Rocky Mountain Chocolate Factory, Inc.'s (NASDAQ:RMCF) Shares May Have Run Too Fast Too Soon

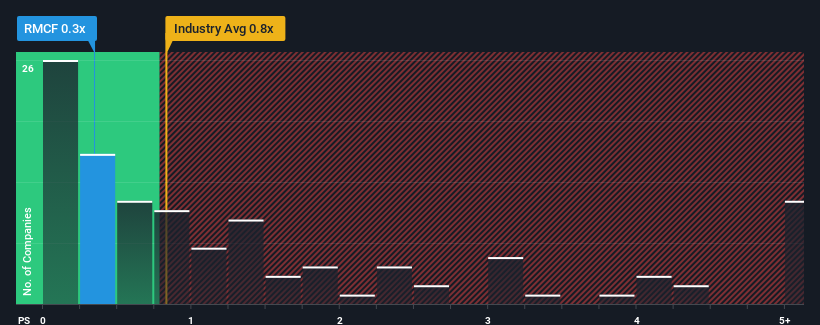

With a median price-to-sales (or "P/S") ratio of close to 0.8x in the Food industry in the United States, you could be forgiven for feeling indifferent about Rocky Mountain Chocolate Factory, Inc.'s (NASDAQ:RMCF) P/S ratio of 0.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Trump has pledged to "unleash" American oil and gas and these 15 US stocks have developments that are poised to benefit.

Check out our latest analysis for Rocky Mountain Chocolate Factory

What Does Rocky Mountain Chocolate Factory's P/S Mean For Shareholders?

For instance, Rocky Mountain Chocolate Factory's receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Rocky Mountain Chocolate Factory, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

Rocky Mountain Chocolate Factory's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 3.1% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 13% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

In contrast to the company, the rest of the industry is expected to grow by 1.5% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that Rocky Mountain Chocolate Factory is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does Rocky Mountain Chocolate Factory's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We find it unexpected that Rocky Mountain Chocolate Factory trades at a P/S ratio that is comparable to the rest of the industry, despite experiencing declining revenues during the medium-term, while the industry as a whole is expected to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

It is also worth noting that we have found 4 warning signs for Rocky Mountain Chocolate Factory (3 make us uncomfortable!) that you need to take into consideration.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

If you're looking to trade Rocky Mountain Chocolate Factory, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10