Switching to a new trading platform can be a hassle — even if it is one that offers a cheaper trading fee and more products. This is because investors are required to furnish important details, supported by the relevant documents. The process can be tedious, and an approval usually takes up to a few working days before a trading account is opened.

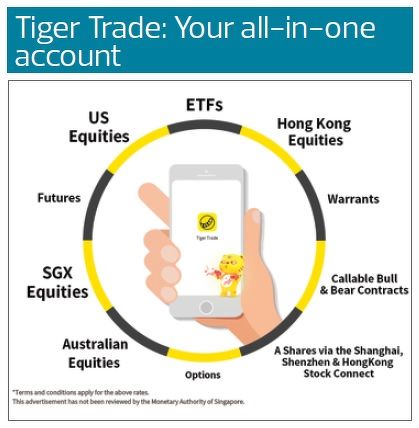

But with Tiger Brokers, the onboarding process is fast and seamless, says Eng Thiam Choon, CEO of Tiger Brokers Singapore. Investors can open a trading account within hours of doing so and start trading on the Singapore Exchange, New York Stock Exchange, Nasdaq, Hong Kong Exchanges and Clearing, and most recently, the Australian Securities Exchange.

For example, Eng says Tiger Brokers is able to open trading accounts within the day itself for several Asia-based investors who wanted to trade US stocks urgently. These investors, he adds, wanted their trading accounts to be ready by night, which is when the US stock market opens. “Our easy and fast account opening process minimises hesitation as investors often feel it is troublesome to open a new trading account,” he says.

To encourage investors to open a trading account with Tiger Brokers, several giveaways are offered too. Investors will receive free “level two” market data for US stocks, general five commission-free trades and stock vouchers of up to $100. If the opening of the trading account was the result of a referral, the referrer also enjoys the same benefits. For traders, they can enjoy up to 30% off commissions and free stocks. “It’s a welcome gift for our clients,” adds Eng.

More importantly, investors should consider switching over to Tiger Brokers because the trading platform offers better value to investors, he says. Under a partnership with Nasdaq, investors can now access US market data at little to no cost using Tiger Brokers’ trading platform. Powered by Nasdaq Basic, the trading platform provides real-time trade and quote data of all US-listed equities for free. These include best bid and offer, tick by tick price and Nasdaq opening and closing prices.

Under Nasdaq TotalView, the trading platform provides a full order book depth to determine the liquidity below top of book. This is useful for sophisticated traders, who want insights into the true supply and demand profile of a security at each price point. Tiger Brokers charges US$26 ($34.78) a month for this plan.

Tiger Brokers also offers complementary services, says Eng. These include round-the-clock financial news updates, multilingual customer service during trading hours, artificial intelligence driven data screeners and easy-to-analyse trading charts.

In addition, Tiger Brokers’ trading fees is one of the most competitive, he adds. For instance, the brokerage charges just US 1 cent per share on a minimum US$1.99 trade in the US stock market. For the Singapore market, Tiger Brokers charges just 0.08% per trade. The brokerage currently has a promotional offer without minimum, which will last until Dec 31. After that, the minimum will be $2.88 per trade.

It makes sense for Tiger Brokers to make it easy and painless for investors to come on board. As a relatively new player in the local securities market, it is up against a slew of more established brokerages. Tiger Brokers can try and enlarge the addressable market by attracting new investors but it can also try and draw existing ones now actively trading via other platforms.

To further raise its profile, Tiger Brokers is taking part in this year’s Singapore FinTech Festival (SFF) as a Silver Sponsor. Meanwhile, Tiger Brokers is also reaching out to investors, but in a different way. By using digital content like short-form videos and infographics, it hopes to make trading lessons less intimidating for newcomers. “We try to create an online environment where senior and junior [investors] can all come together and discuss their views on the market,” says Eng, who prior to Tiger Brokers, spent 14 years in the financial sector. He spent 12 of those years at Phillip Futures where, among other things, he helped to oversee the Greater China market.

Next generation investors

Tiger Brokers has so far seen a surge of new investors worldwide, especially among the young. The brokerage has three times more account openings in 3Q2020 as compared to 2Q2020, with more than 80% of new users under 45 years old. Generation Z, which comprises those aged between 18 to 24 years old, made up of around 15% of the company’s current one million customers worldwide.

According to Tiger Brokers, 45% of Generation Z investors prefer long-term stocks like Apple, Boeing and Carnival while 35% are invested in REITs and ETFs across the US, Hong Kong and Singapore. Another 10% of Generation Z investors have sunk their money into high-volatility stocks such as Afterpay, Kodak and Vaccinex, while another 10% are invested in options.

In Singapore, Generation Z makes up 30% of Tiger Brokers’ customers, following the launch of the Tiger Trade app in February. For 3Q2020, the most traded stocks by Generation Z here were Tesla, Apple, NIO and Medtech International.

Despite the easy access to overseas markets, Eng says investors here generally tend to focus on the local stock market. Singapore Airlines, he notes, has been an actively traded stock in the last few months amid signs of an earlier recovery in the aviation industry. Real estate investment trusts and exchange traded funds are also popular among investors given the financial and economic uncertainty, he says.

Other asset classes are also getting popular. Tiger Brokers has seen more options and futures traded on its trading platform. In particular, Micro E-mini futures are popular among investors, such as the Nasdaq 100, S&P 500, Dow Jones and China A50 index.

Tiger Brokers is also currently seeing increasing interest in US fractional shares from its users, which is a relatively popular financial product in the US. Eng says fractional shares allow Generation Z or new investors to start investing with lower capital. He adds that investors may access US fractional shares via Tiger Trade platform in the near future.

Addressing pain points

Eng says Tiger Brokers was founded in 2014 to address certain pain points faced by its founder, director and CEO Wu Tian Hua. The latter was previously an engineer working for a multinational corporation in China. When he was given share options in the company, Wu found the process of opening a trading account to be tedious.

There were other inconveniences, too. Back then, many Chinese brokerages offered online trading platforms to investors to perform their trades. But none of them provided a mobile trading platform. Moreover, the fees to trade shares in foreign markets like the US were expensive. “So that’s when he actually started Tiger Brokers in China,” explains Eng. “He believes that investing should be more friendly and approachable by using a trading app such as Tiger Brokers.”

Tiger Brokers then saw an opportunity to expand into Southeast Asia. According to Eng, Wu saw similar pain points experienced by investors in the region. And so, Tiger Brokers set up operations in Singapore two years ago. Last year, it secured the Capital Markets Services license from the Monetary Authority of Singapore, potentially broadening the range of services it can offer here.

While Tiger Brokers may be a relatively young player in the online brokerage arena, Eng says the brokerage is backed by prominent investors. These financial backers are Chinese technology giant Xiaomi Corp, US-based Interactive Brokers and investment guru Jim Rogers, who in recent years has become a prominent investor in Asia.

But since Interactive Brokers itself is an online brokerage, would it not compete for customers with Tiger Brokers? Eng does not see this as a problem. “I think the market is big enough,” he says. “Everyone is offering a similar product. But it is how you differentiate yourself. Most importantly, we are able to achieve our vision and serve our customers.”