Super Micro Computer (SMCI) Stock Upgraded to a Zacks Rank #1 (Strong Buy)

Added to the Zacks Rank #1 (Strong Buy) list this week, Super Micro Computer’s SMCI stock has become compelling among the tech sector as it looks to move past investigations into its accounting practices.

Furthermore, Super Micro’s artificial intelligence initiatives are reassuring and have led to sprawling sales growth that is acknowledged even amid probes by the Department of Justice (DOJ).

Super Micro’s AI Expansion

Having a strategic partnership with Nvidia NVDA, Super Micro offers various AI solutions from edge computing for real-time processing to enterprise AI and large-scale AI training. Using Nvidia’s advanced GPUs, including the chip giant’s latest Blackwell series, Super Micro has been able to optimize these AI workloads.

Last month, Super Micro announced new systems and rack solutions powered by Nvidia’s Blackwell Ultra Platform, which is expected to strengthen its leadership in AI by delivering breakthrough performance for the most compute-intensive AI workloads such as AI reasoning, agentic AI, and video inference applications.

Compelling Sales Growth

Based on Zacks' estimates, Super Micro’s sales are expected to soar 59% in fiscal 2025 to $23.79 billion compared to $14.94 billion last year. Even better, FY26 sales are projected to spike another 46% to $34.87 billion.

Image Source: Zacks Investment Research

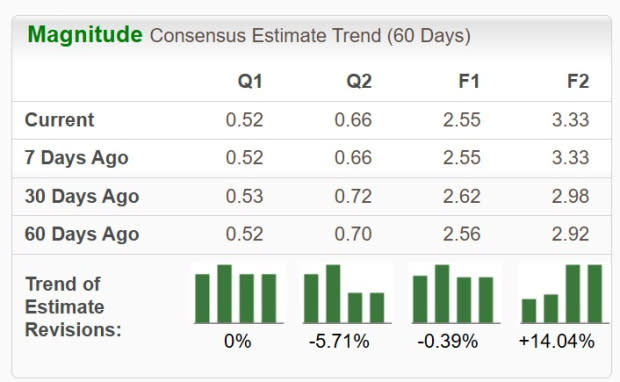

Earnings Outlook & EPS Revisions

On the bottom line, Super Micro’s annual earnings are expected to increase 15% in FY25 and are forecasted to soar another 30% in FY26 to $3.33 per share. Notably, FY25 EPS estimates are slightly down over the last 60 days, but FY26 EPS estimates have spiked 14%.

Image Source: Zacks Investment Research

SMCI Performance & Valuation

Holding up better than the tech sector's broader year-to-date decline, Super Micro's stock is up +3% in 2025 to outpace the Nasdaq’s -15%, with Nvidia shares down 24%. More impressive, over the last three years, SMCI has skyrocketed over +700% to impressively outperform the broader indexes and Nvidia’s +266%.

Image Source: Zacks Investment Research

Most compelling regarding Super Micro’s attractive growth trajectory is that SMCI is trading under $35 a share and at an intriguing 12.7X forward earnings multiple. Offering a noticeable discount to the benchmark S&P 500, SMCI trades near its Zacks Computer-Storage Devices Industry average of 11.2X forward earnings and beneath Nvidia’s 23.7X.

Image Source: Zacks Investment Research

Bottom Line

The risk-to-reward is starting to look favorable to invest in Super Micro's stock again thanks to the company’s continued expansion in the AI realm. That said, now may be an ideal time to buy SMCI, considering the tech leader's attractive valuation and growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Super Micro Computer, Inc. (SMCI) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

Most Discussed

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10