Aytu BioPharma, Inc. (NASDAQ:AYTU) On The Verge Of Breaking Even

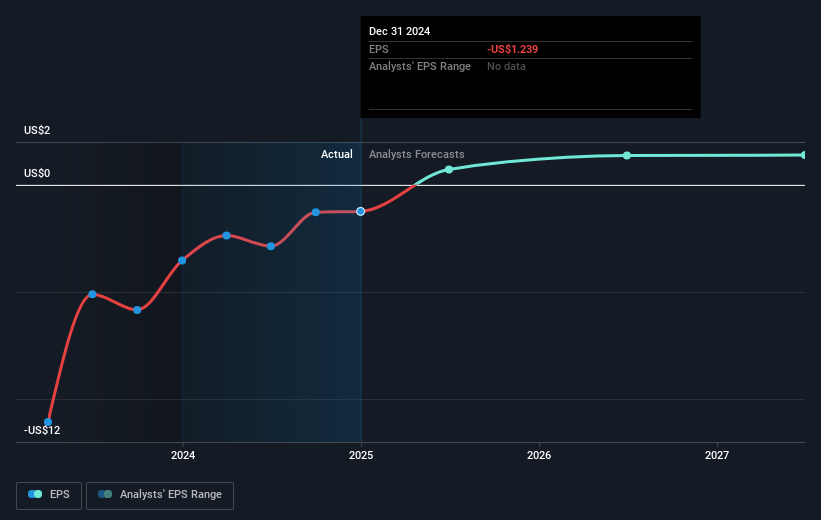

We feel now is a pretty good time to analyse Aytu BioPharma, Inc.'s (NASDAQ:AYTU) business as it appears the company may be on the cusp of a considerable accomplishment. Aytu BioPharma, Inc., a pharmaceutical company, focuses on commercializing novel therapeutics drugs in the United States and internationally. With the latest financial year loss of US$16m and a trailing-twelve-month loss of US$7.2m, the US$6.4m market-cap company alleviated its loss by moving closer towards its target of breakeven. The most pressing concern for investors is Aytu BioPharma's path to profitability – when will it breakeven? We've put together a brief outline of industry analyst expectations for the company, its year of breakeven and its implied growth rate.

This technology could replace computers: discover the 20 stocks are working to make quantum computing a reality.

Expectations from some of the American Pharmaceuticals analysts is that Aytu BioPharma is on the verge of breakeven. They expect the company to post a final loss in 2024, before turning a profit of US$5.8m in 2025. Therefore, the company is expected to breakeven roughly a year from now or less! How fast will the company have to grow to reach the consensus forecasts that anticipate breakeven by 2025? Working backwards from analyst estimates, it turns out that they expect the company to grow 77% year-on-year, on average, which is rather optimistic! Should the business grow at a slower rate, it will become profitable at a later date than expected.

Given this is a high-level overview, we won’t go into details of Aytu BioPharma's upcoming projects, however, keep in mind that by and large pharmaceuticals, depending on the stage of product development, have irregular periods of cash flow. This means, large upcoming growth rates are not abnormal as the company is beginning to reap the benefits of earlier investments.

See our latest analysis for Aytu BioPharma

Before we wrap up, there’s one issue worth mentioning. Aytu BioPharma currently has a relatively high level of debt. Typically, debt shouldn’t exceed 40% of your equity, which in Aytu BioPharma's case is 52%. Note that a higher debt obligation increases the risk in investing in the loss-making company.

Next Steps:

This article is not intended to be a comprehensive analysis on Aytu BioPharma, so if you are interested in understanding the company at a deeper level, take a look at Aytu BioPharma's company page on Simply Wall St. We've also compiled a list of important aspects you should look at:

- Historical Track Record: What has Aytu BioPharma's performance been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Aytu BioPharma's board and the CEO’s background .

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency• Be alerted to new Warning Signs or Risks via email or mobile• Track the Fair Value of your stocks

Try a Demo Portfolio for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10