U.S. Bancorp (NYSE:USB) Slips 10% Over The Week As Global Trade Tensions Rise

U.S. Bancorp (NYSE:USB) experienced a 10% decline in its stock price over the past week, amid a broader market downturn driven by escalating global trade tensions. Despite the company's recent initiatives, such as launching the U.S. Bank Shield Visa Card and affirming quarterly dividends, the stock’s performance appears to be influenced more by the market-wide reactions to significant tariff announcements by President Trump, which led to a 4% drop in the Dow Jones Industrial Average and a bear market entry for the Nasdaq Composite. This macroeconomic environment overshadowed U.S. Bancorp’s recent product and dividend announcements.

Buy, Hold or Sell U.S. Bancorp? View our complete analysis and fair value estimate and you decide.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

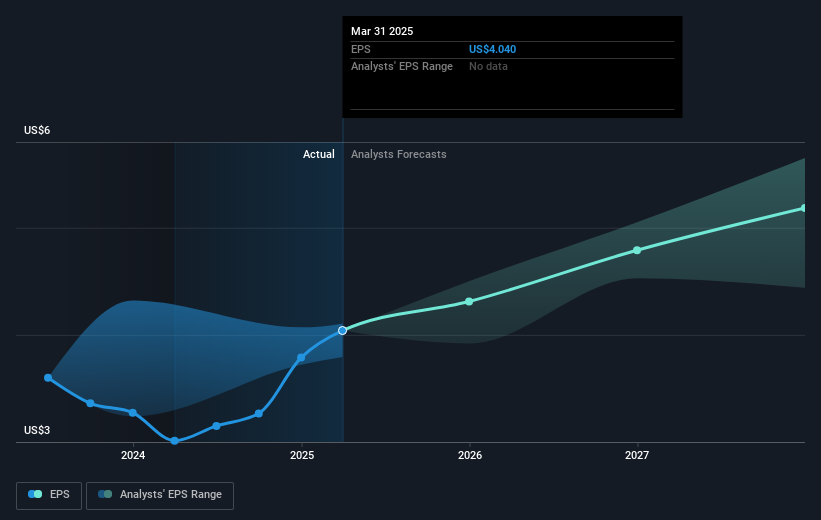

Over a five-year horizon, U.S. Bancorp delivered a total return of 26.47%, with both its share price and dividends contributing to its performance. This period witnessed a mix of market-sensitive developments that may have shaped the company's long-term stock trajectory. Notably, the introduction of the U.S. Bank Shield Visa Card in March 2025 aimed to enhance customer offerings through competitive features, likely driving interest and engagement. Additionally, collaborations like the partnership with Elavon in 2023 expanded their payment solution capabilities, potentially adding to revenue streams and bolstering performance.

While U.S. Bancorp has shown resilience in earnings growth, such as the annual net income rise to approximately $6.30 billion in 2024, challenges have persisted. Regulatory scrutiny in early 2024, related to allegations around sales practices, introduced potential headwinds. Despite such setbacks, the company remained shareholder-focused, evident through consistent dividend declarations, including a US$0.50 payout announced in March 2025, and share repurchases totaling US$121.8 million prior to January 2025. These actions underscore an emphasis on maintaining investor confidence.

Navigate through the intricacies of U.S. Bancorp with our comprehensive balance sheet health report here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10