热点栏目

客户端

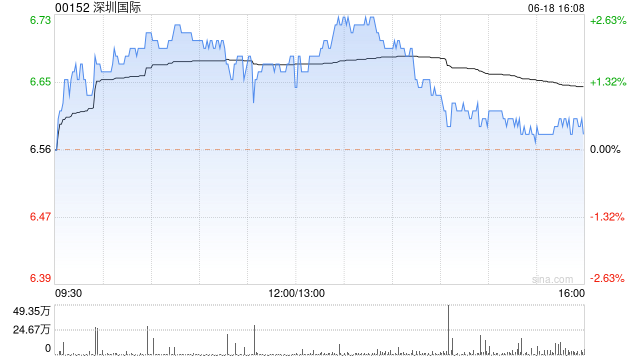

花旗发布研报称,维持深圳国际(00152)“买入”评级,目标价8.4港元。深圳国际发盈喜,预期去年纯利约28亿至31亿港元,同比增长53%至63%,与该行估计的30亿港元相符。

花旗指出,深圳国际管理层将去年纯利增长归因于深国际华南物流园转型升级项目确认土地置换税后收益约23亿元、成功将两个物流港项目置入公募REIT,以及集团主动改善借贷货币结构令汇兑损失大幅减少。该行相信深圳国际将维持50%的派息比率,确保去年每股派息为0.59至0.65港元,意味着有吸引力的8.2%至9%股息率。

责任编辑:史丽君

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.