随着美国收益率曲线变陡,各类资产波动性上升,30年期收益率飙升至5%以上,为判断这只是重新定价,还是更深层次的结构性问题提供了试金石。

周三,随着投资者争相筹集现金,长期美债抛售加速,给全球流动性最强的债券市场带来了新的压力。30年期国债收益率隔夜一度飙升25个基点,触及5.02%,不过已有所回落,至略低于4.9%的水平。这一走势仍将收益率推高了近50个基点,迈向1982年以来最大周涨幅之一。

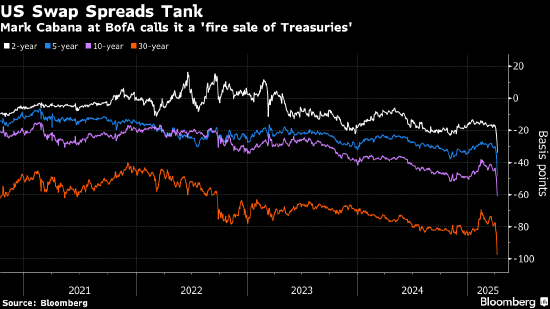

与此同时,长端掉期利差以历史罕见的速度收窄,30年期出现了有史以来最大的收窄幅度之一,正如彭博的Valerie Tytel的图表所显示。这表明,流动性问题可能在不断恶化,现金市场和衍生品市场之间可能出现错位,可能会给做市商的资产负债表带来压力。

虽然国债历来是避风港,但正如笔者同事最近指出的那样,本周的动向表明国债的地位如今已受到质疑。此番跌势令人们更加担忧,由关税引发的通货膨胀将使美联储无所作为,再加上市场猜测,外国储备管理者正在撤资,对冲基金也在平仓基差交易。

责任编辑:郭明煜

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.