Do Wanguo Gold Group's (HKG:3939) Earnings Warrant Your Attention?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Wanguo Gold Group (HKG:3939). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Wanguo Gold Group

Wanguo Gold Group's Earnings Per Share Are Growing

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Shareholders will be happy to know that Wanguo Gold Group's EPS has grown 25% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

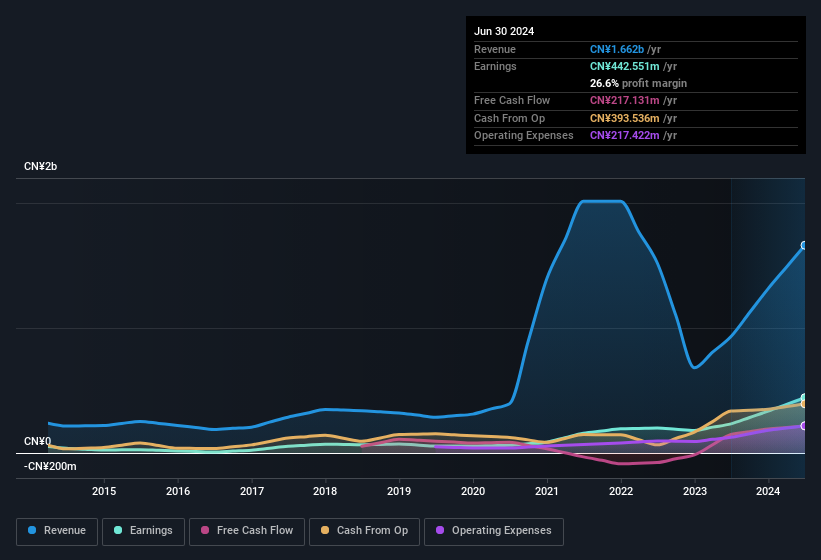

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of Wanguo Gold Group shareholders is that EBIT margins have grown from 33% to 37% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Wanguo Gold Group Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for Wanguo Gold Group is that one insider has illustrated their belief in the company's future with a huge purchase of shares in the last 12 months. In other words, the company insider, Guangping He, acquired CN¥586m worth of shares over the previous 12 months at an average price of around CN¥8.12. Seeing such high conviction in the company is a huge positive for shareholders and should instil confidence in their mission.

On top of the insider buying, we can also see that Wanguo Gold Group insiders own a large chunk of the company. Actually, with 46% of the company to their names, insiders are profoundly invested in the business. Shareholders and speculators should be reassured by this kind of alignment, as it suggests the business will be run for the benefit of shareholders. CN¥6.5b This is an incredible endorsement from them.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because Wanguo Gold Group's CEO, Mingqing Gao, is paid at a relatively modest level when compared to other CEOs for companies of this size. The median total compensation for CEOs of companies similar in size to Wanguo Gold Group, with market caps between CN¥7.3b and CN¥23b, is around CN¥3.7m.

Wanguo Gold Group's CEO took home a total compensation package of CN¥1.3m in the year prior to December 2023. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Wanguo Gold Group To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Wanguo Gold Group's strong EPS growth. Better still, insiders own a large chunk of the company and one has even been buying more shares. Astute investors will want to keep this stock on watch. You still need to take note of risks, for example - Wanguo Gold Group has 1 warning sign we think you should be aware of.

Keen growth investors love to see insider activity. Thankfully, Wanguo Gold Group isn't the only one. You can see a a curated list of Hong Kong companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Wanguo Gold Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10