China Everbright Water (SGX:U9E) Is Paying Out A Dividend Of HK$0.0102

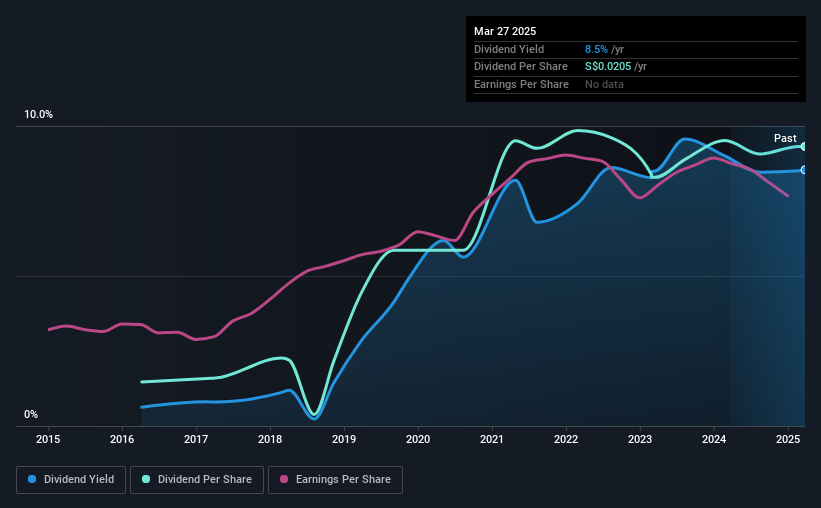

China Everbright Water Limited (SGX:U9E) will pay a dividend of HK$0.0102 on the 23rd of May. The dividend yield will be 8.5% based on this payment which is still above the industry average.

We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

China Everbright Water's Future Dividend Projections Appear Well Covered By Earnings

A big dividend yield for a few years doesn't mean much if it can't be sustained. Prior to this announcement, China Everbright Water's earnings easily covered the dividend, but free cash flows were negative. With the company not bringing in any cash, paying out to shareholders is bound to become difficult at some point.

If the trend of the last few years continues, EPS will grow by 3.5% over the next 12 months. Assuming the dividend continues along recent trends, we think the payout ratio could be 6.6% by next year, which is in a pretty sustainable range.

See our latest analysis for China Everbright Water

China Everbright Water's Dividend Has Lacked Consistency

It's comforting to see that China Everbright Water has been paying a dividend for a number of years now, however it has been cut at least once in that time. If the company cuts once, it definitely isn't argument against the possibility of it cutting in the future. The annual payment during the last 9 years was HK$0.0187 in 2016, and the most recent fiscal year payment was HK$0.119. This implies that the company grew its distributions at a yearly rate of about 23% over that duration. Dividends have grown rapidly over this time, but with cuts in the past we are not certain that this stock will be a reliable source of income in the future.

Dividend Growth May Be Hard To Achieve

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Earnings per share has been crawling upwards at 3.5% per year. While growth may be thin on the ground, China Everbright Water could always pay out a higher proportion of earnings to increase shareholder returns.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. While China Everbright Water is earning enough to cover the payments, the cash flows are lacking. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 2 warning signs for China Everbright Water (of which 1 is potentially serious!) you should know about. Is China Everbright Water not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10