Citigroup (NYSE:C) Declares US$0.56 Dividend Despite 12% Share Price Dip

Citigroup (NYSE:C) recently announced dividend declarations, with a common stock dividend of $0.56 per share, amidst a challenging market backdrop where major indexes, including the Dow, are experiencing significant tumbles due to escalating trade tensions. As the global trade landscape remains uncertain, Citigroup's stock price moved downward by 11.20% over the last quarter. The market's overall decline of 5.6% during this time reflects broader economic unease, amplified by tariff announcements and concerns over potential recessions. Noteworthy developments at Citigroup, including debt redemptions and strategic executive appointments, occurred during this volatile period but could not reverse the stock's declining trend.

Buy, Hold or Sell Citigroup? View our complete analysis and fair value estimate and you decide.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

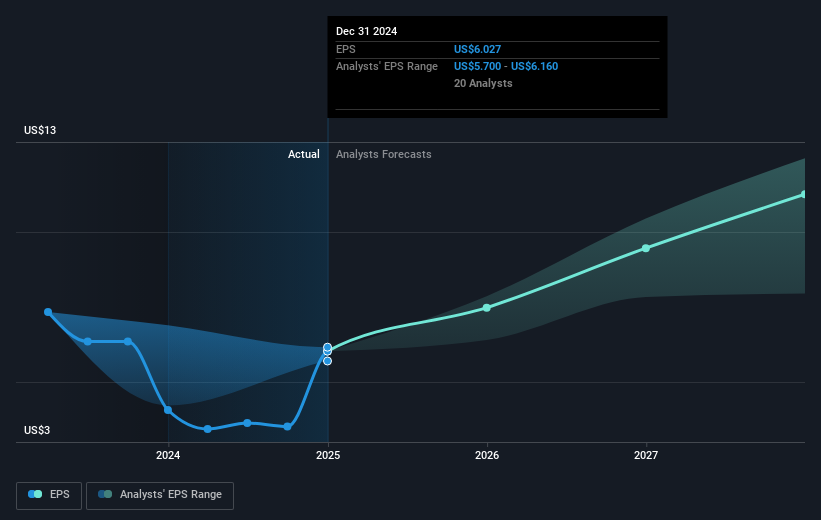

Over the past five years, Citigroup's total shareholder return, combining share price appreciation and dividends, reached 60.99%. While the last year saw Citigroup underperform the US Banks industry, which returned 7.7%, several developments shaped its longer-term trajectory. The AI investments and collaborations with Apollo and American Airlines likely played a crucial role, potentially improving client services and operational efficiency. Expansion in Wealth Management, focusing on enriching client experiences, may have also driven revenue growth. Another significant factor was the implementation of a $20 billion share buyback program, signaling a strong commitment to shareholder returns.

This period also saw Citigroup navigating complex economic landscapes, including net interest income fluctuations. In 2024, they reported net interest income of US$13.51 billion for Q1, indicative of consistent earnings momentum. Moreover, executive changes, such as the 2020 appointment of Jane Fraser as CEO, marked a new era of leadership, shaping Citigroup's corporate strategies and market responses.

Click to explore a detailed breakdown of our findings in Citigroup's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10