Shareholders Can't Ignore AU$7.5m Of Sales By Hancock & Gore Insiders

Hancock & Gore Ltd's (ASX:HNG) stock rose 11% last week, but insiders who sold AU$7.5m worth of stock over the last year are probably in a more advantageous position. Holding on to stock would have meant their investment would be worth less now than it was at the time of sale. Thus selling at an average price of AU$0.34, which is higher than the current price, may have been the best decision.

Although we don't think shareholders should simply follow insider transactions, we do think it is perfectly logical to keep tabs on what insiders are doing.

See our latest analysis for Hancock & Gore

The Last 12 Months Of Insider Transactions At Hancock & Gore

The insider, Peter Miller, made the biggest insider sale in the last 12 months. That single transaction was for AU$7.5m worth of shares at a price of AU$0.34 each. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. The good news is that this large sale was at well above current price of AU$0.26. So it may not tell us anything about how insiders feel about the current share price. Peter Miller was the only individual insider to sell over the last year.

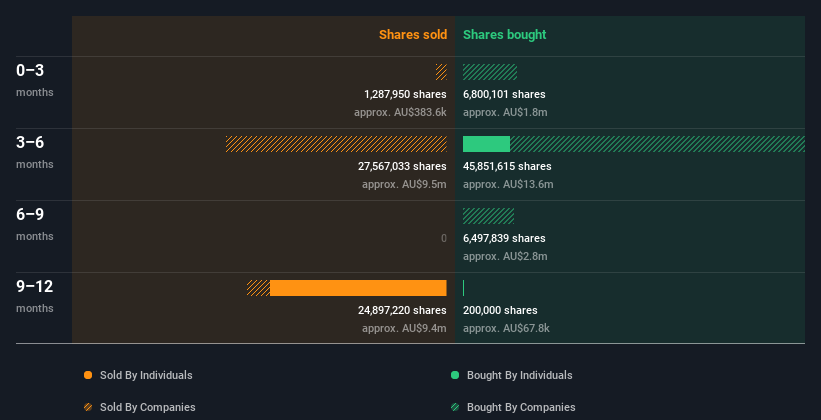

Over the last year, we can see that insiders have bought 6.20m shares worth AU$1.9m. But they sold 22.07m shares for AU$7.5m. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: Most of them are flying under the radar).

Insiders At Hancock & Gore Have Bought Stock Recently

We saw some Hancock & Gore insider buying shares in the last three months. Executive Chairman of the Board Alexander Beard purchased AU$19k worth of shares in that period. We like it when there are only buyers, and no sellers. But the amount invested in the last three months isn't enough for us too put much weight on it, as a single factor.

Does Hancock & Gore Boast High Insider Ownership?

Looking at the total insider shareholdings in a company can help to inform your view of whether they are well aligned with common shareholders. We usually like to see fairly high levels of insider ownership. Hancock & Gore insiders own about AU$56m worth of shares (which is 45% of the company). Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Do The Hancock & Gore Insider Transactions Indicate?

Insider purchases may have been minimal, in the last three months, but there was no selling at all. That said, the purchases were not large. It's heartening that insiders own plenty of stock, but we'd like to see more insider buying, since the last year of Hancock & Gore insider transactions don't fill us with confidence. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. Every company has risks, and we've spotted 5 warning signs for Hancock & Gore (of which 3 are concerning!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

If you're looking to trade Hancock & Gore, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hancock & Gore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10