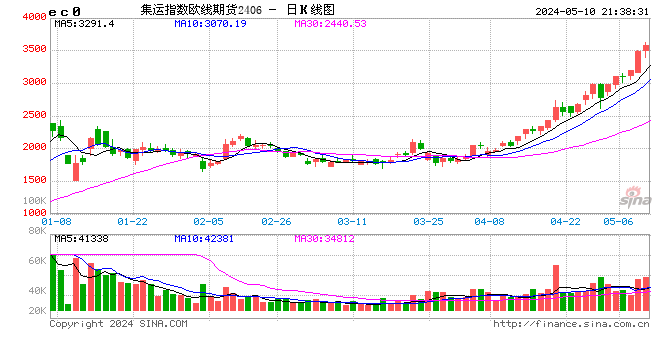

午盘收盘,国内期货主力合约跌多涨少,集运欧线跌超8%,20号胶、PX、SC原油跌超6%,合成橡胶、PTA跌超5%,烧碱、焦煤、橡胶、焦炭跌超4%,短纤跌近4%,铁矿、燃油、低硫燃料油(LU)跌超3%。涨幅方面,菜粕、鸡蛋涨超3%,豆粕涨近3%,生猪、玻璃涨近2%。

短期风险因素骤增 集运指数波动较大

全球金融市场受到猛烈冲击,恐慌情绪蔓延,周一集运指数大幅下挫。受政策影响,进出口贸易磋商难度显著增加,为航运市场带来较大不确定性。托运人或采取延期谈判、取消订舱等方式,预计短期美线货量及运价波动将明显加剧。昨日上海航交易所公布最新一期SCFIS欧线录得1422.42点,环比下跌3.5%,显示现货市场依旧偏弱,结算运价持续下行,续创年内低点。4月中下旬停航减少,运价供给增加近20%,对运价仍有压力,重点关注需求拐点。中欧双方同意尽快重启电动汽车反补贴案价格承诺谈判,部分船商在线运价显示5月初再度提涨,但幅度大幅弱于去年。短期风险因素骤增,策略上观望为宜,可等待盘面维稳后择机关注06与10合约之间的正套机会。(一德期货)

若4月9日前美国政策未有逆转,则原油价格下跌压力延续

上周初我们持续提示原油市场交易主题或自美国对伊朗、俄罗斯、委内瑞拉加重制裁引发的供应风险切换至贸易战引发的石油需求担忧,布伦特75美元/桶、SC550元/桶一线的压制作用依然有效,原油价格短期风险偏向下行。OPEC+增产降价策略配合推动下的油价下跌部分对冲美国因贸易战引发的通胀压力,若4月9日前美国政策未有逆转则下跌压力延续,关注WTI55-60美元/桶(对应布伦特60-65美元/桶、SC430-470元/桶)成本支撑作用。(国投期货)

责任编辑:张靖笛