The Gap, Inc. (NYSE:GAP) will release its fourth-quarter financial results, after the closing bell, on Thursday, March 6.

Analysts expect the company to report quarterly earnings at 38 cents per share, down from 49 cents per share in the year-ago period. Gap projects quarterly revenue of $4.07 billion, compared to $4.3 billion a year earlier, according to data from Benzinga Pro.

On Feb. 25, Gap announced a 10% dividend hike to $0.165 per share for the first quarter.

Gap shares fell 0.1% to trade at $19.83 on Thursday.

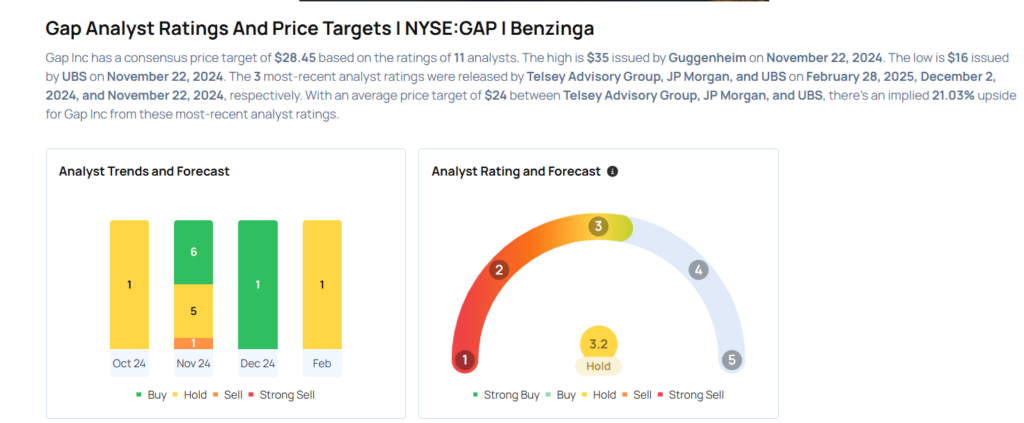

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- JP Morgan analyst Matthew Boss upgraded the stock from Neutral to Overweight and raised the price target from $28 to $30 on Dec. 2, 2024. This analyst has an accuracy rate of 67%.

- UBS analyst Jay Sole maintained a Sell rating and boosted the price target from $14 to $16 on Nov. 22, 2024. This analyst has an accuracy rate of 69%.

- Guggenheim analyst Robert Drbul reiterated a Buy rating with a price target of $35 on Nov. 22, 2024. This analyst has an accuracy rate of 60%.

- BMO Capital analyst Simeon Siegel maintained a Market Perform rating and raised the price target from $23 to $25 on Nov. 22, 2024. This analyst has an accuracy rate of 75%.

- Evercore ISI Group analyst Michael Binetti maintained an Outperform rating and raised the price target from $32 to $33 on Nov. 22, 2024. This analyst has an accuracy rate of 63%.

Considering buying GAP stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Give Their Take On 3 Defensive Stocks Delivering High-Dividend Yields