The recent surge in demand for Bitcoin ETFs has propelled its price to exceed $69,000 on the evening of March 5th, marking a historic high not seen since November 2021.If you've ever been put off by the tricky process of buying cryptocurrencies like Bitcoin, the introduction of Bitcoin Spot ETFs is a game-changer for the average investor. This article is to give you a fair and square look at the situation, helping you to get the full picture and make a smart choice after doing your research, without pushing you one way or the other. If you're ready to jump in, we've got a "Trading Guide" section waiting for you at the end. But first, let's get down to brass tacks:

Introduction to Bitcoin Spot ETFs

Pros and cons of Bitcoin Spot ETFs

Current Trends and Future Prospects in Bitcoin Spot ETFs

Introduction to Bitcoin Spot ETFs

What exactly is a Bitcoin Spot ETF?

A Bitcoin spot ETF is a tool that simplifies investing in Bitcoin for individuals. The United States Securities and Exchange Commission approved the first batch of 11 Bitcoin spot ETFs in the United States on January 10, 2024, marking another step forward following the listing of Bitcoin futures ETFs in 2021. Unlike futures ETFs, which rely on futures contracts, spot ETFs directly invest in actual Bitcoin. This means you can easily dip into cryptocurrency investment through familiar brokerage accounts without the hassle of complex buying and storage processes. Although there are certain management fees and commissions, this method remains more convenient than direct buying and selling of Bitcoin.

How Do Bitcoin Spot ETFs Work?

The operation of Bitcoin spot ETFs is quite clever, securely storing Bitcoin in trusted digital vaults overseen by professional custodians. Their goal is to accurately track the fluctuations of the Bitcoin market price. Initially, the ETF purchases Bitcoin on the market or through specific cryptocurrency exchanges, and these Bitcoins are then stored in digital wallets. To maximize asset security, protective measures like cold storage are utilized, where Bitcoins are kept on offline devices to reduce the risk of theft by hackers.

After storing the Bitcoins, the Bitcoin spot ETF issues shares based on the amount of Bitcoin it holds. The price of these shares reflects the real-time market price of Bitcoin and can be traded on regular securities exchanges. This allows the ETF's share price to closely follow the fluctuations of the Bitcoin market. To ensure the share price aligns with the actual value of Bitcoin, the ETF adjusts as needed by buying or selling Bitcoin to maintain balance.

Shares of the Bitcoin spot ETF are created and redeemed by Authorized Participants (usually large financial institutions), who regulate the ETF's shares based on market demand to keep supply balanced. If the ETF's trading price deviates from the Bitcoin market price, these institutions will engage in arbitrage by buying or selling ETF shares to help the price return to normal levels.

What Does This Mean for Individual Investors?

With this setup, investing in a Bitcoin spot ETF becomes as straightforward as buying stocks or other ETFs. Market makers ensure you can buy and sell at any time, keeping these shares liquid and the trading efficient. This means both institutional and individual investors can more easily dive into Bitcoin investment without worrying about the technicalities and security challenges of directly managing crypto wallets or safeguarding private keys.

Pros and Cons of Bitcoin Spot ETFs

Benefits:

Convenience: Significantly simplifies the crypto market entry process. Direct handling of crypto wallets or navigating complicated exchange issues isn't necessary, making it accessible for average investors.

Liquidity: Offers the convenience of buying and selling through familiar brokerage accounts, akin to stock trading, simplifying entry into the Bitcoin market.

Regulatory Protection: ETFs undergo strict regulation, offering more transactional transparency and security compared to the uncertainties of direct Bitcoin purchases.

Tax Advantages: In certain regions, ETF investors might enjoy favorable tax treatments over direct cryptocurrency holdings, streamlining tax management.

Drawbacks:

Volatility: Bitcoin's price is highly volatile, introducing significant risk. While ETFs simplify investing in Bitcoin, they do not mitigate the market's inherent unpredictability.

Regulatory Uncertainty: The crypto market's regulatory landscape is still evolving, presenting risks related to fraud and manipulation. Future changes in regulations could also affect ETFs.

Security Risks: Storing large amounts of Bitcoin makes ETFs potential hacker targets. Despite security measures like cold storage, hacking threats remain, with slim recovery chances for stolen Bitcoins.

Management Fees: Investors avoid the direct purchase and storage hassles but incur management fees, potentially higher than those for traditional stock ETFs due to cryptocurrency transaction and security costs.

Tracking Error: ETFs aim to mirror Bitcoin's market movements closely; however, potential pricing discrepancies mean returns might not fully match Bitcoin's actual market performance.

Current Status and Outlook for Bitcoin Spot ETFs

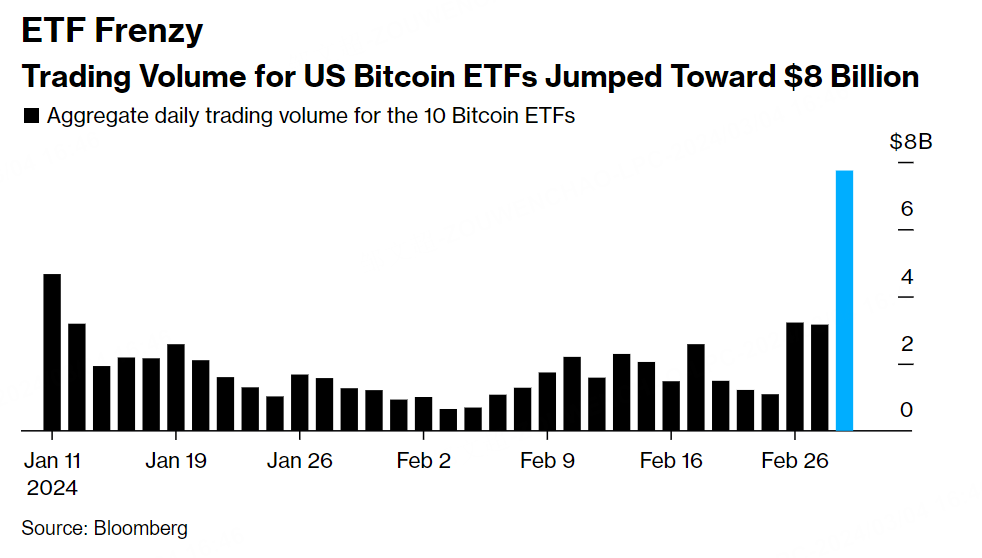

Initially, the growth of Bitcoin spot ETFs wasn't particularly striking, but within just a couple of months, they quickly garnered over $7 billion in inflows, significantly ramping up the demand for the token. Bloomberg Intelligence analyst James Seyffart has forecasted that these ETFs might attract a total of $10 billion in capital within their first year, and they could potentially exceed this estimate. The price of Bitcoin surged to over $69,000 on the evening of March 5th, marking a historic high not seen since November 2021. Subsequently, there was a slight pullback in the price.

The upcoming Bitcoin halving event is also a key driver behind the recent price surge. Simply put, Bitcoin halving is a rule within the Bitcoin system that occurs every four years, cutting the Bitcoin rewards for miners in half. This mechanism is designed to control the growth of new Bitcoin supply and maintain its scarcity, similar to how gold mining becomes increasingly difficult, aiming to prevent inflation of value. Historically, Bitcoin's price has significantly increased after each halving event, as seen in 2012 and 2016. However, this is not a guaranteed outcome. The next halving is expected around April 2024, and many investors and analysts view it as a potential market catalyst that could positively impact Bitcoin's price again.

While predicting Bitcoin's price movement in the coming months is still premature, one thing is certain: the total supply of Bitcoin is capped at 21 million. This limit, coupled with an increasing number of financial products and growing investor interest, means that the Bitcoin available on the market will not be plentiful, which is sure to impact its long-term price. Bitcoin spot ETFs are one such innovation that could attract significant investment. Although mainstream platforms like Vanguard have not yet included Bitcoin spot ETFs, as more people become aware of their potential, their popularity and acceptance are expected to gradually increase.

It's important to note that Bitcoin spot ETFs differ significantly from the ETFs commonly seen on trading platforms like Tiger Trade. Traditionally, ETFs holding stocks of listed companies are considered lower risk over the long term because they invest in tangible companies that can adjust their holdings according to the market. However, the risk associated with Bitcoin spot ETFs is closely tied to Bitcoin's market performance; if Bitcoin's price plummets, the ETFs would also suffer. Therefore, if you're interested in Bitcoin ETFs, it's advised to do thorough research and proceed with caution. Additionally, it's wise to listen to a range of opinions and make investment decisions based on your own circumstances and risk tolerance.

Trading Guide

Before diving into trading, there are a few points you should be mindful of:

Will Bitcoin Spot ETFs Affect Bitcoin's Price? ETFs don't directly alter Bitcoin's price but can have an indirect impact. For instance, they can increase Bitcoin's acceptance, boost market recognition, stimulate active trading, and possibly reduce the purchasing costs for institutional investors. Consequently, they can attract more investors, elevate Bitcoin's status, and may lead to more transactions and volatility, indirectly influencing the price.

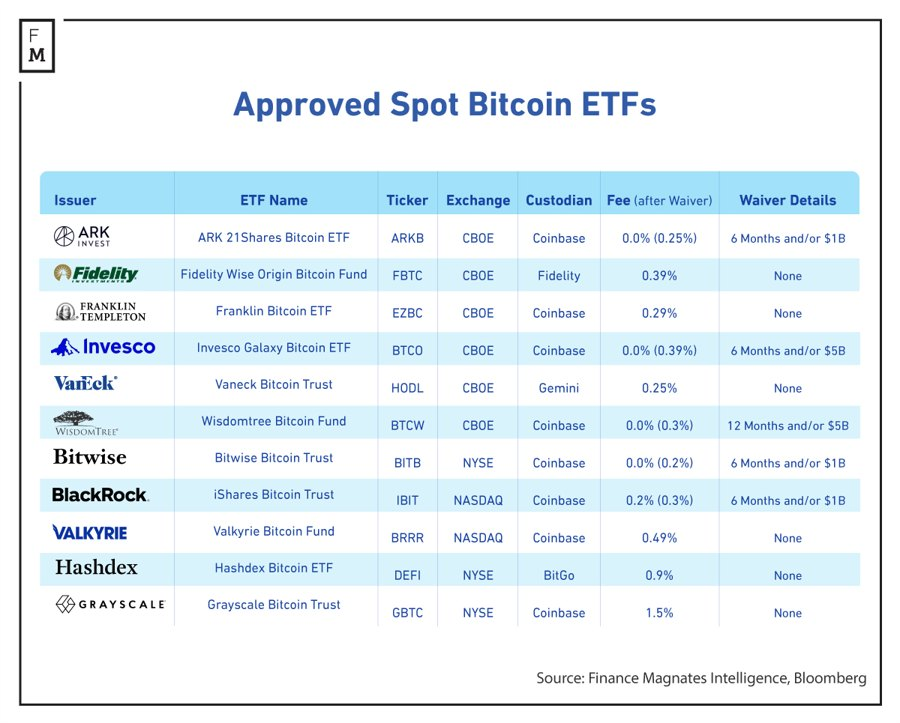

Do Bitcoin Spot ETFs Carry Custodial Risks? Yes, ETFs store Bitcoin with third-party custodians, with most opting for Coinbase, while others like Fidelity and VanEck choose themselves or Gemini. Should the custodian, say Coinbase, encounter issues (such as financial difficulties or cyberattacks), your investment's safety could be at risk. Although there are ways to recover Bitcoin, they might not be swift or straightforward, making it important to consider custodial risks.

Do Bitcoin Spot ETFs Offer Dividends? No, there are no dividends. Since Bitcoin itself does not generate any income, the purpose of Bitcoin spot ETFs is to realize capital appreciation through the price movements of Bitcoin, not through dividends. The value of the ETF is primarily influenced by the price of Bitcoin, rather than relying on dividends.

Is There a Minimum Investment for Bitcoin Spot ETFs? There's no minimum investment threshold; you can start investing with just one share, making it easy for retail investors to participate. However, for small investments, be mindful of transaction fees.

With the information provided above, on Tiger Trade, you (excluding residents within mainland China) can now trade all 11 Bitcoin spot ETFs, offering a variety of choices. You can begin by searching for the ETF tickers you're interested in on Tiger Trade. Add them to your watchlist to track their performance over time before making your investment decision:

The following list outlines the fees and corresponding promotional policies for these 11 ETFs, allowing you to choose based on your needs:

Of course, before making any investment, your research should not stop here. Beyond assessing your own goals and risk tolerance, you should also delve into detailed information about the ETFs, including:

Visiting the official websites of the ETFs to gather key data and information about fund managers;

Reading reviews and news articles about the fund and its managers;

Paying attention to other details that might influence your decision-making process.

Ultimately, whether this (or any) investment is right for you depends on your own judgment. The more comprehensive the information you have, the better prepared you are, and the wiser your decision will be.

Disclaimer: All information and content are provided for reference purposes only and do not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement of any financial product or strategy. The data and charts presented are for illustrative purposes only. Options trading involves significant risk and is not suitable for all investors. You should only invest money that you can afford to lose. All investment products carry risks. Before trading, please read and understand the Financial Services Guide, Risk Disclosure Statement, Product Disclosure Statements, Target Market Determination, and other disclosure documents available on the official website. All information and content are not investment advice and have not considered your investment objectives, financial situation, or needs. You must decide whether it is suitable for your circumstances and requirements and seek independent advice if necessary. Tiger Brokers (AU) Pty Limited ABN 12 007 268 386 AFSL 300767