ASML Holding NV (NASDAQ:ASML) reported better-than-expected first-quarter earnings as its revenue and earnings per share beat analyst estimates on Wednesday.

What Happened: A Dutch lithography equipment supplier to Nvidia Corp. (NASDAQ:NVDA), ASML, reported its first-quarter revenue of €7.742 billion or $8.764 billion, beating analyst estimates of $7.760 billion by 12.94%, according to Benzinga.

Sequentially, the revenue declined by 16.75% from €9.3 billion in the fourth quarter.

It reported basic earnings of €6 or $6.83 per share, 18.58% above estimates of $5.760. However, it declined sequentially by 12.41% from €6.85 per share in the fourth quarter.

The company’s gross profit stood at €4.180 billion or $4.757 billion, down 12.73% from €4.790 billion in the fourth quarter.

“Our first-quarter total net sales came in at €7.7 billion, in line with our guidance. The gross margin was 54.0%, above guidance, driven by a favorable EUV product mix and the achievement of performance milestones. In the first quarter, we shipped our fifth High NA system, and we now have these systems at three customers,” said the CEO of ASML, Christophe Fouquet.

Buyback: In the first quarter, ASML purchased around €2.7 billion worth of shares under the current 2022-2025 share buyback program.

See Also: Trump Administration Imposes Up To 245% Tariff On Chinese Imports Amid Intensifying Trade Battle

Guidance: “We expect second-quarter total net sales between €7.2 billion and €7.7 billion, with a gross margin between 50% and 53%. We expect R&D costs of around €1.2 billion and SG&A costs of around €300 million. As we previously communicated, we expect total net sales for the year between €30 billion and €35 billion, with a gross margin between 51% and 53%, subject to the uncertainties mentioned earlier,” said Fouquet.

Price Action: ASML ended 1.53% higher on Tuesday at $683.16 apiece, the exchange-traded fund tracking the Nasdaq 100 index, Invesco QQQ Trust, Series 1 (NASDAQ:QQQ), on the other hand, rose just 0.11%.

ASML has declined 2.46% on a year-to-date basis, whereas it has dropped 30.07% over a year.

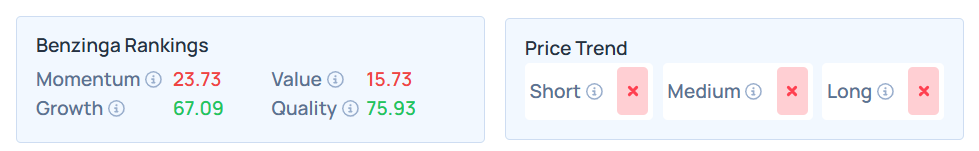

Benzinga Edge Stock Rankings indicate that ASML has a weaker price trend over the short, medium, and long term. Its momentum ranking was weak at the 23.73th percentile, whereas its growth and value rankings were mixed; more details on the fundamentals are available here.

Benzinga’s analysis of 13 analysts shows a consensus “buy” rating for the stock, with an average price target of $873.14, ranging from $510 to $1100. Recent ratings from JPMorgan, Wells Fargo, and Bernstein average $909, suggesting a 35.02% potential upside.

Read Next:

- Cathie Wood Says ‘Shock Therapy' From Trump's Trade Moves May End Prolonged Economic Slump

Photo courtesy: Skorzewiak / Shutterstock.com