3 Asian Penny Stocks With Market Caps Up To US$7B

As global markets grapple with economic uncertainties, including inflation concerns and trade policy shifts, investors are increasingly looking towards alternative investment opportunities. Penny stocks, often associated with smaller or newer companies in Asia, remain a relevant area for exploration due to their potential for growth at lower price points. Despite being considered a throwback term, these stocks can offer intriguing prospects when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$4.30 | HK$49.29B | ★★★★★★ |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.33 | SGD9.2B | ★★★★★☆ |

| Lever Style (SEHK:1346) | HK$1.31 | HK$831.57M | ★★★★★★ |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.10 | CN¥3.59B | ★★★★★★ |

| Beng Kuang Marine (SGX:BEZ) | SGD0.21 | SGD41.83M | ★★★★★★ |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.485 | SGD462.39M | ★★★★★★ |

| Interlink Telecom (SET:ITEL) | THB1.44 | THB2B | ★★★★☆☆ |

| China Zheshang Bank (SEHK:2016) | HK$2.46 | HK$81.9B | ★★★★★★ |

| Jiumaojiu International Holdings (SEHK:9922) | HK$3.34 | HK$4.67B | ★★★★★★ |

| Chumporn Palm Oil Industry (SET:CPI) | THB2.78 | THB1.76B | ★★★★★★ |

Click here to see the full list of 1,155 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Bosideng International Holdings (SEHK:3998)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bosideng International Holdings Limited operates in the apparel industry in the People's Republic of China, with a market cap of HK$49.29 billion.

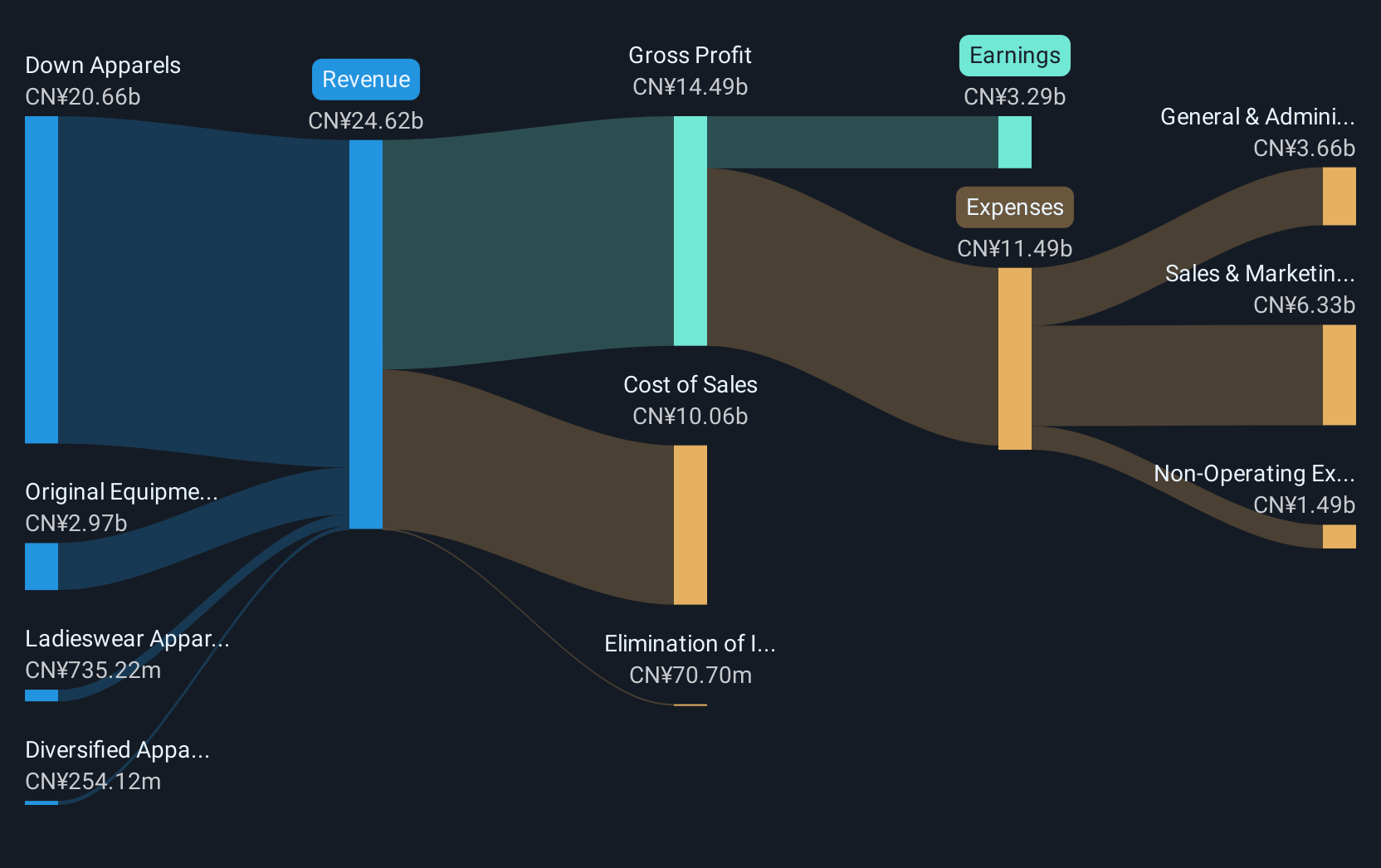

Operations: The company's revenue is primarily derived from Down Apparels at CN¥20.66 billion, followed by Original Equipment Manufacturing (OEM) Management at CN¥2.97 billion, Ladieswear Apparels at CN¥735.22 million, and Diversified Apparels at CN¥254.12 million.

Market Cap: HK$49.29B

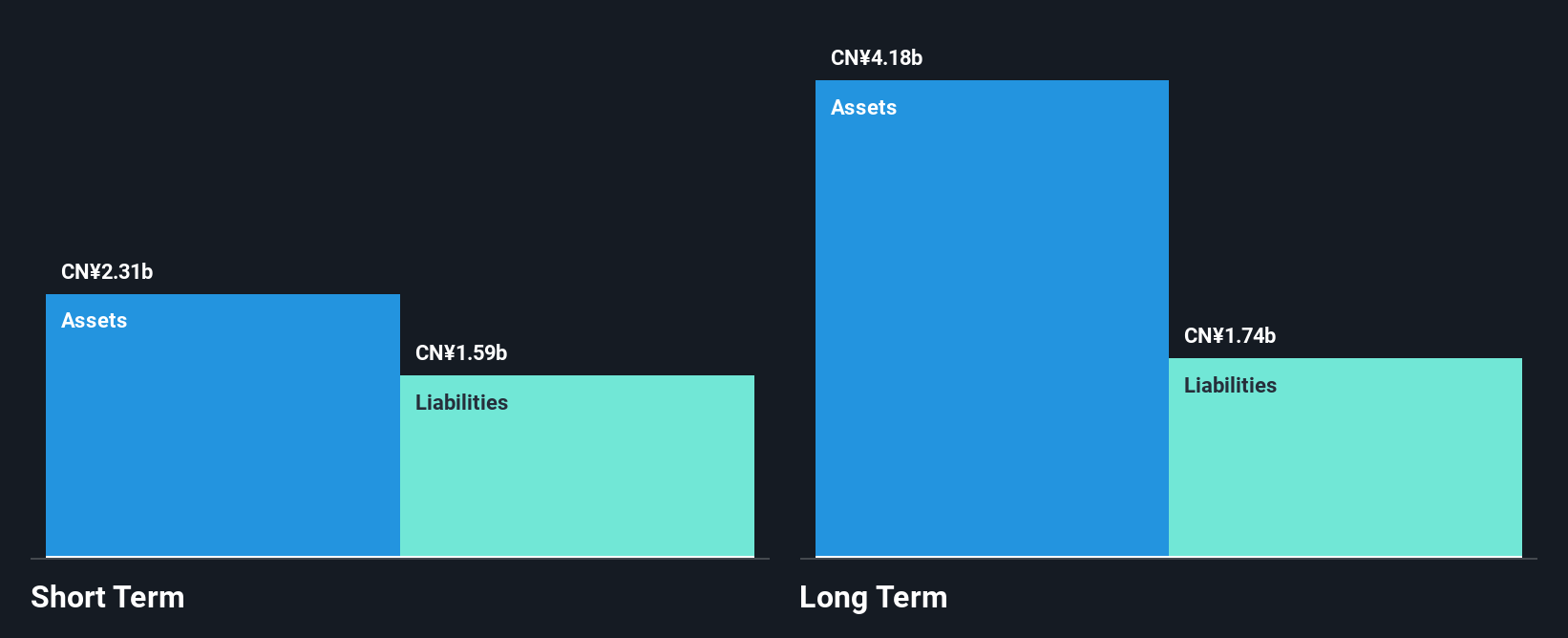

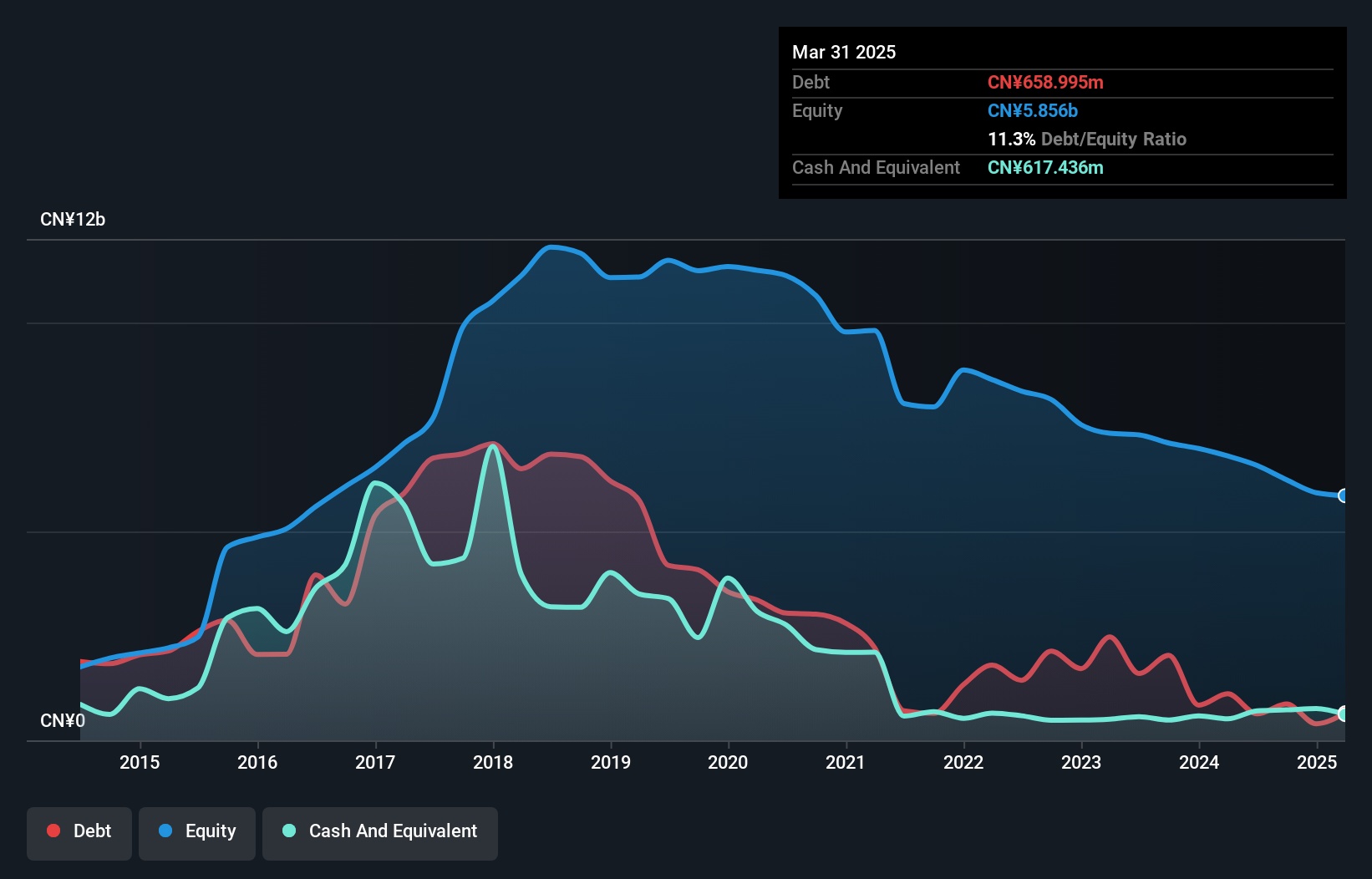

Bosideng International Holdings has demonstrated robust financial health, with earnings growing by 41.4% over the past year, significantly outpacing its five-year average of 20.2%. The company's strong balance sheet is evident as short-term assets of CN¥19.6 billion exceed both short-term and long-term liabilities, while having more cash than total debt. Bosideng's return on equity is high at 25.1%, and its debt-to-equity ratio has improved over time. Recently, the company initiated a share buyback program to enhance net asset value and earnings per share, utilizing available cash flow or working capital facilities for repurchases.

- Click to explore a detailed breakdown of our findings in Bosideng International Holdings' financial health report.

- Evaluate Bosideng International Holdings' prospects by accessing our earnings growth report.

Jiumaojiu International Holdings (SEHK:9922)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jiumaojiu International Holdings Limited manages and operates Chinese cuisine restaurant brands across several countries, including China, Singapore, Canada, Malaysia, Thailand, and the United States, with a market cap of HK$4.67 billion.

Operations: The company's revenue is primarily derived from its restaurant brands, with Tai Er generating CN¥4.54 billion, Jiu Mao Jiu contributing CN¥603.83 million, and Song Hot Pot accounting for CN¥885.66 million.

Market Cap: HK$4.67B

Jiumaojiu International Holdings has shown promising financial performance, with a significant earnings growth of 42% over the past year, surpassing its five-year average of 21.2%. The company's balance sheet is robust, as it holds more cash than total debt and its short-term assets exceed both short-term and long-term liabilities. Despite having a relatively inexperienced management team with an average tenure of 1.4 years, the board is seasoned with an average tenure of 3.9 years. Although trading at a discount to its estimated fair value, Jiumaojiu's return on equity remains low at 9.8%.

- Click here to discover the nuances of Jiumaojiu International Holdings with our detailed analytical financial health report.

- Learn about Jiumaojiu International Holdings' future growth trajectory here.

Beijing Haixin Energy TechnologyLtd (SZSE:300072)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Beijing Haixin Energy Technology Co., Ltd. (SZSE:300072) operates in the energy technology sector and has a market cap of CN¥8.22 billion.

Operations: Beijing Haixin Energy Technology Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥8.22B

Beijing Haixin Energy Technology Ltd. is currently unprofitable, with a negative return on equity of -8.89%. However, its financial position shows resilience as short-term assets (CN¥4.9 billion) cover both short-term and long-term liabilities comfortably. The company has managed to reduce its debt-to-equity ratio from 36.3% to 13.9% over five years, indicating improved financial health, while operating cash flow covers debt well at 109.8%. Despite trading significantly below estimated fair value and having stable weekly volatility at 6%, the board's inexperience could pose challenges for strategic direction amidst ongoing connected transactions requiring shareholder approval.

- Dive into the specifics of Beijing Haixin Energy TechnologyLtd here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into Beijing Haixin Energy TechnologyLtd's future.

Taking Advantage

- Take a closer look at our Asian Penny Stocks list of 1,155 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Jiumaojiu International Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10