M&T Bank Corporation (NYSE:MTB) posted weaker-than-expected earnings for its first quarter on Monday.

M&T Bank reported quarterly earnings of $3.38 per share which missed the analyst consensus estimate of $3.40 per share. The company reported quarterly sales of $2.31 billion which missed the analyst consensus estimate of $2.34 billion.

The company's Chief Financial Officer said, “I am pleased with the solid financial results we obtained in the first quarter. M&T’s start to the year reflects the consistency and strength of our diversified banking model, healthy levels of capital and liquidity as well as improved credit results. We continue to invest in our people, technology and processes to better serve our customers. We remain steadfast in our goal to make a difference in the communities where we work and live.”

M&T Bank shares gained 2.3% to trade at $162.18 on Tuesday.

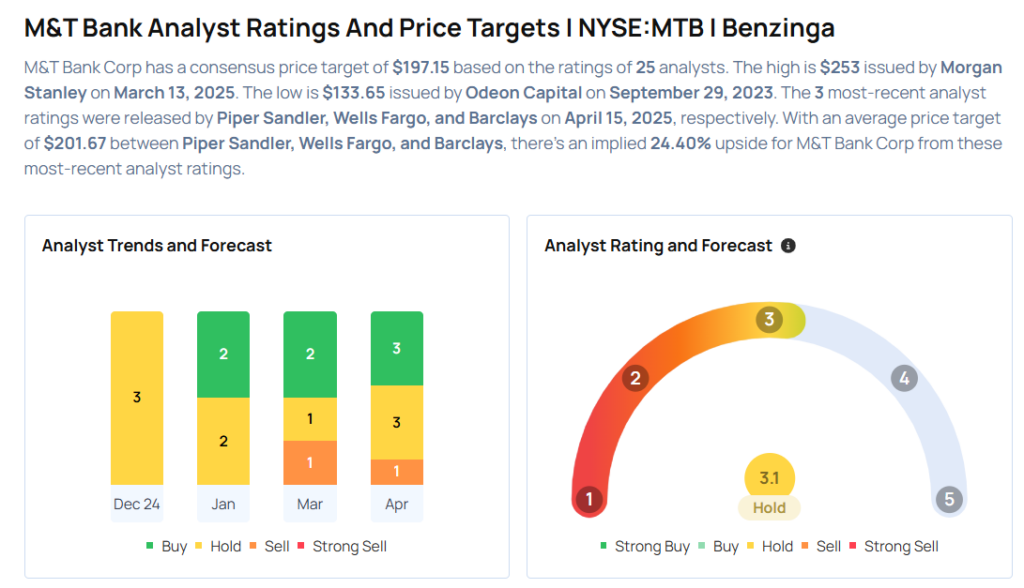

These analysts made changes to their price targets on M&T Bank following earnings announcement.

- Baird analyst David George maintained M&T Bank with an Outperform rating and lowered the price target from $220 to $200.

- DA Davidson analyst Peter Winter maintained the stock with a Neutral and lowered the price target from $205 to $189.

- Barclays analyst Jason Goldberg maintained M&T Bank with an Equal-Weight rating and cut the price target from $235 to $220.

- Wells Fargo analyst Mike Mayo maintained M&T Bank with an Underweight rating and lowered the price target from $185 to $175.

- Piper Sandler analyst Frank Schiraldi maintained the stock with an Overweight rating and lowered the price target from $220 to $210.

Considering buying MTB stock? Here’s what analysts think:

Read This Next:

- Jim Cramer: Planet Fitness Is Doing Better Than Expected, Says No To This Industrial Stock

Photo via Shutterstock