High Growth Tech Stocks In Asia For April 2025

As trade tensions between the U.S. and China escalate, investor sentiment in global markets has been volatile, with key indices like the Nasdaq Composite experiencing significant fluctuations. Despite these challenges, Asia's tech sector continues to attract attention for its potential high growth opportunities, especially as companies in this region seek to innovate and expand amidst a shifting economic landscape. In such an environment, identifying stocks that demonstrate resilience and adaptability can be crucial for investors looking at high-growth tech opportunities in Asia.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 34.26% | 32.15% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Xi'an NovaStar Tech | 30.60% | 36.56% | ★★★★★★ |

| Shanghai Baosight SoftwareLtd | 20.52% | 25.50% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 26.94% | 24.31% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| PharmaResearch | 20.73% | 27.75% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Click here to see the full list of 491 stocks from our Asian High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Innovent Biologics (SEHK:1801)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Innovent Biologics, Inc. is a biopharmaceutical company that focuses on the development and commercialization of monoclonal antibodies and other drug assets for various therapeutic areas including oncology, ophthalmology, autoimmune, and cardiovascular and metabolic diseases in China, with a market cap of approximately HK$79.29 billion.

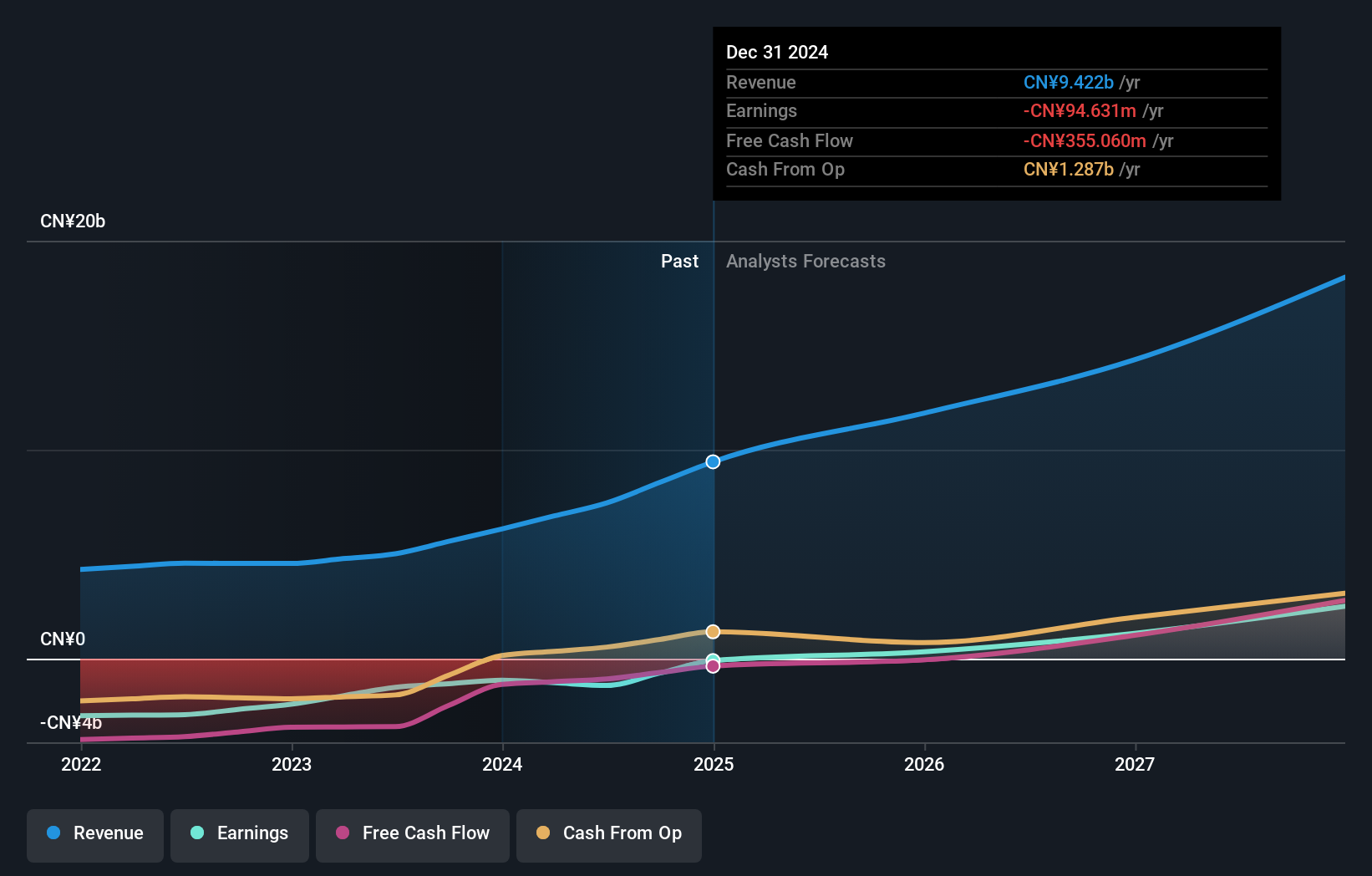

Operations: The company generates revenue primarily from its biotechnology segment, amounting to CN¥9.42 billion.

Innovent Biologics, a key player in Asia's biotech sector, has demonstrated compelling growth dynamics with an 18.5% annual revenue increase and an expected earnings surge of 38.72% per year. Recently, the company made significant strides by presenting novel oncology treatments at the AACR Annual Meeting and reporting a reduced net loss from CNY 1,028 million to CNY 95 million year-over-year. These advancements underscore Innovent's commitment to innovation and its potential in addressing critical medical needs through R&D efforts, which are pivotal for sustaining its rapid growth trajectory in the competitive biotech landscape.

- Click here and access our complete health analysis report to understand the dynamics of Innovent Biologics.

Examine Innovent Biologics' past performance report to understand how it has performed in the past.

Xiaomi (SEHK:1810)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xiaomi Corporation is an investment holding company that offers hardware and software services both in Mainland China and internationally, with a market cap of HK$1.12 trillion.

Operations: The company generates revenue primarily from smartphones, contributing CN¥191.76 billion, and IoT and lifestyle products at CN¥104.10 billion. Internet services add another CN¥34.12 billion to its revenue streams, while smart EV and new initiatives account for CN¥32.75 billion.

Xiaomi's recent strategic partnership with NaaS Technology to enhance EV charging interconnectivity underscores its innovative edge in the smart mobility sector. This collaboration is set to improve user experience and efficiency, tapping into China’s rapidly expanding NEV market which saw over 12 million units produced last year. Financially, Xiaomi reported a robust annual revenue growth of 35%, reaching CNY 365.9 billion, while net income surged by 35.4% to CNY 23.66 billion, reflecting strong operational execution and market demand that outpaced industry expectations with over 135,000 deliveries since its market debut in 2024.

- Dive into the specifics of Xiaomi here with our thorough health report.

Gain insights into Xiaomi's past trends and performance with our Past report.

Shanghai Baosight SoftwareLtd (SHSE:600845)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shanghai Baosight Software Co., Ltd. offers industrial solutions in China and has a market capitalization of CN¥67.26 billion.

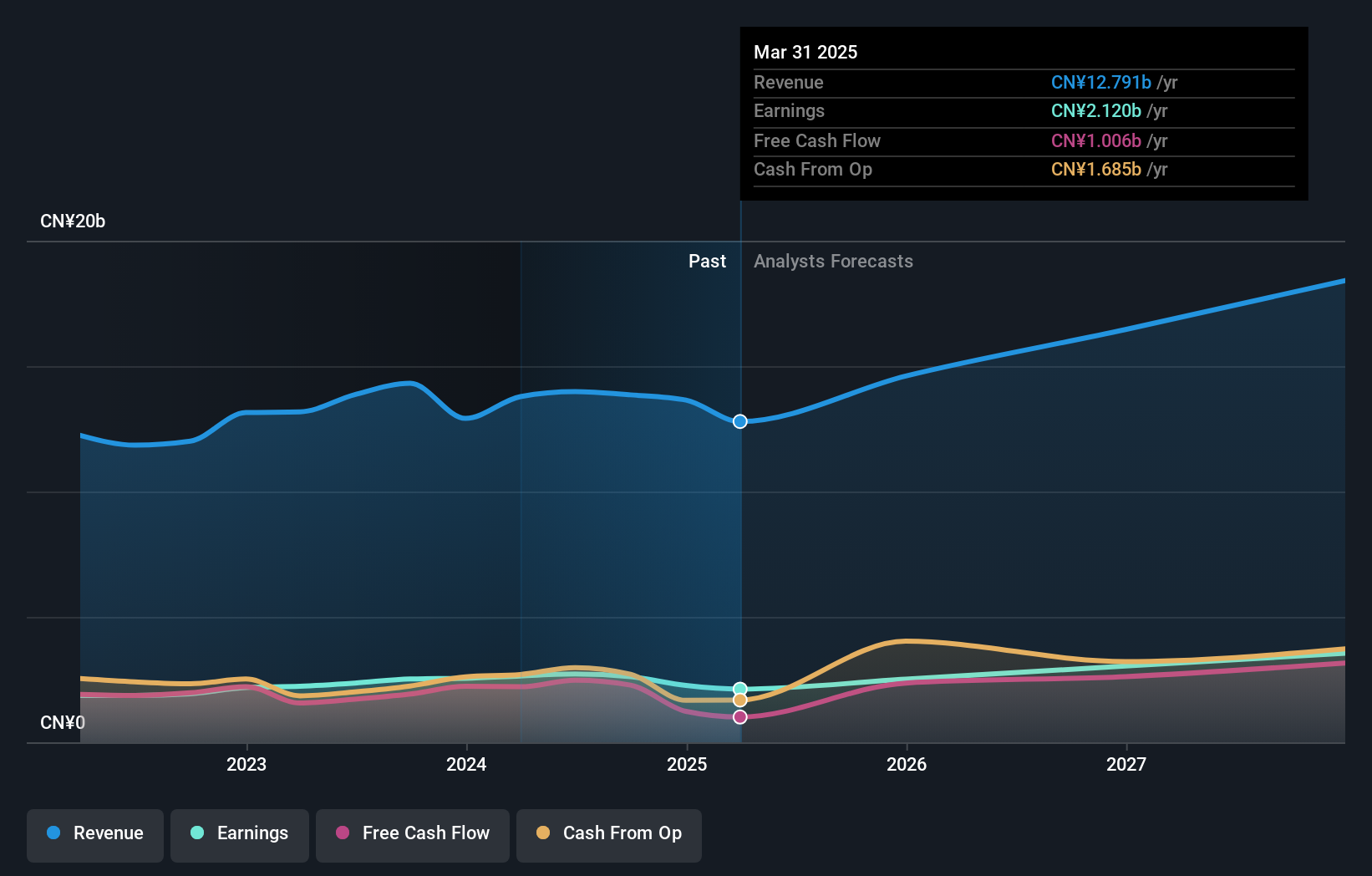

Operations: Baosight Software generates revenue primarily through three segments: Software Development and Engineering Service (CN¥9.91 billion), Service Outsourcing (CN¥3.66 billion), and System Integration (CN¥65.19 million). The company focuses on providing industrial solutions within these areas in the Chinese market.

Shanghai Baosight Software Co., Ltd. has demonstrated resilience with a 20.5% annual revenue growth, outpacing the Chinese market average of 12.6%. Despite a challenging year that saw earnings contract by 11.3%, the company's commitment to innovation is evident in its R&D spending, which remains robust in support of long-term growth strategies. Notably, its recent earnings announcement highlighted an increase in sales to CNY 13.64 billion from CNY 12.91 billion year-over-year, underscoring potential recovery signs and market confidence. With earnings expected to surge by 25.5% annually over the next three years, Baosight is positioning itself as a formidable contender in Asia's competitive tech landscape.

- Take a closer look at Shanghai Baosight SoftwareLtd's potential here in our health report.

Learn about Shanghai Baosight SoftwareLtd's historical performance.

Where To Now?

- Access the full spectrum of 491 Asian High Growth Tech and AI Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)• Undervalued Small Caps with Insider Buying• High growth Tech and AI CompaniesOr build your own from over 50 metrics.

Explore Now for FreeHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10