Undervalued Small Caps With Insider Action In March 2025

Over the last 7 days, the United States market has experienced a 3.5% drop, although it remains up by 5.8% over the past year with earnings projected to grow by 14% annually in the coming years. In this fluctuating environment, identifying small-cap stocks that are potentially undervalued and exhibit insider activity can offer intriguing opportunities for investors seeking to capitalize on emerging growth prospects.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Shore Bancshares | 10.3x | 2.3x | 8.96% | ★★★★☆☆ |

| MVB Financial | 11.2x | 1.5x | 28.56% | ★★★★☆☆ |

| S&T Bancorp | 10.8x | 3.7x | 42.42% | ★★★★☆☆ |

| PDF Solutions | 185.9x | 4.2x | 22.02% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.7x | 18.22% | ★★★★☆☆ |

| West Bancorporation | 14.0x | 4.3x | 43.45% | ★★★☆☆☆ |

| Franklin Financial Services | 14.2x | 2.3x | 33.39% | ★★★☆☆☆ |

| Union Bankshares | 16.4x | 3.1x | 37.46% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -252.35% | ★★★☆☆☆ |

| Titan Machinery | NA | 0.1x | -347.77% | ★★★☆☆☆ |

Click here to see the full list of 91 stocks from our Undervalued US Small Caps With Insider Buying screener.

Let's review some notable picks from our screened stocks.

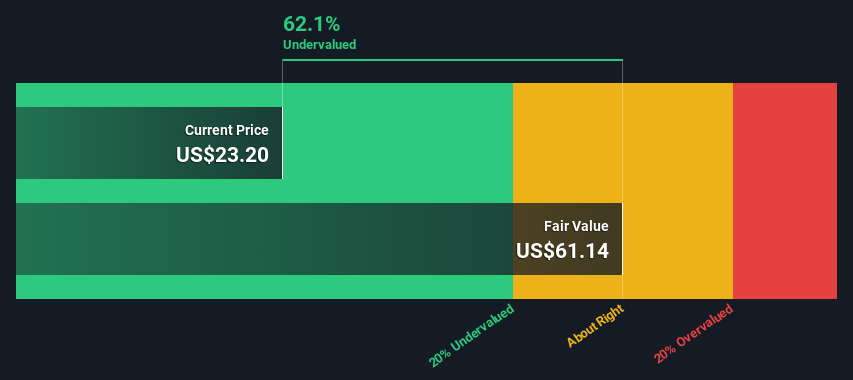

Northeast Community Bancorp (NasdaqCM:NECB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Northeast Community Bancorp operates as a thrift/savings and loan institution with a focus on providing financial services, holding a market capitalization of approximately $0.26 billion.

Operations: The company generates revenue primarily through its thrift and savings and loan institutions. Operating expenses are a significant component of costs, with general and administrative expenses consistently being the largest portion. The net income margin has shown an upward trend, reaching 46.12% in recent periods.

PE: 5.8x

Northeast Community Bancorp, a smaller player in the financial sector, shows potential for value with its recent earnings report. For 2024, net interest income rose to US$102.79 million from US$97.19 million in 2023, reflecting steady growth despite a dip in quarterly net income from US$12.1 million to US$10.93 million year-over-year. Insider confidence is evident with share purchases over past periods, though recent buyback activity was paused last quarter. The company faces challenges like increased charge-offs but maintains strong annual performance overall.

- Click here and access our complete valuation analysis report to understand the dynamics of Northeast Community Bancorp.

Learn about Northeast Community Bancorp's historical performance.

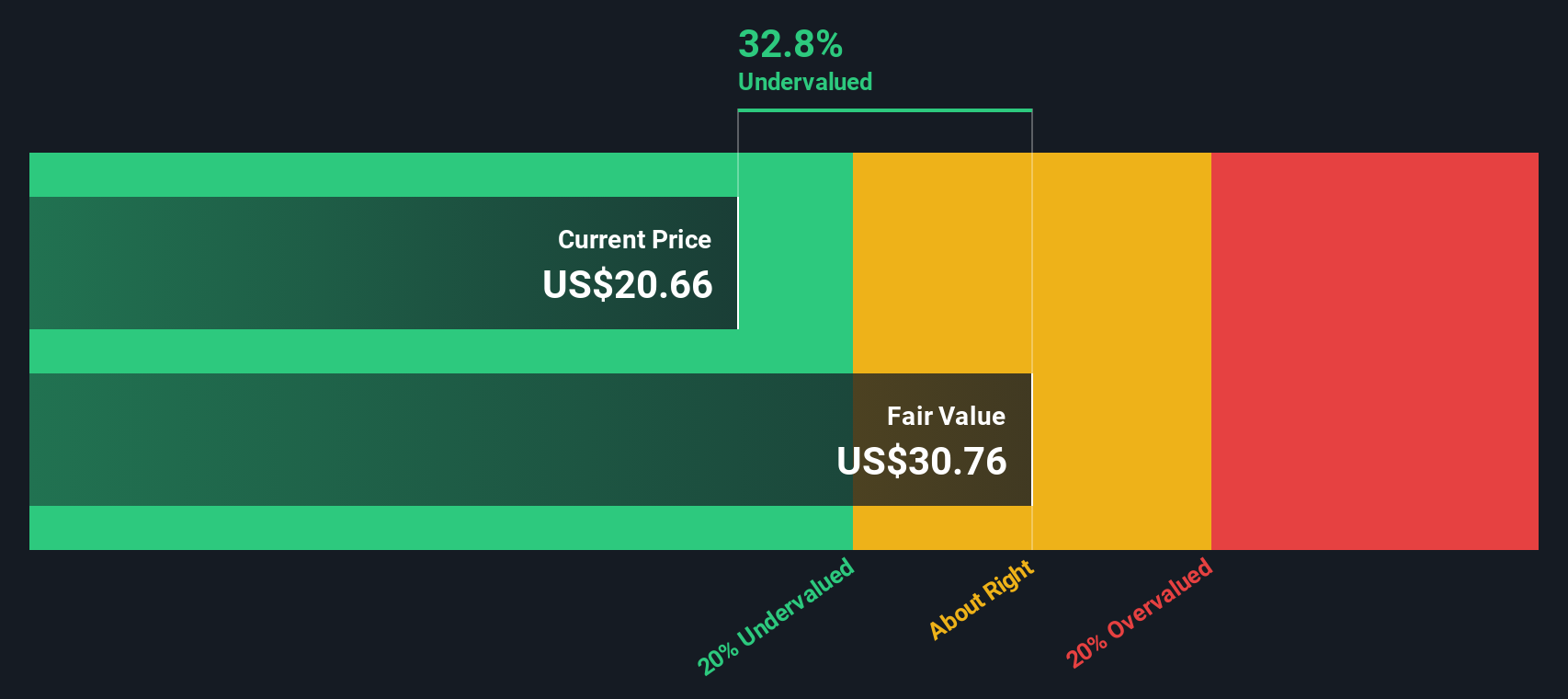

Capital Southwest (NasdaqGS:CSWC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Capital Southwest is a business development company that provides capital to middle-market companies, with a market cap of approximately $0.54 billion.

Operations: The company generates revenue primarily from its investment activities, with recent figures showing $198.46 million in revenue. Operating expenses are significant, with general and administrative costs being a major component, reaching $25.51 million recently. The net income margin has varied over time but was reported at 33.49% in the most recent period, indicating the portion of revenue that translates into profit after all expenses are accounted for.

PE: 17.0x

Capital Southwest, a smaller company in the U.S., has seen insider confidence with recent share purchases, signaling potential value. Despite a drop in profit margins to 33.5% from 52.2% last year and net income decreasing to US$16 million for Q3 2024, revenue grew to US$52 million. Leadership changes include Michael Sarner stepping up as CEO, bringing substantial financial expertise and strategic vision after raising over US$2 billion in capital since joining in 2015.

- Get an in-depth perspective on Capital Southwest's performance by reading our valuation report here.

Examine Capital Southwest's past performance report to understand how it has performed in the past.

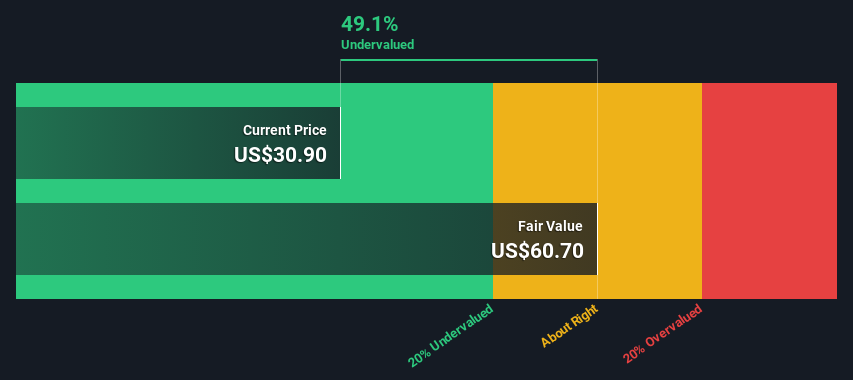

SmartFinancial (NYSE:SMBK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: SmartFinancial operates as a bank holding company providing a range of financial services primarily through its banking subsidiary, with operations contributing to a market capitalization of approximately $0.49 billion.

Operations: SmartFinancial generates revenue primarily from its banking operations, with the latest reported revenue being $166.35 million. The company consistently shows a gross profit margin of 100%, indicating no cost of goods sold data available, and significant operating expenses are driven mainly by general and administrative costs, which reached $99.85 million in the most recent period. Net income margin has fluctuated over time, recently recorded at 21.73%.

PE: 14.7x

SmartFinancial, a smaller company in the U.S., shows potential for growth with earnings forecasted to increase by 15.78% annually. Recent financial results highlight a strong performance, with Q4 net interest income rising to US$37.78 million from US$31.52 million year-over-year and net income climbing to US$9.64 million from US$6.19 million. The company recently expanded its board, appointing Kelli D. Shomaker, bringing extensive financial expertise which could bolster governance and strategic direction moving forward.

- Take a closer look at SmartFinancial's potential here in our valuation report.

Assess SmartFinancial's past performance with our detailed historical performance reports.

Key Takeaways

- Click here to access our complete index of 91 Undervalued US Small Caps With Insider Buying.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10