances in Affirm's operational and financial metrics seem to have supported its noteworthy share price increase.

Get an in-depth perspective on Affirm Holdings's performance by reading our analysis here.

Over the last year, Affirm Holdings achieved a total shareholder return of 72.11%, significantly outperforming the US Diversified Financial industry and the broader market, which returned 19.3% and 16.9% respectively. Key drivers for this performance include several impactful strategic partnerships. Notably, the expanded global agreement with Shopify in February 2025 established Affirm as the exclusive pay-over-time provider for Shop Pay Installments in North America, indicating potential future growth in Europe.

Additionally, Affirm's collaborations with FIS and WooCommerce, announced in February and December 2024 respectively, enhanced its market presence and service offerings in e-commerce and financial services. Affirm's entry into the UK market in November 2024, coupled with an app redesign a month earlier to enhance user experience, further supported its growth trajectory. These maneuvers, along with improved earnings reports, played a vital role in boosting market confidence over the year.

- See whether Affirm Holdings' current market price aligns with its intrinsic value in our detailed report

- Uncover the uncertainties that could impact Affirm Holdings' future growth—read our risk evaluation here.

- Are you invested in Affirm Holdings already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10