High Growth Tech Stocks to Watch in March 2025

In March 2025, global markets are navigating a complex landscape characterized by easing U.S. inflation yet persistent recession fears, compounded by trade policy uncertainties and recent tariff announcements that have weighed heavily on major indices like the S&P 500 and Nasdaq Composite. Amidst this backdrop, investors are closely watching high growth tech stocks, as these companies often demonstrate resilience through innovation and adaptability in challenging economic environments.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 31.08% | 34.32% | ★★★★★★ |

| eWeLLLtd | 24.65% | 25.30% | ★★★★★★ |

| Pharma Mar | 24.24% | 40.82% | ★★★★★★ |

| CD Projekt | 27.71% | 41.31% | ★★★★★★ |

| Elliptic Laboratories | 49.76% | 88.21% | ★★★★★★ |

| Ascelia Pharma | 46.09% | 66.93% | ★★★★★★ |

| Ascentage Pharma Group International | 23.29% | 60.86% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 793 stocks from our Global High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

AAC Technologies Holdings (SEHK:2018)

Simply Wall St Growth Rating: ★★★★☆☆

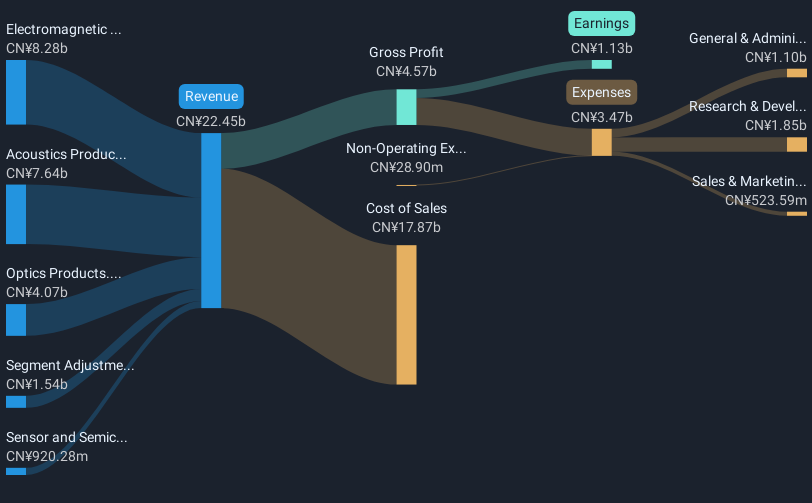

Overview: AAC Technologies Holdings Inc. is an investment holding company that offers solutions for smart devices across various regions including Mainland China, Hong Kong, Taiwan, other parts of Asia, the United States, and Europe with a market capitalization of HK$60.46 billion.

Operations: The company generates revenue primarily through its acoustics and electromagnetic drives and precision mechanics segments, contributing CN¥7.64 billion and CN¥8.28 billion, respectively. The optics products segment also plays a significant role with revenue of CN¥4.07 billion.

AAC Technologies Holdings Inc. has demonstrated robust performance with an expected significant increase in profit, estimated between 130% to 145% for the year ended December 2024, primarily fueled by a rebound in the global smartphone market and strategic acquisitions like Acoustics Solutions International B.V. This growth is underpinned by a strong focus on R&D, which has enabled AAC to pioneer advanced solutions across sensory interaction technologies showcased at CES 2025. Innovations such as the Ultimate Speaker and RichTap AI Vibration Solutions not only reinforce AAC's leadership in acoustics and haptics but also enhance its competitive edge in smart automotive and other high-tech sectors. With revenue growth forecasted at 12.2% annually and earnings anticipated to rise by 20.6% per year, AAC is strategically positioned to capitalize on technological trends while enhancing shareholder value through initiatives like the recent share repurchase program authorized for up to $100 million worth of shares until May 2025.

- Navigate through the intricacies of AAC Technologies Holdings with our comprehensive health report here.

Learn about AAC Technologies Holdings' historical performance.

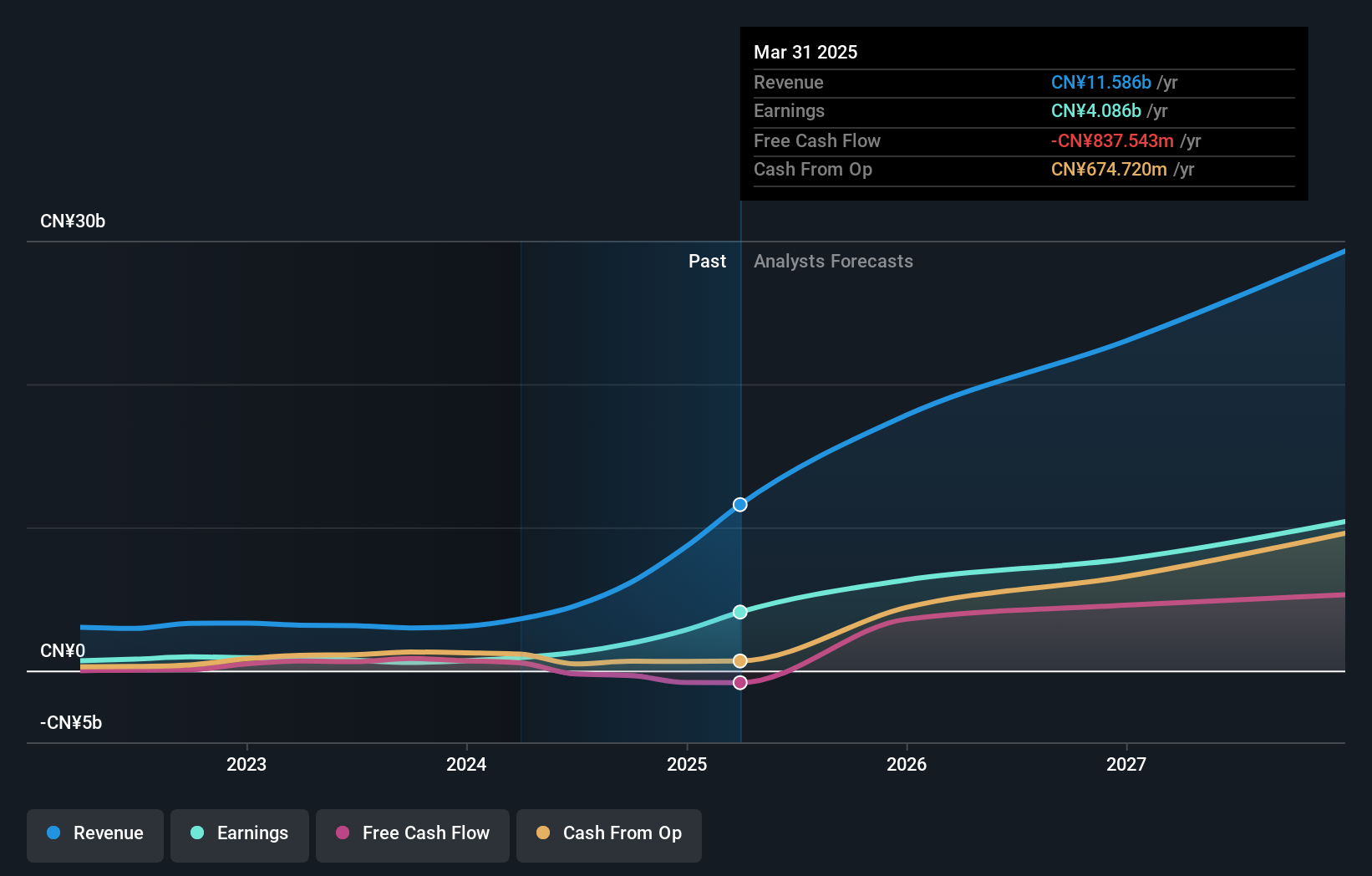

Eoptolink Technology (SZSE:300502)

Simply Wall St Growth Rating: ★★★★★★

Overview: Eoptolink Technology Inc., Ltd. is involved in the R&D, manufacturing, and sale of optical transceivers both in China and globally, with a market capitalization of CN¥66.51 billion.

Operations: Eoptolink Technology generates revenue primarily through its optical communication equipment segment, amounting to CN¥6.14 billion. The company focuses on the development and production of optical transceivers for both domestic and international markets.

Eoptolink Technology, amidst a competitive tech landscape, has shown impressive growth metrics that underscore its potential in high-growth sectors. With annualized revenue and earnings growth rates at 41.9% and 36.6% respectively, the company outpaces the broader Chinese market averages of 13.1% for revenue and 25.2% for earnings growth. This performance is bolstered by significant R&D investments which have not only fueled innovations but also positioned Eoptolink favorably against industry norms. Despite challenges like a volatile share price, the firm's strategic focus on enhancing product offerings through substantial non-cash earnings suggests robust future prospects in an evolving electronic sector.

- Dive into the specifics of Eoptolink Technology here with our thorough health report.

Gain insights into Eoptolink Technology's historical performance by reviewing our past performance report.

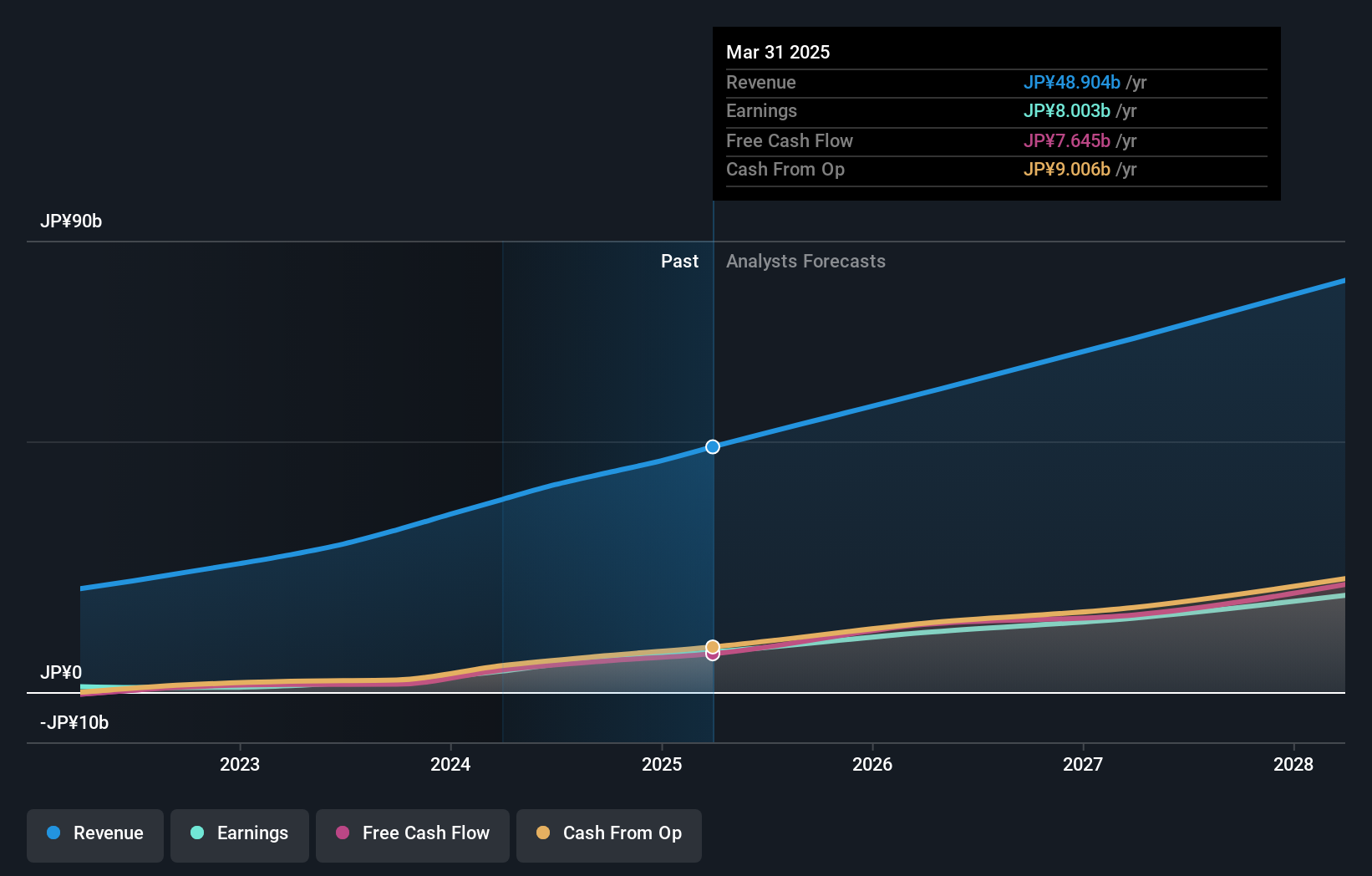

Rakus (TSE:3923)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rakus Co., Ltd. is a company that, along with its subsidiaries, offers cloud services in Japan and has a market capitalization of approximately ¥348.03 billion.

Operations: Rakus focuses on providing cloud-based services in Japan, generating revenue primarily through its software solutions for businesses. The company's financial performance is highlighted by a notable net profit margin trend, reflecting its operational efficiency and cost management strategies.

Rakus, in its recent strategic maneuvers, has demonstrated a keen eye for global expansion and innovation. The company's decision to establish a subsidiary in Indonesia taps into the region's burgeoning tech talent pool, aiming to bolster its cloud services development. This move aligns with Rakus’s impressive earnings growth of 137.9% over the past year, significantly outpacing the software industry's average of 12%. Furthermore, with an expected annual profit growth rate of 24.8% and revenue growth projections at 16.1%, Rakus is not only expanding geographically but also deepening its technological capabilities to stay ahead in a competitive market. These figures underscore Rakus’s robust position in leveraging global resources and R&D to drive future growth amidst dynamic market demands.

- Click here and access our complete health analysis report to understand the dynamics of Rakus.

Explore historical data to track Rakus' performance over time in our Past section.

Summing It All Up

- Investigate our full lineup of 793 Global High Growth Tech and AI Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10