Fastenal Company (NASDAQ:FAST) will release earnings results for the first quarter, before the opening bell on Friday, April 11.

Analysts expect the Winona, Minnesota-based company to report quarterly earnings at 52 cents per share, compared to 52 cents per share in the year-ago period. Fastenal projects to report quarterly revenue at $1.95 billion, compared to $1.9 billion a year earlier, according to data from Benzinga Pro.

On Jan. 17, Fastenal reported sales growth of 3.7% year-over-year to $1.825 billion, missing the consensus of $1.844 billion.

Fastenal shares gained 7.4% to close at $76.47 on Wednesday.

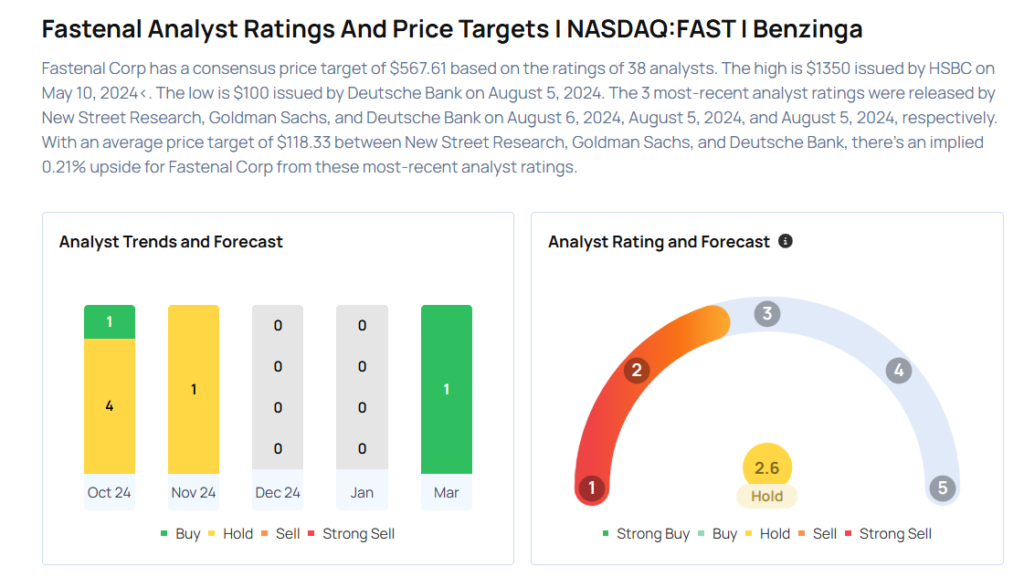

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- William Blair analyst Ryan Merkel upgraded the stock from Market Perform to Outperform on March 10, 2025. This analyst has an accuracy rate of 65%.

- Jefferies analyst Stephen Volkmann maintained a Hold rating and raised the price target from $74 to $85 on Dec. 6, 2024. This analyst has an accuracy rate of 71%.

- UBS analyst Amit Mehrotra assumed a Neutral rating and increased the price target from $71 to $88 on Nov. 13, 2024. This analyst has an accuracy rate of 75%.

- Morgan Stanley analyst Chris Snyder maintained an Equal-Weight rating and raised the price target from $72 to $76 on Oct. 14, 2024. This analyst has an accuracy rate of 66%.

- Baird analyst David Manthey maintained a Neutral rating and raised the price target from $67 to $80 on Oct. 14, 2024. This analyst has an accuracy rate of 74%.

Considering buying FAST stock? Here’s what analysts think:

Read This Next:

- Top 2 Materials Stocks That May Fall Off A Cliff This Quarter

Photo via Shutterstock