RH (NYSE:RH) will release its fourth-quarter financial results, after the closing bell, on Wednesday, April 2.

Analysts expect the Corte Madera, California-based company to report quarterly earnings at $1.92 per share, up from 72 cents per share in the year-ago period. RH projects quarterly revenue of $829.56 million, compared to $738.26 million a year earlier, according to data from Benzinga Pro.

On Dec. 12, RH reported third-quarter revenue of $811.73 million, missing the consensus estimate of $812.16 million.

RH shares rose 2% to close at $239.06 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

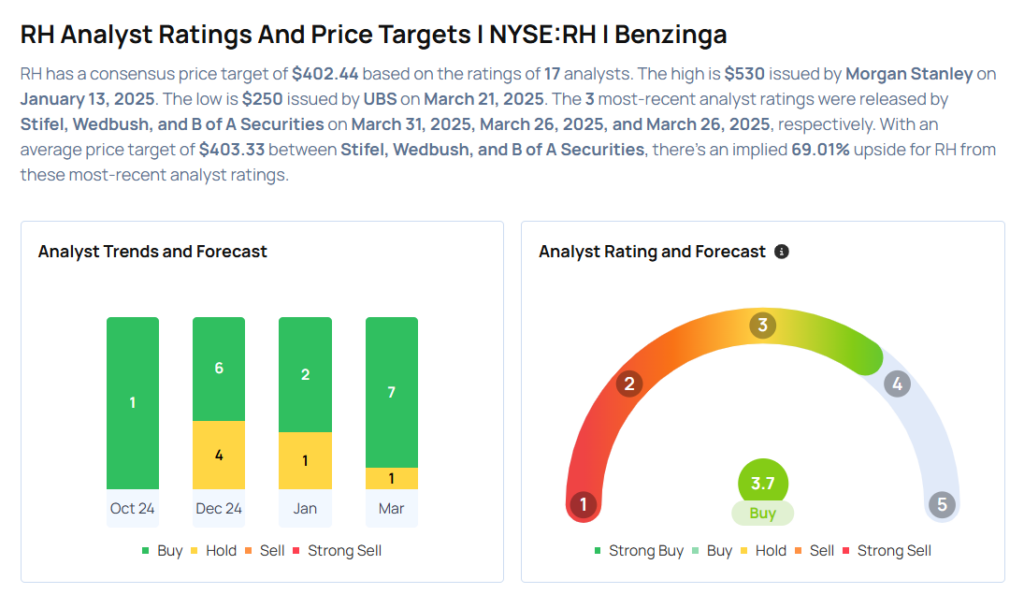

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Wedbush analyst Seth Basham maintained an Outperform rating and slashed the price target from $500 to $350 on March 26, 2025. This analyst has an accuracy rate of 67%.

- UBS analyst Michael Lasser maintained a Neutral rating and cut the price target from $440 to $250 on March 21, 2025. This analyst has an accuracy rate of 77%.

- Wells Fargo analyst Zachary Fadem maintained an Overweight rating and lowered the price target from $500 to $375 on March 18, 2025. This analyst has an accuracy rate of 84%.

- Goldman Sachs analyst Kate McShane upgraded the stock from Sell to Neutral and boosted the price target from $261 to $374 on Jan. 30, 2025. This analyst has an accuracy rate of 66%.

- Morgan Stanley analyst Simeon Gutman upgraded the stock from Equal-Weight to Overweight and increased the price target from $435 to $530 on Jan. 13, 2025. This analyst has an accuracy rate of 66%.

Considering buying RH stock? Here’s what analysts think:

Read This Next:

- Wall Street’s Most Accurate Analysts Give Their Take On 3 Consumer Stocks Delivering High-Dividend Yields

Photo via Shutterstock