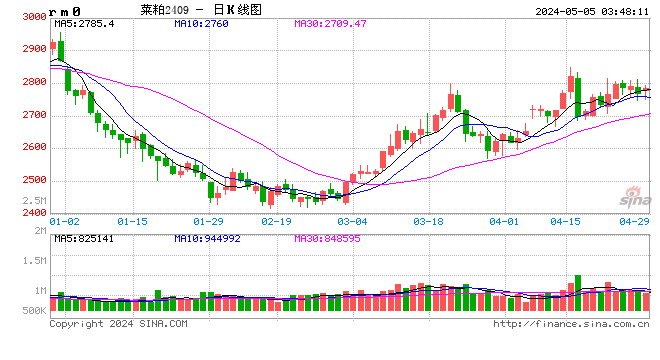

收评:菜粕跌超5% 集运指数跌近5%

午盘收盘,国内期货主力合约多数下跌,菜粕跌超5%,集运欧线跌近5%,纯碱跌超4%,豆二、豆粕、焦煤跌超3%,燃油、低硫燃料油(LU)跌近3%,玻璃、SC原油、焦炭、橡胶跌超2%;涨幅方面,苹果涨近2%,沪金涨近1%。

利空因素较多 集运指数大幅回调

在标的指数(SCFIS欧线)超预期回落以及船公司再度调降3月中下旬运价带动下,集运指数大幅回调。周二赫伯罗特、长荣海运等船商跟随调降运价,其中长荣海运调降幅度超逾20%至1450美元/TEU和2460美元/FEU,赫伯罗特微幅下调4%至1350美元/TEU和2200美元/FEU,表明运输需求疲弱,船商被迫降价揽货,利空市场情绪。此外,贸易战升级从长期角度看亦对航运业形成冲击。不过新出口订单出现改善,伴随下游订单生产完成后陆续发运,将对二季度海运需求形成改善预期,叠加船公司仍有涨价预期,因此指数可参考去年同期走势,策略上等待主力06合约充分回调后的多单介入机会,套利方面可适当关注EC2506—EC2510之间正套机会。(一德期货)

炒作逐步弱化,纯碱震荡偏弱

上周在远兴和金山两大巨头发布检修通知后,加之现货会议不断,行业内也有提涨的声音传来,两会政策预期下,盘面迅速组织了一波反弹。但目前价格运行至此,多空双方在这个价格上再做方向上的表达是比较困难的。在检修预期和两会政策预期均在盘面上炒作过之后,后续缺乏新一轮的炒作新闻,纯碱价格陷入震荡。远兴和金山的检修量确实会影响到供给端的数据,所以在这个检修的支撑下,盘面不至于深跌,后续关注金山检修落地之后,盘面冲高回落的可能性。(三立期货)

责任编辑:张靖笛

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10