Robinhood Markets (NasdaqGS:HOOD) Surges 18% Last Quarter Following Earnings Report

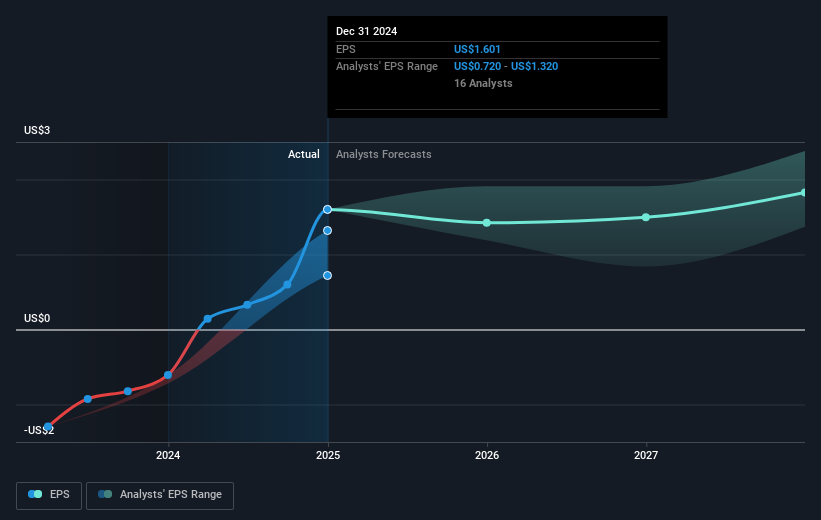

Robinhood Markets (NasdaqGS:HOOD) experienced an 18% price increase over the last quarter, likely influenced by its strong earnings report and ongoing share buyback program. The company reported a dramatic rise in revenue and net income for the fourth quarter compared to the previous year, making its financial performance a potential driver of the stock's upward trajectory. Additionally, Robinhood's share buyback initiative, resulting in over 5 million shares repurchased, helped reinforce investor confidence. During the broader market period, both the S&P 500 and Nasdaq saw upward movement, which may have provided a supportive backdrop for the company's stock rally.

Buy, Hold or Sell Robinhood Markets? View our complete analysis and fair value estimate and you decide.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Over the past three years, Robinhood Markets' shares provided total returns of approximately 258%, driven by several key developments. The company’s strategic expansion into the derivatives market and innovative product launches like the Robinhood Legend platform and Gold Card service contributed significantly to this growth. Particularly notable was the Robinhood Legend platform, generating $50 million in annualized revenue, reflecting enhanced transaction volumes. Simultaneously, the rapid increase in Gold subscribers indicated improved average revenue per user.

Additionally, Robinhood's international expansion, highlighted by the integration of Bitstamp, opened global market avenues and new revenue streams within the crypto sector. The strategic implementation of a comprehensive share buyback program, authorizing up to $1 billion in repurchases, further reinforced shareholder value. In the past year, Robinhood's share performance exceeded market returns, underscoring its competitive strength within the US Capital Markets industry, which recorded returns of 19.5% in the same timeframe.

Unlock comprehensive insights into our analysis of Robinhood Markets stock in this financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Robinhood Markets, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10