On Holding AG (NYSE:ONON) will release its fourth-quarter financial results before the opening bell on Tuesday, March 4.

Analysts expect the Zurich, Switzerland-based company to report quarterly earnings at 18 cents per share, versus a year-ago loss of 5 cents per share. On Holding projects quarterly revenue of $594.37 million, compared to $447.1 million a year earlier, according to data from Benzinga Pro.

On Nov. 12, 2024, On Holding reported better-than-expected third-quarter sales results and raised its FY24 net sales guidance.

On Holding shares gained 3.8% to close at $48.48 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

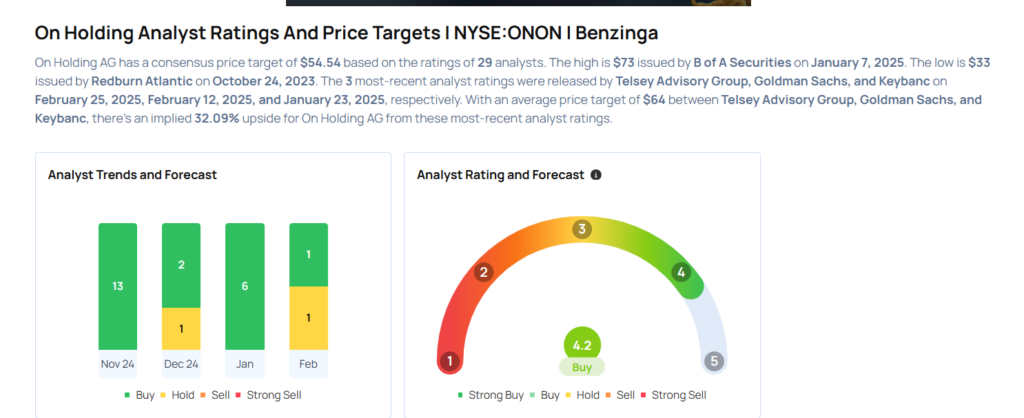

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Telsey Advisory Group analyst Cristina Fernandez maintained an Outperform rating with a price target of $67 on Feb. 25, 2025. This analyst has an accuracy rate of 64%.

- Goldman Sachs analyst Richard Edwards downgraded the stock from Buy to Neutral with a price target of $57 on Feb. 12, 2025. This analyst has an accuracy rate of 66%.

- Morgan Stanley analyst Alex Straton maintained an Overweight rating and increased the price target from $62 to $65 on Jan. 21, 2025. This analyst has an accuracy rate of 65%.

- Needham analyst Tom Nikic reiterated a Buy rating with a price target of $64 on Jan. 15, 2025. This analyst has an accuracy rate of 64%.

- TD Cowen analyst John Kernan maintained a Buy rating and increased the price target from $65 to $66 on Jan. 8, 2025. This analyst has an accuracy rate of 71%.

Considering buying ONON stock? Here’s what analysts think:

Read This Next:

- Top 2 Tech And Telecom Stocks That May Implode In Q1